Social Security Statement Has Impact

When a Social Security statement comes in the mail, most people do not, as one might suspect, throw it on the pile of envelopes. They actually open it up and read it.

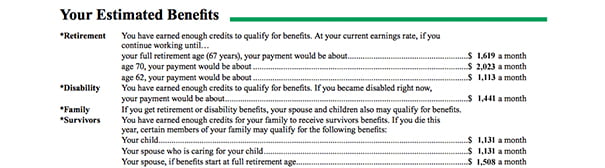

But are they absorbing the statements’ detailed estimates of how much money they’ll get from Social Security? RAND researcher Philip Armour tested this and found that the statement does, in fact, prompt people to stop and think about retirement: workers said their behavior and perceptions of the program changed after seeing the statement of their benefits.

The study was made possible after Social Security introduced a new system for mailing out statements. Workers used to get them in the mail every year. In 2011, the government took a hiatus and stopped sending them out. The mailings resumed in 2014 – but now they go out only before every fifth birthday (ages 25, 30, 35 etc.).

Armour was able to use the infrequent mailings to compare the reactions of the workers who had received a statement with those who had not during a four-year period, 2013-2017.

The statements bolstered their confidence that they could count on Social Security when they retire. More important, receiving them in the mail spurred some people to work more. To be clear, this is what they said – it isn’t known what they actually did.

Those who had been out of the labor market were much more likely, after getting a statement, to say they had returned to work. Working people under age 50 increased their hours of work.

Social Security benefits, on their own, usually are not enough to live on in retirement, and half of U.S. working-age households are at risk of falling short in retirement. But unfortunately, the study wasn’t able to detect another critical aspect of their retirement preparation: saving.

Armour doesn’t speculate about why some people decided to work more. But perhaps seeing a concrete estimate of their benefits made them realize they needed to earn more now to help themselves later.

To read Armour’s entire study, see “The Reintroduction of the Social Security Statement and its Effects on Social Security Expectations, Retirement Savings, and Labor Supply across the Age Distribution.”

The research reported herein was performed pursuant to a grant from the U.S. Social Security Administration (SSA) funded as part of the Retirement Research Consortium. The opinions and conclusions expressed are solely those of the author(s) and do not represent the opinions or policy of SSA or any agency of the federal government. Neither the United States Government nor any agency thereof, nor any of their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.

Comments are closed.

For many workers with a solid 35 plus years of wages, that “if you continue working until…” is very close to “if you delay claiming a benefit until…” If that was better understood, people might make different decisions on when to claim.

Since the automatic mailings of Social Security statements are so infrequent, we request ours every year. Every year, the day after both my and my wife’s birthdays, we request a copy of our respective statements through mySocialSecurity. It’s easy, it’s quick, and it leaves no excuses for not having the information.

What did surprise us though, was that after a few years of early retirement, the “Disability” information now shows as “not having enough credits” earned in the last 10 years.

That’s because you must have worked, IIRC, for five of the last 10 years in order to be eligible for SS Disability.

This requirement varies for younger workers who have not had time to accumulate that amount of work history.