1 in 4 Seniors Have Meager Savings

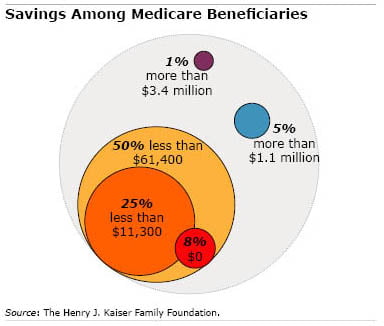

Less than $11,300 – that’s how little savings one-quarter of all Medicare beneficiaries have in their 401(k)s, IRAs, and other financial accounts.

Less than $11,300 – that’s how little savings one-quarter of all Medicare beneficiaries have in their 401(k)s, IRAs, and other financial accounts.

This grim statistic comes out of a report by the Kaiser Family Foundation, a health care and policy non-profit. Kaiser’s goal was to gauge whether older Americans will be able to absorb rising Medicare premiums, co-pays, deductibles and related costs.

“Most people on Medicare are of modest means with relatively low incomes, low savings and low home equity,” concluded Gretchen Jacobson, the foundation’s associate director of the Medicare policy program and lead author of the report.

When retirees’ incomes can’t cover their out-of-pocket costs, they need money in the bank to pay for care. But half of all Medicare beneficiaries have annual incomes below $23,500 and have less than $61,400 in the bank – less than the cost of a year in a nursing home – Kaiser said.

The foundation’s report also projects beneficiary incomes and wealth over the next two decades, as baby boomers age: much of the growth in incomes and wealth will be skewed toward individuals in the higher income and wealth brackets.

This report should “raise questions about the extent to which the next generation of Medicare beneficiaries will be able to bear a larger share of costs,” Kaiser said.