Do Couples Save Enough for Two?

Since only about half of all private sector workers currently have access to an employer 401(k) plan, it’s not at all unusual for spouses who are both working to have only one saver in the family.

When that’s the case, is the person who is contributing to the employer retirement plan saving for two? The answer is definitely not, concludes a new study by the Center for Retirement Research.

When that’s the case, is the person who is contributing to the employer retirement plan saving for two? The answer is definitely not, concludes a new study by the Center for Retirement Research.

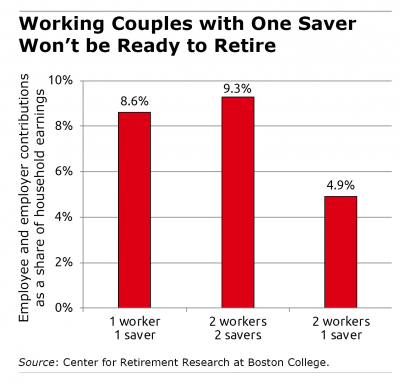

The challenge for couples living on two paychecks is that they have to save more money to maintain their current lifestyle after they retire. But households with two earners and only one saver end up saving less than others – only about 5 percent of the couple’s combined incomes, compared with more than 9 percent when both spouses are working and saving, the study found.

Couples who rely on a lone saver need that person to pick up the slack. Employers could help them if they considered the employee’s family situation when setting a 401(k) contribution rate in plans that automatically enroll workers.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Comments are closed.

This study left me wanting more. Are the two worker, one saver households those in which only one spouse is eligible? If the household pools resources and is rational and far-sighted, the other spouse should pick up the slack. A failure to do so is consistent with either a) behavioral impediments to optimal behavior, or b) the spouses not pooling resources and having different preferences, beliefs, or budget constraints.

Tony,

You raise a good point. But in my professional experience and research, people are not as rational as you, or my economist colleagues, might think.

I am a financial adviser (formerly an anthropologist) who collects net worth statements from clients over the last 18 years. My clients are North Americans who are less likely to save and more likely to take on debt (mortgages and credit card debt) in our consumption-obsessed economy.

Culture, or tradition, directs behavior in so many ways, including saving for retirement. Women often stay home to take care of the children (traditional-not rational). Why? Women get higher grades when they compete in higher ed and get the same advanced degrees. That enables their husbands to work long hours to make a lot more money. (There is a gender pay gap and it is not rational, either.) And seemingly gender-blind tax laws play a role. The highly paid male gets the big tax break when he puts money in his 401k, in his name.

Yes there are spousal IRAs, but most couples don’t think of them, nor contribute to them. And the max contribution is far lower than the max on 401ks.

A simpler question might be, why doesn’t every employee max out on her/his 401k and IRA?

That would be rational. But is it realistic in today’s economy?

Partial answer: The middle class is paid too little and has not seen a real raise in 20+ years. Expenses have risen more than their real incomes. But that does not explain why the top 20% does not max out, even if they do receive substantial raises each year.

Wendy is right about culture’s impact but I wonder if she is speaking of ethnic culture vs age groups and social cultures? Overriding each of these is the desire to provide for a better life for their kids no matter what and to also be responsible for parents or others. For instance, my tuition at BC was $1,800 a semester back in ’66. Today’s is … ? Just student loans are greater than all mortgages today. Result is smaller families plus putting off saving.

In addition financial advice of parents is largely ignored as far as I can tell. Kids do not normally talk openly to parents about their own finances or investing.

All of this is only talk and not a solution or a path to a solution. Reality is (1) those who do not save are not aware of reality (downside potentials), (2) they think they have “enough” either in resources to sustain them, or (3) they are relying on both their resources and/or outside help.

Reality is a lot of middle class people are working too hard and long to take time to manage finances, do taxes and plan for the future. Even learning how to is too much, unless a way to motivate them is found.

If you want to know why people don’t max 401ks/IRAs, you have to ask them. That could lead to a solution.

I offered to teach a money/finance course but no one wanted to listen. Too bad.

We are a highly educated couple who 30 years ago decided that one parent (the female spouse) would stay at home and raise the children in order that the higher earning spouse could maximize their career (travel) and thus earnings. As 401k moved to an online status it was natural for me to manage his (our) 401k as much as it was to manage the other financial aspects of our lives. This is more common (according to Fidelity) than most people think. As soon as Social Security maxed out I would up the contribution amount accordingly without any change in our take home pay. I did the same with raises and catch up contributions and paid particular attention to our deposits after cash flow improved when the children left the nest. We never failed to hit the max contributions after I was able to pay closer attention.

The implicit plan being made is that the non saving spouse will continue working, and earning. This assumption needs to be highlighted to the couples.