1 in 4 Seniors Have Little Home Equity

Retirees can use the equity sitting in their homes to pay for their daily expenses, out-of-pocket medical bills or nursing care, especially toward the end of their lives.

Retirees can use the equity sitting in their homes to pay for their daily expenses, out-of-pocket medical bills or nursing care, especially toward the end of their lives.

Cash-strapped older retirees can access that equity by taking out reverse mortgages or home equity loans or by downsizing to less expensive homes or condominiums.

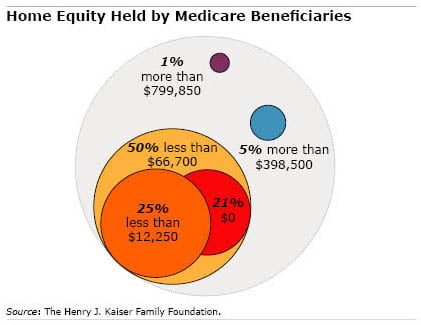

But one in four Medicare recipients has less than $12,250 in home equity, according to a new report by the Kaiser Family Foundation, a healthcare non-profit.

Kaiser’s calculations also show that the distribution of home equity among older Americans is – like the distribution of income and financial assets – top heavy. While 5 percent of Medicare beneficiaries in 2013 had more than $398,500 in home equity, half have less than $66,700.

According to Kaiser’s projections, that gap will widen in the future. By 2030, those whose home equity places them in the top 5 percent will see that equity grow more than 40 percent, but it will rise less than 10 percent for those with mid-level – or median – amounts of equity.

The analysis was part of a study to examine the ability of older Americans to absorb rising out-of-pocket retiree medical costs and increasing Medicare premiums. This blog also reported the study’s similarly grim findings about the meager financial savings held by many retirees to cover their health care costs.

Comments are closed.

Great post!