Can’t Afford to Retire? Not All Your Fault

Three out of four members of Generation X wish they could turn back the clock and get another shot at planning for retirement. One in three baby boomers say don’t think they’ll ever be able to retire.

“Overwhelmingly, Americans are stressed about their current – and future – financial situation,” the National Association of Personal Financial Advisors said about these new survey results.

Regrets about not planning and saving enough are enmeshed in our thinking about retirement. But it is really all your fault that you’re not getting it done?

The honest answer to that question is “no.” There are big gaps in the U.S. retirement system that make it very difficult for many to carry the responsibility it places on workers’ shoulders.

I predict some of our readers will send a comment into this blog saying, “I worked hard and planned and am comfortable about my retirement. Why can’t you?”

Granted, we should all strive to do as much as possible to prepare for old age, and many people have made enormous sacrifices in preparation for retiring. The hard truth is that some people are much better-positioned than others. Obvious examples include a public employee with a pension waiting for him at the end of his career, or a well-paid biotechnology worker with an employer that contributes 10 percent of every paycheck to her retirement savings account. These workers frequently also have employer-sponsored health insurance, which limits their out-of-pocket spending on medical care. This leaves more money for retirement saving than someone who pays their entire premium and has a $5,000 deductible.

Sure, we could all do a better job of planning out our careers when we’re first starting out. But my husband, as a Boston public school teacher, started accruing pension credits before he could’ve imagined ever getting old. He recently retired, and his pension, accumulated during 27 years of teaching, is making our life a lot easier.

Sure, we could all do a better job of planning out our careers when we’re first starting out. But my husband, as a Boston public school teacher, started accruing pension credits before he could’ve imagined ever getting old. He recently retired, and his pension, accumulated during 27 years of teaching, is making our life a lot easier.

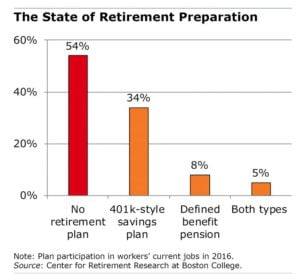

But pensions are on the wane in the private sector, and more than half of U.S. workers have neither a pension nor a 401(k) in their current job – this makes it pretty hard to save. IRAs are an option available to anyone, but human inertia makes that an imperfect solution to the problem, because people tend to procrastinate and don’t set them up. Further, working couples in which only one spouse has a 401(k) aren’t saving enough for both of them, one analysis found.

The people with jobs that lack retirement plans tend to earn less, too, which limits how much they can save after paying for necessities like housing. The New School for Social Research found that high-income workers save 6.1 percent of their income for retirement, while workers in the bottom half save only 2.8 percent.

Lower-income workers get more help from Social Security, which is a progressive program that replaces more of their earnings than it does for high-paid workers. Even so, low-income workers are less financially prepared.

The newest structural barrier to savings to emerge is student debt. One study found that Millennials who don’t have student loans are saving two times more for retirement than young adults with the loans.

Finally, workers have failed to address changes in the retirement calculation resulting from the fact that the majority of wives today work full time. Having two incomes improves a household’s standard of living, but it also raises the bar on how much they will need from their savings and Social Security benefits, which are replacing less of two earning spouses’ income over time.

Planning for retirement is an enormous responsibility, and we could all do more. But the path to retirement is tougher for some than for others.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Comments are closed.

I agree and like what you wrote, but it’s been my constant experience that among my many professional friends & strangers who are in their 50s and 60s know they need to save more. They see the math of downsizing that allows them to put more into retirement, eating out less, keep their cars longer, and other behavior change that can help them with a bigger 401K but they refuse to change. Again, this is 99% of my professional friends & strangers throughout the U.S. I coach retirement too. Still, these people – middle/upper-middle class – want to keep their current lifestyles into retirement, but their 401K math does not add up to reflect the lifestyle they want in retirement. I downsized in my mid-50s, keep my car as long as possible, and poured thousands of “extra” dollars from downsizing into the S&P 500.

My professional peers tease me about why I did not keep the big house (I live in a 55 plus community just outside Washington, DC). My wife and I are very health conscious and long-term planners; therefore, we know your data and the consequences of not saving. Unlike most of my peers, we do not want to depend on anything from our children – NADA! That means eating out less (for money and health), getting rid of the big house, and moving into a 1,100 sq ft condo with a $1,700/year property tax just outside of D.C., therefore, enjoy the D.C. area w/o “paying” for it.

NONE of my friends want to downsize, and their 401K is a lot smaller than ours. I work for the fed gov that gives me 1% of my pay for every year I work there. So I’m better off than most but don’t act like it. I also plan to stop working at 70 and refused many promotions because the stress will most likely “force” me to retire sooner and possibly take my Social Security sooner/lower amount.

BOTTOM LINE: Your piece also applies to a lot of “capable” people who don’t want to change and save more.

Society’s biggest mistake, although well intentioned, is the replacement of the defined benefit plans with defined contribution plans.

ERISA is perhaps the best legislation ever. However the existence of ERISA forced corporations to address the true reality that benefit plans are expensive. This led to corporations moving away from the costly obligations. Some states have moved in this direction, several in the south.

Any financial advisor would agree, individuals covered under defined benefit plans are among the clients best off for the future. Clients who were offered both plans and aggressively saved are in the catbird seat.

What actions can society take to deliver these to all?

Public policy regarding our retirement system, as with our health care system, is pitiful. Add to that the general lack of support for personal financial education in this country and it is obvious why so many people are in such a sad situation. Most of our leaders don’t represent Americans — they represent special interests. And is it any wonder why? Look at how much money is going into November’s elections. To change things, I personally feel it’s going to take a huge grassroots movement fueled by a populace willing to discern fact from fiction when it comes to our situation and why we’re stuck in it.

Complete hogwash! It’s always only your fault!

You don’t have the full picture on why so many Americans are unprepared for retirement until you consider why pensions have been disappearing from the private sector – see below – and that many employer sponsored 401(k) type plans are substandard at best. (For example, they include high fees and expenses; lousy investment options chosen to generate pay-for-play revenue sharing, etc., and little to no contribution from the employer.)

“Ellen Schultz argued that many large employers have plundered employee pension plans over the past decades and detailed some of their tactics. She also talked about the crisis this loss has created. She responded to questions from the retiree association leaders in the audience. This talk was part of their orientation for the National Retiree Legislative Network’s third annual Washington, D.C., Fly-In to advocate for retirement issues.”

https://www.c-span.org/person/?ellenschultz

Schultz’s book is quite illuminating. It isn’t so much that employers are spending less on retirement benefits, just that those have mainly become deferred compensation to high earners.

Excuses, excuses, excuses! The only person to blame for not being able to retire in a financially comfortable manner is the person themselves. I’m tired of people blaming everything/everyone else for their situation and complaining as well about how they were treated unfairly by the system. There’s obviously a lot of people who figured out how to make retirement a reality and financially secure. Blaming the system or the government is an excuse. No one should ever rely on the government to support them. Our ancestors came to this country when the services we have today did NOT exist, yet they found a way to support their families and eventually retire. Being smart about your choices such as the type of college degree to pursue, spending appropriately in adulthood and saving throughout life will easily get you to the right place in the end. It’s called the “American Dream” for a reason, but it’s imperative that an individual follow a good plan of action from the start. It’s entirely achievable if you execute your plan. Hoping, wishing, complaining and demanding that it’s the government that should take care of you is ridiculous and shameful. Throw away the excuses and just work hard towards your goal. It’ll happen.

“Retirement” per se has only existed for most people since the postwar era. Before that, people were just expected to work until they were no longer able to do so.

The article title is not true. If you can’t afford to retire – yes, it’s your fault. It means you chose to spend money versus saving money. Student debt is your fault. You signed up for it. Retirement savings is your responsibility. Just because your company doesn’t offer a great pension – so what? Everyone can invest in IRA’s. There are minimal excuses…

You left out from your chart people who only had the benefit of IRAs to retire. Retiring with no 401 or pension can be done. Just cultivate a mindset to pay yourself first with your income. It can be done quite easily.

Does anyone think that pampering these people, and saying “it’s not your fault, pumpkin”, will actually make the situation better? You merely perpetuate a feeling of entitlement and self-pity which has hobbled the Millennial generation like no other, and now threatens to do the same with others. And I love how the article comes out of Boston College, a very expensive school that largely is part of the student loan problem directly by their outrageous costs.

To all of the commenters who have little or no empathy for those who are working hard, sometimes two or more jobs and who are NOT spendthrifts, but who are still finding it hard to create anything that resembles a stable retirement — I have to believe you have never, ever walked in those shoes. I guess I’m glad you have had some combination of all that goes into creating an income base that allows you to retire in some sort of comfort. However, I dearly wish that you would come off your perches and see how so many really live in the US today — through no fault of their own. Which, btw, is not to say that there aren’t plenty of anecdotal up-from-the-bottom stories. I am one of them. The reality, however, is those are anecdotal and not what huge numbers of people face in today’s economic environment.

Normally there is “truth of both sides” of any issue with any degree of complexity. I’ve been supervising Gen X and Millennials for quite some time. I won’t refute your structural arguments like the demise of the DB pension. But you can’t hide from the fact that the 401K shifted the burden to the individual. Having financial security takes a lifetime of denying short-term gratification. I see so many buy too much house, drive too much car, eat out constantly, etc. This is like everything else in a capitalist economy. The more the responsibility shifts to the individual the more variance in outcome you will see.

This is the best comment on this article.

One of the best things I did when I first began living on my own was learning to cook for myself. Preparing my own food has saved me thousands of dollars over the years, helped me avoid gaining too much weight in middle age, and I directed much of my savings from eating at home into an IRA.

I think there is a cultural issue when it comes to saving and investing. If your father and mother invested in stocks when you were growing up, you are more likely to consider investing yourself when you “set up shop” on your own, and pay closer attention to any defined contribution or employee stock purchase plan that your employer does offer, or contribute to an IRA and invest on your own if they don’t.

It should be easier to invest today; brokerage commissions are dramatically lower today than back during the 70’s and 80’s; thanks to online trading. I bought a Treasury (CATs; they’re not available any more) in 1985, and paid about $50 commission, at a discount brokerage.

Thanks for information! Good luck!