Retirement System Urgently Needs Fixing

The state of our retirement preparedness is captured in this fact: about half of U.S. private sector workers at any given time are not enrolled in an employer retirement plan.

To be clear, they are not currently enrolled. Some of them have participated in a plan in the past or will in the future. But this inconsistency is the problem, largely because so many employers still don’t offer 401(k) savings plans to their employees.

The financial toll of not saving consistently is modest retirement account balances. Yet saving has become increasingly urgent as traditional pensions have virtually disappeared from the private sector and Social Security is replacing less of workers’ incomes over time.

In 2019 – after several years of economic growth and a surging stock market – the typical working household, ages 55 to 64, that saves in a 401(k) had only $144,000 in its 401(k)s and IRAs combined, the Center for Retirement Research found in an analysis of the Federal Reserve’s 2019 Survey of Consumer Finances.

In 2019 – after several years of economic growth and a surging stock market – the typical working household, ages 55 to 64, that saves in a 401(k) had only $144,000 in its 401(k)s and IRAs combined, the Center for Retirement Research found in an analysis of the Federal Reserve’s 2019 Survey of Consumer Finances.

That’s just $9,000 more than they had in the 2016 survey, and $144,000 won’t go very far.

A $144,000 account would yield $570 per month for retirement if a couple purchases an annuity that pays a guaranteed income for the rest of their lives. For most retirees, the annuity payments – totaling just under $7,000 per year – would be their only source of income outside of Social Security.

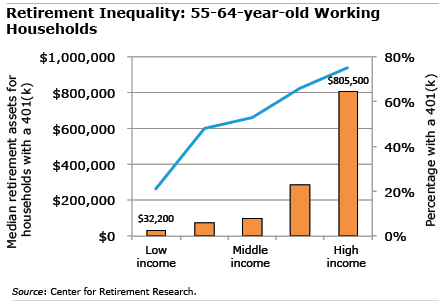

There are also enormous differences between high- and low-income households’ savings, which reflect the nation’s economic disparities and uneven employer coverage. The highest-income older households in the study had $805,500 in their combined 401(k) and IRA accounts, compared with just $32,200 for low-income households.

And only 21 percent of low-income households had 401(k) saving compared to 75 percent of those at the top.

More needs to be done about the dismal retirement prospects for the middle class and lower-paid earners, the researchers argue. They call for a national policy mandating that all workers be enrolled in a savings plan.

Our retirement system is not working for everyone – it’s time that it does.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Comments are closed.

Hubster has worked for the state since 1993. Contribution to retirement is mandatory at 6.8%. There is an option for additional contribution to a different plan in the state system similar to a 401k. I think this is brilliant even though in those early days, that money would have been nice. But as we are approaching 60 years of age, it is a nice monthly retirement sum.

I was already putting into my 403b and we both increased that over time from our wage increases until we hit the federal allowable. So grateful for his forced contribution!

Hopefully, they won’t break it for those who use it well. At retirement we had almost $700K in our 401K accounts. Year after year dollar-cost averaging into them – even during the Great Recession.

Even with government efforts to push people to save in IRAs, most choose not to. I’m not sure what else the government can do to get people to choose to save. As usual, it’s almost always about personal choices, rather than the opportunities.

Auto enroll everyone in an IRA since most workers do not even put that much away.

It would be great to have a gender breakdown. I’m betting women fare even worse than men.

Government needs to step up and lead. Retirement fund contributions should universally be “opt-out,” with automatic contributions until the employee specifically chooses not to do so after counselling.

We are one of the lucky ones. In that we had many years of putting the allowed maximum in to a 401k (IRA when we had our own business). We also were fortunate to get out of the market just before the big 2008 crash. Pure luck the market had been dropped for several months and we just decided to pull back on a Thursday. The next Tuesday it had it big 30% ish drop.

Our approach since retirement has been to ensure we could take the steps (if the sky fell) to be able to live on our combined Social Security income. That means no car payments, no home mortgage, and good medical insurance. One other thing we did was to purchase LTC insurance in our 50’s.

Since age 70 (we are now 75) my wife has had a kidney transplant, cost us only $2000 out of pocket, two broken shoulders, a hip replacement (no out of pocket). Jan has had two strokes which left her with minimal short term memory and a weak left side. With the LTC insurance she has 7 day a week in home help. The long term care insurance in the last 18 months has covered the $90,000 + of home health care.

I believe it is almost impossible to get people to voluntarily save to be secure in retirement. The only solution I see is to have a greater required input into Social Security or a similar program so that the amounts available at retirement are greater.

Create a retirement school that teaches how to plan, prep and practice for retirement. It’s overwhelming for most people and the government allows it to be more complex with fiscal policies that benefit some to detriment of most.

That’s too late. It needs to start in grade school, additionally required in middle school and again in high school. Even in college there should be a mandatory fiscal responsibility elective (and stick family planning in there too). It had to be part of long term education.

I have talked with members of Congress about privatizing Social Security properly and that would fix the problem. Currently, Social Security is a pay as you go governmental redistribution system that needs to have them make the rules but implementation in the private sector. I have run the numbers and they blow away the current program with real reserves and less risk.

I wonder what your source is for the statement in this post that, “Social Security is replacing less of workers’ incomes over time”?

I don’t think there has been a change in the formula used to determine PIA. How is it that Social Security is replacing less income?

Even with auto-enroll plans, there would still be significant leakage (withdrawals and distributions taken before retirement).

It seems preferable (to me) to skew Social Security benefits slightly more toward lower lifetime wage earners (so a higher percentage of their earnings was replaced) rather than auto-enroll everyone in an IRA. There is no leakage from Social Security.

When the full retirement age has been increased, that has essentially been a cut in benefit at every age. If my FRA is 66 and yours is 67, that means that you are due less at 66 or 67 than I am. If you delay until 70, you’ll be getting less than I will at 70.

Dave – the reason that Social Security is replacing less of workers’ earnings when they retire is that the program’s full retirement age has gradually been increasing over the years. As it increases, benefits are reduced for any given age that an older worker retires.

Also, more people are paying income tax on some portion of their benefits over time, because the income thresholds that determine taxes are not rising with inflation.

Thanks for the question!

Kim

Kim,

Thanks for your reply.

You’re going back to when the law changed with the Social Security Act of 1983, that affected individuals who retired starting 20 years ago, in 2000.

And the fact that the income tax threshold was not indexed for inflation is also really old news,

Social Security replacing less income “over time” refers to, I guess, laws written 37 years ago.

I appreciate your clarification.

Dave – Social Security has a schedule of the gradual increases over time in the full retirement age.

People can check their full retirement age here: https://www.ssa.gov/benefits/retirement/planner/agereduction.html

What is the threshold to be considered as high income?

John – I asked the researcher the same question: what are the income thresholds for each quintile?

Unfortunately, the methodology used didn’t calculate the actuals incomes – only the income quintile that each household falls into (as shown in the chart).

Kim

I am 62 and retired. Self employed my entire career. Saving was always something that was MY priority. I felt if I didn’t no one would. Sadly, I had some high income clients who were spend, spend, spend. I had low income clients who never paid anyone to do something they could do and they saved, saved, saved. Guess which client is enjoying retirement? Right, the low income one. If you want a government solution mandatory contribution by the employee with NO OPTION to have access before age 60 except for disability. There is too much “I need (want) it now”.

As someone who is self-employed, you are required to pay into Social Security so you do have that, however, I would like to see that the money you have paid into the system be invested privately. The government needs to make the rules but I do not want them controlling the investment. It is time for us to put on our big boy pants

Government is not the solution. We should be advocating personal finance and savings while in high school and into college. There is not enough emphasis on savings – rather spending and keeping up with the Joneses.

Government intervention is not the solution. Social Security is no longer as viable as it was 30-40 years ago. This is due to government tinkering as well as changing demographics. People need to learn responsibility and actions result in consequences. We have taken this away.

No voluntary system works if retirement preparation isn’t a priority. And, importantly, retirement preparation isn’t a current financial priority for a significant minority of American workers. So, our elites and masters should avoid substituting their priorities.

Your stated concern: “… about half of U.S. private sector workers at any given time are not enrolled in an employer retirement plan. …”

Consideration: Many times, individuals choose not to enroll, especially in plans with voluntary enrollment. Other times, because of age and service eligibility requirements, they are not eligible when first hired. Because median tenure of workers under age 35 has consistently been less than three years, a substantial portion don’t voluntarily enroll or opt out where enrollment is automatic.

Solution: IRAs have been available to all wage earners since 1982 – that’s 38 years. Median wage earner, age 22 in 1982, saving the IRA maximum until reaching age 67 SSNRA in 2027, earning 5% average return on investments, can buy an annuity that, when combined with Social Security, replaces 90+% of pre-retirement wages. So, if retirement planning is a priority, there are enough tax-preferred solutions out there.

Facilitating that Solution: Encourage plan sponsors to add automatic enrollment Deemed IRA functionality to their plans. So, because median wage earners seldom contribute more than $6,000 a year, individual has opportunity to save in plan she already knows, whether or not she has access to an employer-sponsored plan at her current employer.

Why is the IRA contribution amount so much lower than the 401(K) amount? I work for myself and not a large corporation. The limited IRA amounts are not enough to fund retirement even at the maximum amount. Remedy please.