Boomers Lament Disappearance of Pensions

More than one of this blog’s readers said a recent article about 401(k)s was hardly revelatory. But it sure generated a lot of comments.

Ed McGrath wrote this about “Retirees with Pensions Slower to Spend 401(k):” “Well thank you for this Caption Obvious.”

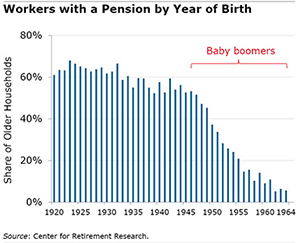

Perhaps the article struck a nerve because baby boomers are the generation who mostly lost out on pensions. Nearly two-thirds of U.S. workers born in the 1920s through the 1940s – many of them parents of boomers – had pensions. But a measly 6 percent of boomers from the tail end of the wave have them.

Millennials and members of Generation Z usually wouldn’t even consider pensions in their retirement plans. But boomers at one time might’ve hoped or even expected to enjoy a retirement similar to their pensioned parents.

“I am a single woman, a former nurse, and not one job offered me a pension,” said Jennifer Lee, who is 67. “I am relying on my savings and Social Security as well as the equity in my home.” Lee expressed chagrin that a 60-year-old cousin – a rare boomer with a pension – has already “mailed in his retirement papers.”

Several readers pointed out problems with a U.S. retirement system that increasingly relies on savings – leaving retirees to figure out how much to withdraw every year – as monthly pension checks have disappeared. Ken Pidock, quoting a financial journalist, said 401(k)s lack the reliability of pensions: “Forcing people of modest means to depend on the stock market for income to pay bills after they stop working is madness.”

Paul Brustowicz, a former insurance company employee in his late 70s, feels lucky to have the security that comes with a pension, along with his Social Security and some IRA funds he converted to an annuity. “The steady monthly income lets my wife rest easy at night,” he said.

But another reader, Brian Jarvis, has a different perspective on the generational pension divide. “Yes, my father had a traditional pension that I don’t have,” he said. But Jarvis and his wife built up an ample nest egg “that my parents couldn’t have dreamed of,” he said. “We’ll be in good shape for quite a while – the rest of our lives – even without our parents’ type of pensions.”

Unfortunately, not everyone is as prepared as Jarvis. About half of U.S. households aren’t saving enough to retire at the traditional age of 65, which puts them at risk of suffering a drop in their standard of living when they quit working and the paychecks stop.

Further, some boomers may forget to plan for the financial impact of paying taxes on their traditional 401(k) and IRA withdrawals, starting at either age 70 or 72 – the rules changed in 2019. The withdrawals are part of the IRS’ requirement that retirees pay taxes on a predetermined percentage of their assets each year.

“If you have large traditional IRAs, you will be clobbered by taxes starting at 72,” warned a reader named Joel.

Geoffrey Hewitt is concerned about the steep cost of U.S. health care, which puts another strain on retirement savings. Health insurance is also tied to the pension issue, because retirees who were members of public or private sector unions often get health insurance along with their pensions, though these plans are also becoming more rare.

Michael Waggoner offers practical advice to people who want their modest savings to last: annuitize some of that 401(k). An annuity, he said, “provide[s] investment security” and “slows winding down the other assets.”

To read the study on which this article is based, see “Can the Drawdown Patterns of Earlier Cohorts Help Predict Boomers’ Behavior?” by Robert Siliciano and Gal Wettstein.

The research reported herein was derived in whole or in part from research activities performed pursuant to a grant from the U.S. Social Security Administration (SSA) funded as part of the Retirement and Disability Research Consortium. The opinions and conclusions expressed are solely those of the authors and do not represent the opinions or policy of SSA, any agency of the federal government, or Boston College. Neither the United States Government nor any agency thereof, nor any of their employees, make any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.

Comments are closed.

“The withdrawals are part of the IRS’ requirement that retirees pay taxes on a predetermined percentage of their assets each year.”

I’m 99.99% certain that the taxes are required by Congress, not the IRS. The IRS enforces the tax laws that Congress passes. It doesn’t have its own authority to require the payment of taxes.

Learning about investing is no different than learning about anything else – one step at a time. For investing, we first started by learning about savings accounts, then checking accounts, then CDs, then mutual funds, stocks, bonds, ETFs, commodities, etc. Along the way we also learned about concepts like dollar-cost-averaging into our 401(k)s, time horizon, and risk tolerance. Just one step at a time. Fairly simple if you build knowledge over time. It’s the financial industry misleading people to believe they have to know everything today or they’ll never make it.

Figuring how much to dispense in retirement was easier. Every year, and especially as we approached retirement, we tracked how much we spent each year. Did we want to maintain that lifestyle in retirement? If so, then multiply annual spending x 30+ years retirement x inflation factor. Does the math add up? Fairly simple math. Again, it’s the financial industry misleading people to believe they can’t do it themselves and they’ll never make it.

Good summary Brian. My wife and I also added a contingency factor for the delta in market returns during our retirement. I would also suggest that those approaching retirement consider holding 3 to 5 years worth of annual expenses in cash available accounts (1 yr. CD’s or money market type accounts) to bridge any investment bubbles.

There was a piece in the Wall Street Journal the other day, from Glenn Ruffenach, where he recommended that, after determining an annual income, we should add around $5,000. That is because he says he sees that, every month, there seems to be some four hundred dollar expense that wasn’t planned for. Seems to make sense.

A good start in learning about money management in retirement is the US Dept. of Labor, Employee Benefits Security Administration’s pamphlet

“Taking the Mystery out of Retirement Planning.” Its several worksheets can help one calculate payments/returns etc for ten years into the future.

News Alert: 401(k)s are a vehicle to save money for you to spend during your retirement – not to pass on a large sum of money to your heirs. Look – you got to avoid taxes earlier in your life on these compensation deferrals – but did you really believe that you would never pay taxes on these funds? Please. Stop Whining.

The move away from DB to DC has had devastating consequences that are only just becoming evident. It is poor policy to believe that the average American has the financial wherewithal to fund this “retirement” benefit, let alone manage and then disperse it. Sure, there is a subset of our working population that may be able to handle this task, but certainly not a majority. We have a substantial percentage living within 200% of the poverty line. Do you really believe that they have discretionary income available to fund their retirement? Couple those issues with the fact that millennials and those that follow are burdened with extraordinary housing and education costs that Boomers didn’t have to deal with. Lastly, the historically low US interest rates have forced those living on savings to either eat more principal sooner or move out on the risk spectrum to try to capture some yield. We no longer have a retirement industry. We have glorified savings accounts that may or may not be supported by one’s employer. The “Great Resignation” is perhaps an unintended consequence of the disappearance of DB plans.

Back in the late 19th/early 20th century, social conditions made it financially advantageous for companies to offer pensions. Time went by and the companies started to resent paying folks for not working. After WWII, resentment grew, so they invented 401k’s, IRA’s, etc in which they did a match in lieu of a pension.

What will the workers do with the money? Why, invest it in the stock market, of course. What did the average worker, blue collar or otherwise, know about the stock market? Next to nothing. But the wealthy had professionals to take care of their money. Slowly the money that had, in the past, been paid by the equity owners to the workers, in the form of pensions, made its way back to them in the equities market.

Brian, with all due respect, there are large swaths of workers who have little to no idea on how to play the market and only limited ability to learn. Not all are blessed with above-average intelligence.

As a 70ish boomer, I’m not sure people understand that the switch from pensions to 401ks was a colossal dump of responsibility from the private sector onto the government. The government was nuts to let them get away with it. (I know, the government is not directly responsible for pensions now but it had to scramble to develop compensatory mechanisms.)

Another perfect example of what Gen X is by mentioning only Boomers, Millennials and Gen Z.

LOL

When I was still working with clients helping them plan for retirement, there was an alarming difference in the financial stability of those Boomers that had a pension and those that didn’t.

But something else I also found interesting was, those that had sizable pensions had very little in cash savings. Without the pensions they would have been cash strapped.