Could Social Security Statement Do More?

Two out of three working Americans grade their retirement readiness at no better than a “C.”

So how about using the Social Security Statement that lands in their mailboxes, grabbing their attention, to spur them to action?

The statement is already valued by millions of Americans. A survey funded by the U.S. Social Security Administration (SSA) found that people who received statements were “dramatically” more knowledgeable about their basic pension benefits than people who had already retired when SSA started mailing them out in the mid-1990s.

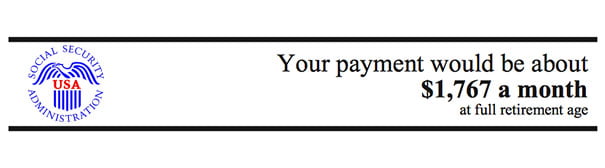

Social Security is the nation’s most important source of retirement income, and the information in the statements is essential to most workers’ retirement planning. Mailed out before every fifth birthday – 25, 30, 35, etc. – and annually at age 60, the statement provides estimates of each worker’s future benefits at three different claiming ages: 62, when they have access to their smallest monthly benefit; the “full retirement age”; and 70, when workers receive their highest monthly benefit. It clearly lays out how much workers can increase their monthly retirement income by delaying when they start collecting their benefits.

[In lieu of paper statements, people who sign up online can check their benefits anytime and will receive an email every year when their updated statement becomes available.]

New evidence is emerging that workers are moving in the right direction, with more of them delaying the age at which they claim their benefits. But the statement does not get credit for driving these decisions. Reasons for these delays include employers shifting away from traditional pensions. Controlling for this and other influences on retirement timing, one study found that the mailed statements had no impact on when workers claimed their benefits.

Further, too many people apparently are not reading the statements coming in the mail. Nearly one-third of workers who were less than two years away from signing up for their benefits were unable to estimate how much they would receive, even though they had been receiving yearly statements for a decade, according to a 2008 survey.

For the majority who do read them, though, it’s reassuring to get a statement in the mail. But this is a false sense of security, if workers do not act on what it’s telling them.

_______________________________________________________

Social Security statements have different cover pages for

workers in different stages of their careers. Click below to

see the sample statements:

- early career

- mid-career

- over 55 and on the way to retirement.

_______________________________________________________

The review reported herein was performed pursuant to a grant from the U.S. Social Security Administration (SSA) funded as part of the Retirement Research Consortium. The opinions and conclusions expressed are solely those of the author(s) and do not represent the opinions or policy of SSA or any agency of the federal government. Neither the United States Government nor any agency thereof, nor any of their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.

Comments are closed.

“At your current earnings rate, if you continue working until…” People don’t get that, with a solid 35 years of work, most of the benefit increase between 62 and 70 is from the delay in claiming, not from continuing to work. They read the statement and think, “I don’t want to work until I’m 70,” so they take the benefit early.

The other change that could be made is projecting the combined earnings of marrieds vs.singles. Singles, especially single women, need to save more to cover the income gap with marrieds.

Re Mr. Pidcock’s comment, SSA could say more precisely that “if you delay applying” for the benefit (irrespective of whether or not you continue to work) until any age between 62 and 70, you will receive a larger benefit. There are two other advantages: surviving spouse gets larger benefit (provided his/her benefit is smaller than that of the deceased’s) and the annual cost of living % increase

provides a larger dollar gain the larger the benefit.