401ks are a Source of Cash in Pandemic

The U.S. retirement savings system has always been a little leaky. But the leaks seem to be getting bigger.

Some Americans are eyeing withdrawals from their 401(k) plans as the best of a few bad options for paying their rent or solving other cash-flow problems.

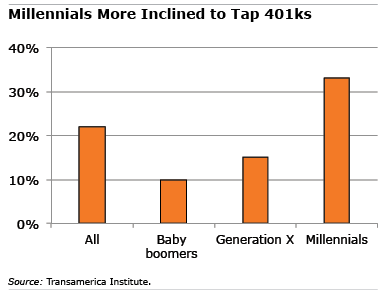

As of May 8, 1.5 percent of retirement plan participants had taken some money out of their 401(k) plans under new federal legislation permitting penalty-free withdrawals, The Wall Street Journal reported. An April survey by the non-profit Transamerica Institute put the number of savers responding to the pandemic much higher – about one in five.

But the data included people who took out loans from their 401(k)s, in addition to withdrawals from 401(k)s and IRAs. Further, Transamerica reported not only on what people have already done but what they say they plan to do. Younger workers and men were the most likely to resort to this desperation move.

But the data included people who took out loans from their 401(k)s, in addition to withdrawals from 401(k)s and IRAs. Further, Transamerica reported not only on what people have already done but what they say they plan to do. Younger workers and men were the most likely to resort to this desperation move.

Prior to the pandemic, many workers were already behind on their retirement savings and still had not fully recovered from the recession a decade ago.

The current economic downturn will only set them back further as the layoffs, reduced hours and sales commissions derail or curtail their efforts to save. Employers having to lay off workers are also conserving cash by suspending their matching contributions to their employees’ 401(k)s.

“The negative economic effects of the pandemic are further threatening retirement savings and security,” said Catherine Collinson, chief executive of the Transamerica Institute, a partner of the Center for Retirement Research, which funds this blog.

The Coronavirus Aid, Relief, and Economic Security Act passed in March made it easier to withdraw money by waiving the standard 20 percent income tax withholding and 10 percent penalty, which usually applies to people under age 59½. But one estimate made prior to the pandemic shows this is a costly strategy: prematurely taking money out of 401(k)s and IRAs reduces the average amount of money available for retirement by about one-fourth.

People who still have jobs are also saving less. One in five workers have reduced their 401(k) contributions, a Magnify Money survey shows. The informal poll isn’t representative of the population but is certainly an indication of the financial strain the pandemic is putting on workers.

Employers are pulling back too. At last count, some four dozen companies reeling from a drop in revenue – including big names like AutoNation, Best Buy, Hilton Grand Vacations, and Tripadvisor – are temporarily halting their matching contributions, according to a list compiled by the Center for Retirement Research.

In the pandemic, the 401(k) is a ready source of cash for millions of people trying to survive from one month to the next. Sadly, COVID-19 will have long-term consequences for their retirement.

Read more blog posts in our ongoing coverage of COVID-19.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.