Reverse Mortgages Get No Respect

Bob and Fran Ciaccia could not be happier with their reverse mortgage, which unlocked some of the equity in the house they purchased in 1966 for $12,500.

Reverse mortgages are federally insured loans available to U.S. homeowners over age 62. The loan is made against the equity in the house, and the principle, plus interest and some federal insurance fees, are not repaid until the homeowners or their children sell the house.

“I cannot find a downside,” Fran Ciaccia, a retired high school cafeteria cook from Levittown, Pennsylvania, said in an interview. “We have told so many people about it.”

Although the Ciaccias may be big fans, reverse mortgages are unpopular, despite historically low interest rates that make them a good deal for retirees right now. AARP has estimated that only 1 percent of older Americans use them.

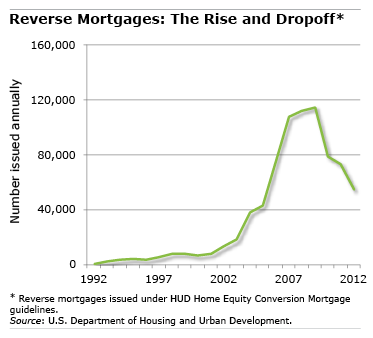

In 2012, the average loan size was $158,228, and 54,676 Americans got one. That is less than half the loans made in the peak year, 2009, according to the U.S. Department of Housing and Urban Development, which insures and sets standards for reverse mortgages.

In 2012, the average loan size was $158,228, and 54,676 Americans got one. That is less than half the loans made in the peak year, 2009, according to the U.S. Department of Housing and Urban Development, which insures and sets standards for reverse mortgages.

Contributing to the drop in sales were a housing market bust that depleted millions of Americans’ home equity, as well as less generous federal standards for determining loan size, and bad publicity surrounding some problem loans. AARP in a 2007 report cited surveys showing that some seniors don’t “trust” them, or are unwilling to pay the fees involved. A lack of consumer awareness does not seem to explain the lower sales – 70 percent of those AARP surveyed said they knew about them.

But home equity is often the largest asset that older Americans have, and reverse mortgages, done right, can bring in much-needed income for retirees, who use the money for medical bills or to improve their lives or even pay off their mortgage. In 2010, the typical older homeowner had $83,000 in equity. The Ciaccias had more than that – about $220,000.

In 2005, the working-class couple cashed in. Their $120,000 loan bought them peace of mind and a $24,000 Shasta recreational vehicle, which they’ve taken camping all over Pennsylvania. The rest was made available in a bank line of credit.

“You know the money’s there if you run into a problem,” said Bob Ciaccia, who retired in May after 25 years as a university locksmith.

Like many older homeowners, the Ciaccias were concerned about using up their home equity. So the couple discussed the idea of a reverse mortgage with their three children. “You know what?” Mrs. Ciaccia said. “They don’t need our money.”

Perhaps if more parents asked, they would get the same answer.

Comments are closed.

Reverse mortgages have high fees. I would only use it as only source of cash. However, it is better than using credit cards for cash.

Having originated nearly 100 reverse mortgages from 2007-09, I got a very good look at these loans, borrowers, and the pluses and minuses of the program.

Most borrowers needed funds to pay off existing mortgages and other debt. Too often there was little left to supplement retirement income. Where funds remained, I cautioned borrowers to consider this rule: Take what you need, but leave the rest.

The biggest problem I saw downstream was borrowers thinking too short term, trying to maintain a lifestyle vs. looking to a time when needs and abilities could change. What happens when your health changes or it’s truly time to downsize? These borrowers risk depleting their housing dollars, only to find themselves with few options later. For these borrowers, the reverse mortgage was a means to paper over problems and delay decisions that could have been addressed sooner.

There are alternatives to the reverse mortgage. For example, some would be better off simply selling now, downsizing while better able to manage change and freeing up home equity without need to borrow. Another idea is a sale/leaseback which may work well if adult children have an interest in owning the property along with the ability to purchase it from their parents. Other seniors could delay taking a reverse mortgage by simply taking in a roommate to share expenses (with care taken selecting that person, of course).

Otherwise, if the borrower’s intent is truly to remain in the home regardless of what happens, having adequate long-term care insurance is essential. A reverse mortgage plus long-term care insurance is thus, in my view, the best strategy. Unfortunately, this will not work for many borrowers because funds may still be lacking to pay insurance premiums or they are unable to qualify for coverage due to poor health.

So, for some people who plan well and borrow for the right reasons, a reverse mortgage may be a good solution. Otherwise, think everything through and consider all other alternatives first.

Thank you for a true life story with a happy ending. It’s nice to see an even-handed approach to talking about the reverse mortgage program.

As with any financial instrument, homeowners need to be aware of consequences when errors happen. Caveat emptor.

One horror story of reverse mortgage gone wrong involves improper titling of house and mortgage papers. Only one spouse had the title to the house but both signed reverse mortgage. When the spouse who owned the house died, the survivor was evicted since he could not pay off the mortgage and did not have title to the house. The facts are approximate, but the whole story was in AARP magazine within the last year.

Surprised the negatives aren’t discussed.

I enjoy your blog and often share the info in my blog and with the women who attend Financial Planning for Women.

I enjoy your blog and often share the info in my blog and with the women who attend Financial Planning for Women.

I recall a recent similar story, but it was the opposite issue. Both spouses were on the title, but only one (who died) was a party to the reverse mortgage. So the loan was technically due. The lender was trying to find a solution to avoid bad publicity, so they were either allowing the surviving homeowner to become party to the original loan or allow a streamline refi with a reverse mortgage.

The real horror stories stem from much older loans, but a few of those are still on the books. The Washington Post wrote last week about one in NJ. It sounded like an old Reverse Annuity Mortgage (RAM) where the borrower had to take out an insurance company annuity to get monthly payments. Worse, the lender took an equity position of 50 percent on any appreciation over the original appraisal. The property continued to gain and hold value, so the equity share left to the lender in the old RAM loan was huge. Turned out, the lender got way more out of the loan than the borrower ever did.

Fortunately, today’s FHA insured reverse product (HECM) does not have these onerous provisions. But stories about these disasters keep surfacing, another reason reverse mortgages remain a niche market product.

This statement is false. There are protections in place that the reverse client will not lose their home if they are recuperating or if the client is elsewhere. If the client is going to return home and live there as their primary residence, they are protected.

Reverse Mortgages seldom reveal that the Owner/Occupier will lose their home to the lender entirely IF they happen to be out of it for a specific time period, i.e. six months, recuperating in a medical facility or rehab facility after major surgery. The same applies if the Owner/Occupier should be needed elsewhere to care for a family matter for a period of time. No ads ever mention this onerous feature.

Judging by the comments to this article, it’s clear that I, as the blog’s writer, did not make one thing clear: all financial products, and especially products as significant to one’s finances as a reverse mortgage, must be studied carefully.

I have provided links in the article to some of the other press written about problems with reverse mortgages. Having only one name on the title is a pitfall for married couples, for example. Can anyone else weigh in?

As Paul noted in his comment, “homeowners need to be aware of consequences … Caveat emptor.”

Kim (blog writer)

I’m not sure if I buy that 1% is “too low” of a utilization rate, which the author seems to imply. D. Gardner’s first comment is on point – there are plenty of other options available – and it’s also hard to trust a financial product that’s so difficult to understand / learn about. Shopping for a traditional mortgage loan isn’t necessarily easy, but it’s much, much easier.

That said, I did enjoy the post 🙂

I have been originating reverse mortgages for the past 7 years. I am a CPA and founder of a state bank. I came out of semi-retirement to do this after I saw how a reverse mortgage improved my sister’s life. About half of my borrowers wanted a HECM (home equity conversion mortgage) to use to liquidate their existing mortgage. Many took lump sums and some line of credit. They all appear happy with their decision. I have been trying to find the “downside” since I started doing this. I had a client, a retired engineer, who asked about a reverse mortgage. I worked with this man off and on for over 2 years while he evaluated the loan features. Finally, he pulled the trigger and said “let’s go ahead Jerry and prepare an application”. He had an expensive home on Lake Wisconsin and a small mortgage. He opted to take a lump sum. At the closing table he said “Jerry, I have been trying to find the downsides with this program for 2 years, and I can’t find any”. I said, “Dick, I can’t either”.

Are there downsides? The main downside is you cannot take your equity with you! Another one might be that you are using up your equity, probably to improve your life or your cash flow. Is this a downside? Some might argue that a downside is that you are using your equity which will not be available to your heirs. How horrible! I had the daughter of one of my clients told me, “Jerry, the only people who want a reverse mortgage are those that want to use up their kid’s inheritance”. Nice kid!

Are we all put on this earth to build up a nice equity in our homes, and then scrimp and save so we can give this equity to our kids?

Now, as to costs and fees. The largest fee which is not present in a conventional “forward” mortgage is the MIP (mortgage insurance premium). This is the fee charged by HUD to insure the loan. It is 2% of the maximum claim amount up front, and then 1.25% per year.

The MIP can be reduced significantly if the borrow opts for the “saver” loan, but then the loan amount is reduced about 20%.

I have a loan in process now and I will give you the details for those interested in making comparisons. A couple with the youngest borrower (the wife): Age 70. Home value: $335,000. Loan amount: $219,090. MIP: $6,700, Other costs/fees: $4,055. Pay off existing loan: $40,000. Taking $10,000 at closing in cash and $1,200 per month. They discussed with their children and it was them who suggested the reverse mortgage. Their initial interest rate will be approximately 2.442%. I do not advise taking a reverse mortgage unless one plans to stay in the home for less than 5-7 years. These people plan to stay in their home as long as they can. If we look at the Total Loan Cost at 14 years (wife will be 84), the total cost at 0% home appreciation will be about 2.46%.

In this case, the total MIP and other costs are about 5% of the loan amount. If they sell their home, they could pay a real estate commission of $23,000, plus have the moving costs and the inconvenience of moving and relocating. Most of the seniors I have met wish to remain in their homes in their own neighborhood.

The problem with these loans is they are not well understood or fairly discussed in news stories.

I know there are lots of smart people on this blog so I hope someone can respond to enlighten me on the negatives and downsides.

I am an attorney and I specialize in reverse mortgages. The main issues in the order that I see them are: 1) Lack of knowledge. Seniors still think reverse mortgages have high fees or the bank takes the home. Also, the senior is unaware that the loan can be tailored to their specific situation. 2) Lack of equity. With the specific caps on lending, many seniors don’t qualify. They tapped into mortgages for quick cash when the economy tanked and now their LTVs are too high to refinance, and 3) The heirs issue. I was surprised how often this crops up, but I have run across more than a few children that look at the property as their inheritance and are against any new liens on the home.

I have been a real estate agent for 50 years. Reverse mortgage and investment advisers are not obligated to advise the prospect what is in their best interest. If they were investment “experts,” they would not be talking to/advising you. They would be earning larger incomes working for those with more assets. The rules of the game are LET THE BUYER BEWARE.

ALWAYS discuss your options with family members, your CPA and family financial advisor. If you do not have them, ask trusted family members or friends or professionals in your church or medical doctors to recommend. Why the small print in the contracts that most buyers do not read and, if they read, do not understand? Sellers of reverse mortgages have the small print for a reason. For their protection and profit, not for your benefit. Always do what is in your best interest. Avoid doing what is in the best interest of the SELLER.

Nice article on the reverse mortgage program. As with any financial decision you need to make sure all your questions are answered before you just jump in with both feet. The reverse mortgage has both pros and cons, but for more people than you think they can be a very good option.

I was in the reverse mortgage industry for 5 years, 2006 to 2011. When all the changes within the lender industry changed, I moved to prime mortgage lending, but my heart is still in reverse mortgages.

Real life, real numbers story: My parents did a reverse mortgage before I knew what a reverse was. Initially I thought all the negative, I “heard” this and I “heard” that about how bad it was. All the misconceptions I lived.

My parents did a reverse in June of 2005. They bought a condo in June 2005 for $278,000. They put $120,000 as a down payment. Their reverse starting loan balance was $165,000 with $18,000 remaining and available in their line of credit. My father died May 2007. My mother remained in the condo, no issues, no problems as it should be if you do the reverse the proper way. My mother moved out January 2013 and into a retirement community.

The principal loan balance had increased to $220,000. The condo was deeded to FHA and then sold for $170,000.

If they would have done a prime mortgage at the time of purchase: $160,000 prime loan at 5%, monthly PI payment of $858.91. Over the life of them living in the condo, 90 months, they would have made monthly mortgage payments totaling $77,301. January 2013 the principal loan balance remaining would have been $138,779. Selling price $170,000 real estate fees, closing costs etc, net proceeds from sale approx $18,000.

By my parents doing a reverse mortgage they saved not only approx $77,000 by NOT making mortgage payments. They were able to keep that money in their IRA accounts appreciating in value over that period of time as well. She put the $18,000 remaining line of credit in her savings account. Arguably they had a net positive cash flowing increase of approx $100,000 by doing a reverse mortgage. It will afford my mother to now live in the retirement community for many more years.

My question has always been, what’s the downside of a reverse mortgage? There are few. This is a program which is not being utilized by people who could use it. They are getting inaccurate information and perception that it is a scam. You must weigh the advantages and disadvantages. You must look at what you want out of life in America.

I am not old enough, however at 62, if I choose to do so, a reverse will keep $15,624 in my pocket each year by eliminating my mortgage payments. That is 20% of my retirement income budget. WOW!! All tax free and it does not affect my home or my ability to live there forever.

Please tell me where the downside is.

JP has asked several times: What are the downsides to a reverse mortgage? He has given examples of how nice it can be when everything goes according to plan with the reverse mortgage. But as Nassim Taleb alerted us, there are black swans lurking in our financial system that we ignore at our own peril.

Here are a few risks that get short shifted, but should be considered by anyone considering a reverse mortgage. Some are inherent in the product, others can arise from unexpected events or due to things attracted by lump sums of cash. Any number of things that can go wrong, if you let them.

Risk #1 – Interest Rate Hikes

The most popular Federal HECM has an adjustable rate. Once tied to the 10-year Treasury Bill, it was later linked to the LIBOR to attract more investor interest in buying these loans. But what has been good for borrowers thus far can quickly turn against them in a rising rate environment, eating up remaining home equity at a pace faster than may have been illustrated to the borrower. The true cost of the loan, can thus not be known until the reverse mortgage is eventually paid off.

Risk #2 – Declining Home Values

Every RM illustration I saw showed a projection of the growing loan balance against a forecast of home appreciation. Alas, thanks to the Great Recession we learned home values do not go up forever and indeed, can drop significantly. RM loan illustrations will show a nice corridor of retained equity only as long as the interest rate matches appreciation. Unfortunately, for many parts of the country, or even specific neighborhoods, this has not been the case.

Risk #1 and #2 combined

Picture rising interest rates with flat or, worse, declining home values. Retained equity goes to zero equity at a pretty brisk clip.

Risk #3 – Rising Defaults

If these are such great products, why are defaults on loans rising rapidly? See this Wall Street Journal article for details. Default can occur when the borrower fails to pay property taxes, insurance, and upkeep. HUD issued a warning back in November about lump sum loans leaving borrowers with insufficient income to cover bills.

The cause of this problem? Unlike traditional loans (or forward mortgages), reverse mortgages do not have a mechanism nor do they require escrow for payment of property taxes and homeowner’s insurance. It is totally the duty of the borrower to make those payments. All fine and good when the borrower has the means and ability to keep track of this, but what happens if a health event occurs? Or the senior loses ability to handle their finances? Who knows this and is watching?

Risk #4 – Loss of Credit Line

Borrowers may be wise to take only what they need and leave the rest to grow on their reverse mortgage credit line. But does the senior or their heirs know this line of credit is only available to the borrower during their lifetime?

OK, so there is no problem as long as the value of the credit line doesn’t exceed the the amount or retained equity in the home. But what happens to a large credit line when you are otherwise upside down in the reverse mortgage and the borrower(s) die? POOF….it’s gone.

This is not theoretical. I recently ran into one 82-year-old borrower with about $80,000 at risk of vanishing because her home value dropped over 40 percent.

The same thing can happen if the borrower loses the ability to manage their own finances. Unless there is a POA or guardianship in place, only the borrower can call for the remaining cash off the credit line.

Risk #5 – Unexpected Events

Nowhere in the other posts, JP’s included, is the impact of a health event addressed. In their defense, a loan officer, CPA, or attorney may not typically be trained to consider this. Though harder to quantify, nonetheless, the challenges of declining health with age deserve attention.

Dollars released to a senior by a reverse mortgage need to be carefully husbanded, like any asset, and are unlikely to have been earmarked for health care.

Ideally everyone wishing to age in place, with or without a reverse mortgage, should have adequate long-term care insurance. Only 8 percent of the population owns it, so it’s reasonable to assume ownership is even less among reverse mortgage borrowers. Yet long-term care is the risk most likely to derail your plans.

Senior alternative living communities are not cheap and often require significant cash deposits to enter. If this is later needed, will the reverse mortgage borrower have enough retained equity to cover this?

This risk is very much discounted by seniors I work with. As Taleb might reason, is this due to our very human tendency to think that what has always been, will always be.

Risk #6 – Family Issues

A senior’s money and home equity may be more exposed to loss from a less than ethical friend or family member. There doesn’t even have to be theft, just pressure from an adult son or daughter for help. Helping with a grandchild’s tuition is not a bad thing, but only if it is not at the expense of the senior’s financial independence. What about families where drug abuse, alcohol or gambling are present? The dangers of being able to access junks of cash should be obvious. Are lenders screening for this?

Like many other financial products these days (such as a variable annuity), should there be a suitability or even a fiduciary standard here?

So, do you still think a reverse mortgage is an ideal product with no downside? Caveat emptor!

JP has asked several times: What are the downsides to a reverse mortgage? He has given examples of how nice it can be when everything goes according to plan with the reverse mortgage. But as Nassim Taleb alerted us, there are black swans lurking in our financial system that we ignore at our own peril.

Here are a few risks that get short shifted, but should be considered by anyone considering a reverse mortgage. Some are inherent in the product, others can arise from unexpected events or due to things attracted by lump sums of cash. Any number of things that can go wrong, if you let them.

Risk #1 – Interest Rate Hikes

The most popular Federal HECM has an adjustable rate. Once tied to the 10-year Treasury Bill, it was later linked to the LIBOR to attract more investor interest in buying these loans. But what has been good for borrowers thus far can quickly turn against them in a rising rate environment, eating up remaining home equity at a pace faster than may have been illustrated to the borrower. The true cost of the loan, can thus not be known until the reverse mortgage is eventually paid off.

Risk #2 – Declining Home Values

Every RM illustration I saw showed a projection of the growing loan balance against a forecast of home appreciation. Alas, thanks to the Great Recession we learned home values do not go up forever and indeed, can drop significantly. RM loan illustrations will show a nice corridor of retained equity only as long as the interest rate matches appreciation. Unfortunately, for many parts of the country, or even specific neighborhoods, this has not been the case.

Risk #1 and #2 combined

Picture rising interest rates with flat or, worse, declining home values. Retained equity goes to zero equity at a pretty brisk clip.

Risk #3 – Rising Defaults

If these are such great products, why are defaults on loans rising rapidly? See this Wall Street Journal article for details. Default can occur when the borrower fails to pay property taxes, insurance, and upkeep. HUD issued a warning back in November about lump sum loans leaving borrowers with insufficient income to cover bills.

The cause of this problem? Unlike traditional loans (or forward mortgages), reverse mortgages do not have a mechanism nor do they require escrow for payment of property taxes and homeowner’s insurance. It is totally the duty of the borrower to make those payments. All fine and good when the borrower has the means and ability to keep track of this, but what happens if a health event occurs? Or the senior loses ability to handle their finances? Who knows this and is watching?

Risk #4 – Loss of Credit Line

Borrowers may be wise to take only what they need and leave the rest to grow on their reverse mortgage credit line. But does the senior or their heirs know this line of credit is only available to the borrower during their lifetime?

OK, so there is no problem as long as the value of the credit line doesn’t exceed the the amount or retained equity in the home. But what happens to a large credit line when you are otherwise upside down in the reverse mortgage and the borrower(s) die? POOF….it’s gone.

This is not theoretical. I recently ran into one 82-year-old borrower with about $80,000 at risk of vanishing because her home value dropped over 40 percent.

The same thing can happen if the borrower loses the ability to manage their own finances. Unless there is a POA or guardianship in place, only the borrower can call for the remaining cash off the credit line.

Risk #5 – Unexpected Events

Nowhere in the other posts, JP’s included, is the impact of a health event addressed. In their defense, a loan officer, CPA, or attorney may not typically be trained to consider this. Though harder to quantify, nonetheless, the challenges of declining health with age deserve attention.

Dollars released to a senior by a reverse mortgage need to be carefully husbanded, like any asset, and are unlikely to have been earmarked for health care.

Ideally everyone wishing to age in place, with or without a reverse mortgage, should have adequate long-term care insurance. Only 8 percent of the population owns it, so it’s reasonable to assume ownership is even less among reverse mortgage borrowers. Yet long-term care is the risk most likely to derail your plans.

Senior alternative living communities are not cheap and often require significant cash deposits to enter. If this is later needed, will the reverse mortgage borrower have enough retained equity to cover this?

This risk is very much discounted by seniors I work with. As Taleb might reason, is this due to our very human tendency to think that what has always been, will always be.

Risk #6 – Family Issues

A senior’s money and home equity may be more exposed to loss from a less than ethical friend or family member. There doesn’t even have to be theft, just pressure from an adult son or daughter for help. Helping with a grandchild’s tuition is not a bad thing, but only if it is not at the expense of the senior’s financial independence. What about families where drug abuse, alcohol or gambling are present? The dangers of being able to access junks of cash should be obvious. Are lenders screening for this?

Like many other financial products these days (such as a variable annuity), should there be a suitability or even a fiduciary standard here?

So, do you still think a reverse mortgage is an ideal product with no downside? Caveat emptor!

I went back to read JP’s post about his parent’s reverse mortgage experience. Good that his mom was able to transition successfully to a new living arrangement. But I’m not convinced the reverse mortgage was a superior solution for her. It was most certainly a disaster for the FHA and the taxpayers who ultimately back these loans.

My first thought was, wow, look how fast they went to zero, even negative equity. The condo priced in 2005 for $270,000 sold for just $170,000, 90 months later when the keys were turned over to the FHA. Against an outstanding loan balance of $220,000, that’s a $50,000 loss the FHA incurs.

Fortunately, neither JP nor his folks weren’t on the hook for this, due to the non-recourse nature of the loan, i.e. only the property itself can be attached for the settlement.

OK, so the FHA got soaked, but how sweet a deal really was it for JP’s folks?

For starters, they plunked down $120,000 with the reverse-to-buy loan. They also drew $18,000 off the loan’s credit line, for a net all-in cost of $102,000. Divided by the 90 months they lived there, we get an average of $1,133.33 per month NOT counting real estate taxes, condo fees, or insurance.

OK, so what if they had rented instead? Maybe they could have rented the same or similar unit at $1,133.33 per month, maybe not. For now, let’s say they could.

Except in the rental option, they held onto their $120,000. Divide this by 90 months and you get $1,333.33. So they would have an extra $200 per month to save or spend, even if they earned zero interest on their money.

Now factor in taxes, condo fees, and homeowner’s insurance. How much more per month is it costing to own using the reverse mortgage? Even 1 percent on $270,000 is $2,700 or $225 per month. Add $200 for a modest condo fee and you’re at $425 per month. And as property values declined, many areas did not lower the tax rate; some even increased it.

The turn around is now $625 per month ($200 extra left by renting + $425 in taxes and condo fees avoided). Times 90 months, you’re out $56,250 in cash flow for the privilege of borrowing to own.

If you had found a reasonable investment for that $120,000 not needed for a down payment, how much more could you have possibly offset rental expense? A modest 3 percent return produces $3,600 per year or another $300 per month. Let’s deduct 20 percent for taxes so call it $240 per month net. Times that by 90 months, that’s another $21,600.

JP compared the cost of the reverse mortgage favorably against a conventional mortgage. But he missed comparing to a good rental option. By my estimate, the reverse mortgage to buy resulted in an estimated loss of $77,850 vs. renting and safely investing that down payment. And without touching the IRA, either.

I’m not saying this would have happened, but it could have, and demonstrates there are indeed viable options to a reverse mortgage. The rent vs. buy also avoids many of the risks I outlined in my other post about what can go wrong with these loans if you let them. Interest rate risk, loss of credit line risk, suitability risk, declining home value risk, etc. are avoided entirely.

My Grandpa and Grandma did this and loved it, they got to share some great times traveling and see me and my brother so much too 😛

There is a one-year time limit to allow the reverse mortgage homeowner to return home. Beyond that, the lender can call the loan.