Credit Unions a Popular Antidote to Fraud

The 1980s featured bankrupt Texas savings and loans. Then, in the mid-2000s, Countrywide failed to clearly disclose to customers the spike in their subprime mortgage payments in year 3. In 2016, 5 million customers learned about their fabricated Wells Fargo accounts. And last year, Equifax breached 140 million customers’ privacy.

No wonder people are flocking to the friendly credit union in their church, labor union or workplace.

The widespread fraud reports making headlines with regularity have fed a perception that “fraud happens in the banking world and a lot of it goes unpunished,” said Mike Schenk, senior economist for the Credit Union National Association (CUNA).

“It’s not just Countrywide as an abstract concept. It’s that Countrywide put people into these toxic mortgages to make a buck.” The 2008 stock market and housing crashes, fueled partly by the collapse of several subprime lenders, hammered this point home.

CUNA has a bold marketing message: credit unions care more about their customers than impersonal banking behemoths. Schenk said he has the evidence to prove credit unions are benefiting from Wall Street’s financial shenanigans: membership increased an “astonishing” 4 percent in 2017, as the U.S. population grew less than 1 percent.

Of course, most banks aren’t bad guys, and they provide services that small credit unions can’t. Banks frequently upgrade their technology – Bank of America’s ATMs are cutting edge. Large banks also have much larger networks of ATMs and branches, and they can service the large corporate accounts credit unions aren’t equipped to do.

So, what do credit unions do better? Here are their three big advantages:

- Their top priority, by default, is the customer, who is also the credit union’s owner. When banks commit fraud, they have other loyalties: they are trying to boost profits to please their institutional stockholders, Schenk said. Bank managers and chief executives also own stock, creating another incentive to pump up the share price. Wells Fargo’s fake accounts increased its sales and hurt customers’ credit scores.

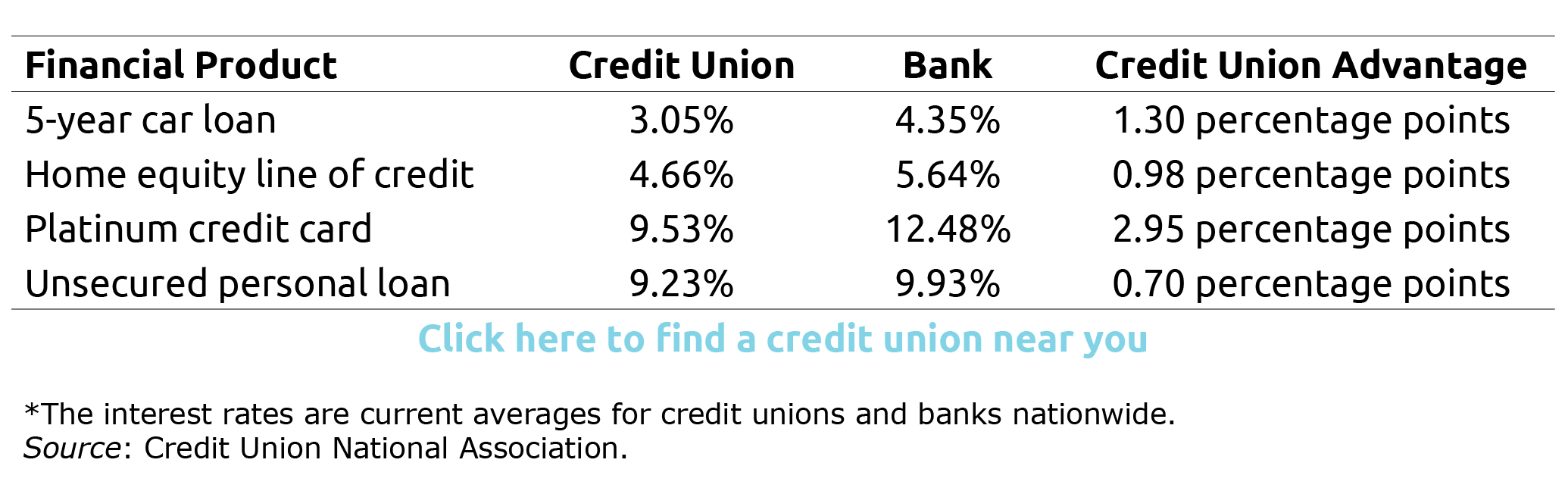

- Small is beautiful translates to much better deals for borrowers and depositors at credit unions, which can be more flexible in their underwriting than banks taking orders from headquarters. At a credit union, for example, the average interest rate on a $30,000, 5-year car loan is 3.05 percent, with monthly payments of $540. The same car loan from a bank charges 4.35 percent, with $557 payments. The additional interest on the bank loan adds up to more than $1,000 over the life of the loan.

- Due to credit unions’ affiliations with churches, unions and other local organizations, their customer service is more personal than the major banks’. For example, one in four credit unions is operated by an individual employer, so the customer knows the credit union staff because they work together.

If you’re convinced you should move your business to a credit union, you can probably find one in your area.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here.

Comments are closed.

The accounts were not fake accounts, but rather unrequested accounts. Clean up the writing of this article. Get the facts right!

I believe Ms. Blanton used the correct term when she said fabricated, i.e., something that is invented or manufactured, most often to deceive.

In addition, Wells Fargo charged clients exorbitant fees for car insurance, forcing many to default and have their cars repossessed. Wells Fargo got away easy in the recent settlement which allocates approximately $147.00 to those affected. Not much to someone who had their car repossessed.

In Humpty Dumptys world, words can mean what we want them to mean. You can parse the difference between words in this case, but the end result is the same. In this case…fraudulence.

If they were unrequested, they were fake.

Was Mr. Mayfield joking? Could his remarks be taken as a satire on political correctness? Hmmm.