COVID and Tech Fueled Fraud Against Older Americans

COVID and technological advances have created a perfect storm of fraud against older Americans.

Between 2019 and 2023, the number of fraud cases reported to the Federal Trade Commission more than doubled to 2.6 million. But the losses from these scams tripled to $10 billion, indicating the scammers are becoming more effective.

“Today’s scams are more coordinated, more sophisticated and more personalized,” Ray Bellucci, executive vice president of TIAA said in a new report on fraud focused on the impact on Americans over 60.

Older people have long been more susceptible to fraud due to high rates of social isolation, heightened during COVID. This is especially true if they are divorced, single, or widowed and don’t have someone to talk to about what’s going on with them, research shows. But their vulnerability is also being exploited by new and unfamiliar technologies that coax them into turning over credit card information and bank account and Social Security numbers.

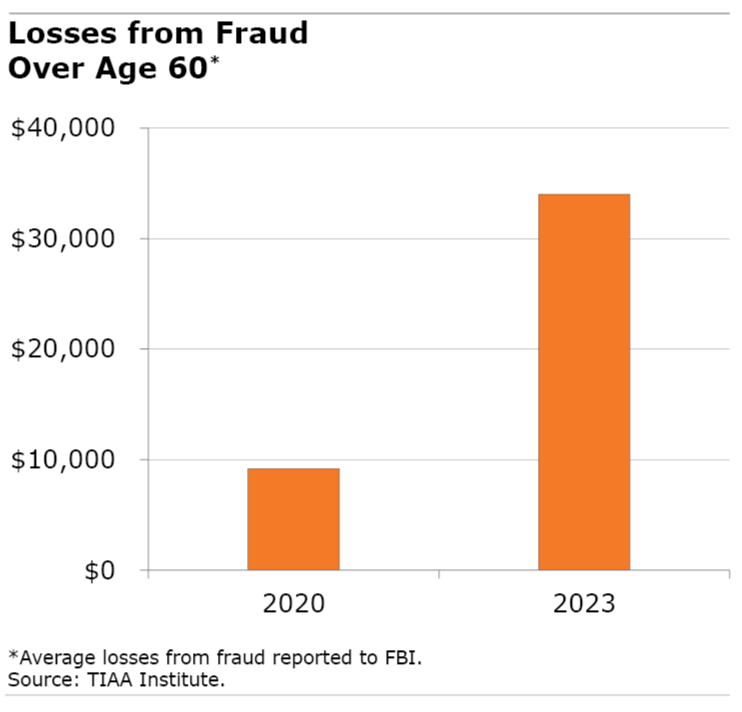

These factors, when combined with cognitive decline among the oldest Americans, might be contributing to the growing losses since the pandemic. The average losses from scams that people over 60 reported to the FBI – presumably the most serious cases – reached $34,000 in 2023, up from $9,175 in COVID’s first year, according to the TIAA Institute.

The danger at this age is that a successful scam can threaten financial security just as people are getting close to retirement age or have already retired and are living on a tight budget.

The most common type of fraud comes in emails or calls seeking personal information from people who claim to be from trusted organizations. Calls from government imposters purportedly from the IRS, Social Security, or the Consumer Financial Protection Bureau spiked during the pandemic and have since subsided but have not disappeared. Now retail and other private-sector imposters, which also spiked during COVID, are the bigger threat, according to FTC data in the TIAA Institute’s report. (The institute supports the Center for Retirement Research, which funds this blog.)

Deepfakes mimicking the voices of relatives or coworkers also are used to obtain information from older people. And scammers are learning to use social media and AI to scour the internet for personal details about individuals they can use when targeting them.

“These technological tools have alarmed officials because AI-enhanced scams are much harder for consumers to identify as fake,” the TIAA Institute said.

Data on fraud losses reported by the FTC demonstrate older Americans’ greater vulnerability. Losses from fraud reported by people over age 70 are as much as three times larger than the losses reported by younger adults, according to the TIAA Institute.

Fortunately, researchers have found some success in preventing fraud. In one effective experiment, individuals were trained to recognize fraud by exposing them to simulated scams on an email platform.

But this and other technology-based methods to prevent fraud, such as complicated passwords or account monitors, are difficult to implement on a large scale and may not work well with older people.

Technology is advancing at lightning speed. It will be an enormous challenge to counter it and protect consumers.

Squared Away writer Kim Blanton invites you to follow us @SquaredAwayBC on X. To stay current on our blog, join our free email list. You’ll receive an email each week – with a link to the week’s article – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.