Billionaires Got Much Richer in Pandemic

In the COVID-19 downturn, this blog has had a steady supply of stories and statistics about the damage being done to low-income and middle-class families.

That’s one perspective on the pandemic. The growing billionaire class is another one.

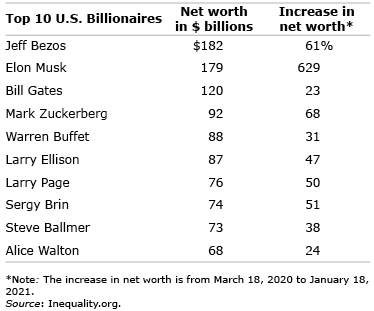

Since last March, the nation’s 660 billionaires have added more than $1 trillion to their wealth – a 39 percent increase. Their combined net worth is now $4 trillion, which is nearly double the $2 trillion held by the 165 million Americans in the bottom half, according to the Institute for Policy Studies’ new report.

Since last March, the nation’s 660 billionaires have added more than $1 trillion to their wealth – a 39 percent increase. Their combined net worth is now $4 trillion, which is nearly double the $2 trillion held by the 165 million Americans in the bottom half, according to the Institute for Policy Studies’ new report.

“It’s a troubling sign that too much of society’s wealth and income is flowing upwards to that small group of people,” Chuck Collins of the Institute for Policy Studies said during an interview on NPR’s Fresh Air.

The institute’s report is based on Forbes magazine’s annual estimates of the net worth of the world’s richest people.

Inequality has always been with us, but economists say it has grown as billionaires’ wealth has hit stratospheric levels.

To be sure, inequality would’ve been worse without the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The $500 billion in direct assistance to families last spring prevented a surge in poverty, and the relief bill passed in late December is sending more aid to unemployed and under-employed people who need it.

The billionaires are getting richer for a couple reasons, starting with a surprisingly strong stock market in 2020. Despite the worst public health crisis in a century and a struggling economy, the Standard & Poor’s 500 stock index shot up 18 percent.

But some billionaires were also in the right place at the right time – a pandemic. Last year, Zoom founder Eric Yuan officially became a billionaire, though his $17 billion net worth pales next to Amazon founder Jeff Bezos’. Bezos’ wealth swelled $69 billion last year to $182 billion as the pandemic made him richer each time someone ordered an item for doorstep delivery.

Amazon is a classic example of a company that Collins said is “benefiting from having their competition effectively shut down during the pandemic.”

Read our blog posts in our ongoing coverage of COVID-19.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Comments are closed.

The U.S. is not a democracy; it is a plutocracy – government of the rich, by the rich and for the rich. Our “representatives” in Congress, in both houses, have one over-riding concern: their own reelection. This makes them beholden to the rich who fund their campaigns. The only true way out of this is strict term limits, coupled with modest taxpayer-funded election funds, so that ideas rather than money would dominate the discussion, and our Senators and Reps would focus on the needs of the country rather than their grip on power, Don’t hold your breath.

Their cost to society is not their wealth, but the amount they consume. I am willing to bet Mark Zuckerberg has a better TV than me. I am not sure his clothing is any better than mine – in fact, quite the reverse. Would workers be any better off if their wealth was confiscated and distributed to the poor, who would then consume it. Workers are better off in a society with a lot of capital than in a society with little – ask any worker in Burkina Faso and they will tell you. In fact, billionaires are the poor’s best defense against a profligate government.

Whaddya say? Incomes distributed as they were in the first Reagan administration?

Honestly, many retirees, with their 401(k) accounts, likewise did well in 2020. I’m with Wade Pfau that attempting to sustain a fixed living standard using distributions from a portfolio of volatile assets is an inefficient retirement income strategy, but it sure worked out last year.

Most people with investments did very well over that same time period.

Over that same 3/18/2020-1/18/2021 time period, our net worth increased by over 15%. That’s not an uncommon net increase for modestly invested assets for that time period. And because we aren’t invested aggressively, we don’t see those high returns of the billionaires mentioned above (nor do we experience the phenomenal losses they do during the rough patches).

What’s interesting about this is the selection of 3/18/2020 as the starting point for the comparison. (I had missed this entirely; my wife brought it to my attention.) 3/18/2020 was near the low point of the Dow Jones Industrial Average last year. When we considered our 15%+ return during the 3/18/2020-1/18/2021 timeframe, but instead adjusted the starting date to just a month earlier (2/18/2020-1/18/2021), our net worth increase was much lower – just over 5%. By selectively choosing that 3/18/2020 as the starting point of the net worth comparison, it provides a skewed impression (though not a wrong impression) of how wealth grows during challenging times.