Expect Widows’ Poverty to Keep Falling

The poverty rate for widows has gone down over the past 20 years. This trend will probably continue for the foreseeable future.

The poverty rate for widows has gone down over the past 20 years. This trend will probably continue for the foreseeable future.

Women face the risk of slipping into poverty when a husband’s death triggers a drop in retirement income from Social Security and a pension (if he had one). But beginning in the 1970s and 1980s, women moved into the nation’s workplaces at an unprecedented pace.

Women now make up nearly half of the labor force and are more educated, which means better jobs – and better odds of having their own employer retirement plan. As a result, they have become increasingly financially independent.

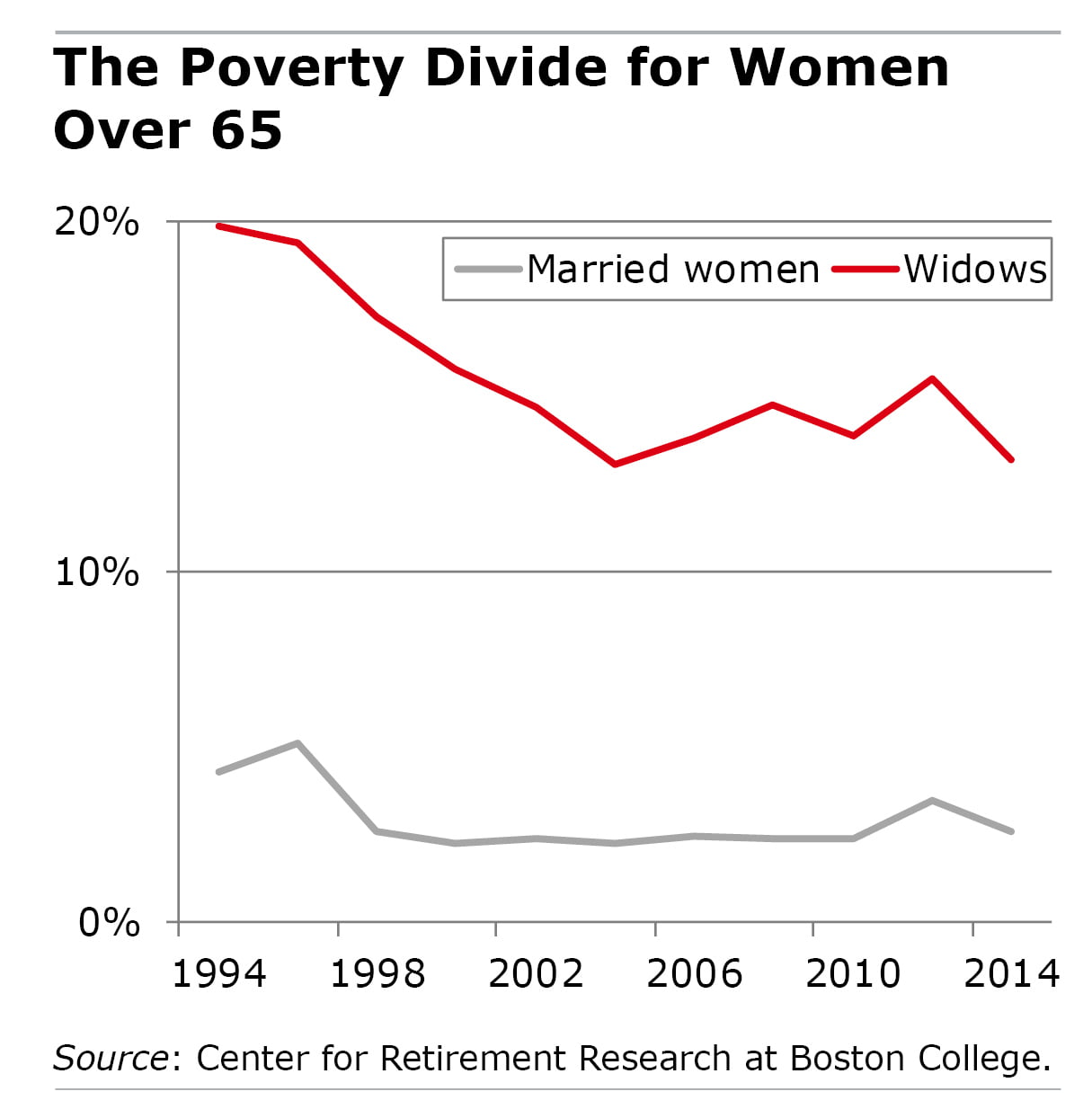

This trend of greater independence is now showing up among older women. Widows between ages 65 and 85 put in 10 more years of work than their mother’s generation, which has helped push down the poverty rate from 20 percent in 1994 to 13 percent in 2014, according to the Center for Retirement Research.

More recently, an important change in marriage patterns has taken hold that is expected to play a role in further reducing widows’ poverty in the future. Women with lower socioeconomic status – less education and lower incomes – are marrying at lower rates than they used to. And married women are increasingly well-educated and have higher incomes; this is known as “marriage selection.”

With more widows being drawn from this select group in coming years, the researchers estimate that the poverty rate for widows will drop to about 8 percent by 2029 – 5 percentage points lower than today.

This study is very encouraging. But the fact remains that widows’ poverty rate is, and will continue to be, significantly higher than it is for married women.

To read the entire study, authored by Alicia H. Munnell, Geoffrey Sanzenbacher, and Alice Zulkarnain, see “What Factors Explain the Decline in Widows’ Poverty?” A summary of the paper is also available.

The research reported herein was performed pursuant to a grant from the U.S. Social Security Administration (SSA) funded as part of the Retirement Research Consortium. The opinions and conclusions expressed are solely those of the author(s) and do not represent the opinions or policy of SSA or any agency of the federal government. Neither the United States Government nor any agency thereof, nor any of their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.