A Lot of Student Debt May Never Be Paid Off

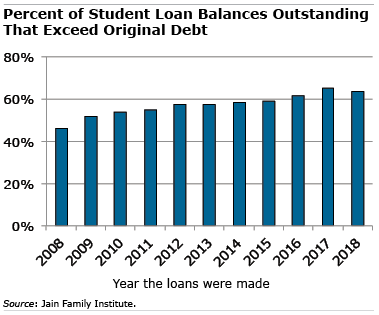

For half to two-thirds of the college loans made over the past decade, the former students owe more than they initially borrowed.

For half to two-thirds of the college loans made over the past decade, the former students owe more than they initially borrowed.

This is the result of a federal program that bases monthly student loan payments on the borrowers’ income if they aren’t earning enough to afford the standard payments. But the monthly payments in these much-needed Income Driven Repayment (IDR) plans are often less than is required to fully service the principal and interest on the loans. So instead of getting ahead, borrowers are perennially behind and never chip away at the balances.

People who go into the repayment plans are “trying to bail out a boat with a bucket that has a hole in it,” said Betsy Mayotte, president of The Institute of Student Loan Advisors, a non-profit that gives free information and advice to people needing help with their loans.

Marshall Steinbaum, an economist with the University of Utah, estimates that at least half of all student loans might never be repaid, based on his back-of-the-envelope calculation. That share is also growing, he said in an email, because more and more former students are enrolling in IDR programs.

The inability to pay “is baked into the system,” Steinbaum wrote in The Appeal.

The good news is that, under the federal repayment plans, any unpaid debt will be extinguished in 20 or 25 years, depending on the specific terms of the plan. (Under a standard plan, the repayment window is 10 years.)

But the loan forgiveness in IDR repayment plans has a catch-22. Once the debt is forgiven, borrowers are still required to pay federal income taxes on their unpaid balances, which can add thousands of dollars to their income in a single tax year. To pay this “tax bomb,” people often save money in a separate account for years, at the same time they’re making loan payments.

The financial stress on borrowers is relentless, Mayotte said. She added that “student loans aren’t the problem. Student loans are the symptom. The problem is the cost of higher education.”

In the pandemic relief bill signed into law this month, Congress temporarily suspended the tax liability on loan forgiveness. This provision is in addition to President Biden’s suspension of required student loan payments through September. During this period, the loans have also stopped accruing the interest but borrowers can pay down the principal.

Mayotte said suspending the tax bomb won’t help most people, however. This provision of the relief bill expires on Jan. 1, 2026, but most of the debt in IDR plans won’t be eligible for forgiveness until at least 2030, because the earliest repayment plans didn’t come into existence until 2009, she said.

The relief is a short-term fix for a longer-term problem.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Comments are closed.

I doubt many of those in distress studied STEM at MIT. People have to live with the consequences of their choices. An associates degree in grievance studies from a for profit school may be a less smart choice than a plumbing apprenticeship.

Suspending the tax bomb won’t help anyone today except for a few people under ICR plans from the ’90s but it sets a powerful precedent. Most tax changes are “temporary” or have “sunset” provisions but are routinely renewed. In 2026, it’s unlikely that either party will want to let the provision expire. The tax bomb never made any sense in the first place.

Alternative view: the problem should weigh heavily on universities. They have hidden data about the poor job prospects for many majors, created new majors that seem sexy to young people, have inflated grades, fattened their administrative ranks, filled teaching ranks with year-to-year independent contractors at very low cost, lengthened the time to get a degree, and advertised loans as if they were problem free. If taxpayers are on the hook for these loans, there is no incentive for universities to change practices. Universities should be brought into the loop and forced to bear much of the cost. If publicly-traded companies offered stock with such little disclosure and accountability, they’d be sued, prosecuted, fined and criminalized into oblivion. But universities, especially big public universities, get away with it. Like your blog post, most writers on student debt never even mention the blameworthiness of universities.

Your point is well taken. Give the universities skin in the game, and they might be choosier about who they admit and what they teach.

Why not just reduce the interest rate on these federal loans? With interest rates at 1-2% these folks have a chance at paying their loans off in 20-25 years

Why not indeed? Do you want to pick up the cost of subsidizing the interest to below market levels? I will take the Bartleby approach and answer that I prefer not to.

On one hand, I am sympathetic that college is so expensive. On the other hand, I see college students borrowing to have resort-style living while attending college, and traveling extensively during spring break, and traveling to Europe in the summer on federal loan dollars. Where is the consideration for those of us that scrimped and saved and did without so our children could graduate from college debt free, while they lived modestly and had jobs during spring break and during the summer?

One thing seems certain: taxpayers will be hung out to dry.

Again.

They should have left student loan issuance to the private sector.

If you don’t repay student debt, it can limit your choices for decades. It may feel like you’re never going to pay off your student loans.