Home Equity Offers Big Boost to Retirees

Retirees’ primary sources of income are the usual suspects: Social Security and employer retirement plans. They rarely use a third option: the equity locked up in their homes.

The Urban Institute recently quantified how much this untapped equity could be worth to seniors in the United States and 10 European countries if it were converted to income – and the amounts are significant.

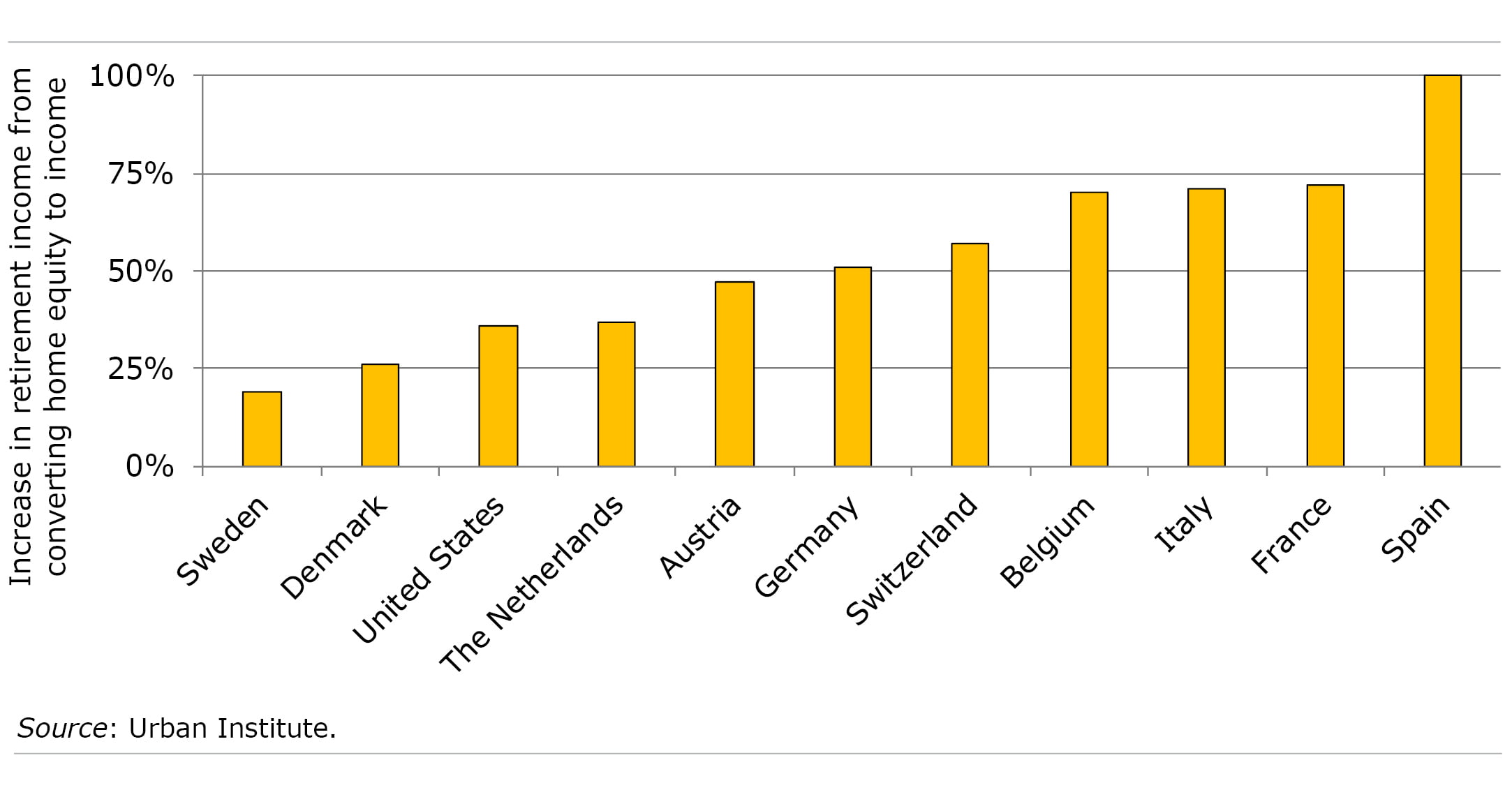

The typical retired U.S. household has the potential to increase its retirement income by 35 percent, researchers Stipica Mudrazija and Barbara Butrica estimate. In Europe, using home equity would add anywhere from 19 percent in Sweden to 100 percent in Spain.

But tapping this asset is a big “if,” because the financial products available to convert home equity to income are rarely used, whether a reverse mortgage in this country or the sale and leaseback of a home in Denmark.

The vast majority of U.S. retirees are homeowners, and the study highlights a central contradiction in their finances. Many baby boomers will struggle to maintain their current standard of living on just their Social Security and retirement savings and could put the additional income from their home equity to good use. Yet only about 2 percent of eligible older homeowners take out a federally insured reverse mortgage (Home Equity Conversion Mortgage) every year.

The researchers cited several reasons for the low demand in the United States and Europe for various financial products that convert home equity to cash. The barriers include the high cost of the products, an aversion to taking on more debt, and homeowners’ desire to leave an inheritance.

A separate issue is that homeownership is concentrated among middle- and high-income retirees, so home equity products have less potential to reach lower-income seniors, who have the greatest need to supplement their income.

The researchers conclude that while converting home equity could be an important option for increasing income, it currently has only a limited role in supporting old age security.

The research reported herein was performed pursuant to a grant from the U.S. Social Security Administration (SSA) funded as part of the Retirement Research Consortium. The opinions and conclusions expressed are solely those of the author(s) and do not represent the opinions or policy of SSA or any agency of the federal government. Neither the United States Government nor any agency thereof, nor any of their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.

Comments are closed.

Many retirees who are house-rich but cash-strappped and want to age in their homes, simply need relief from ever-increasing property taxes. Reverse mortgages and other vehicles have up-front fees or other attributes to cause retirees to reject those options.

About two dozen states have property tax deferral programs that can help retirees who simply need property tax relief. Each of the states’ programs are slightly different, but can provide these specific retirees what they need to remain in their homes for the rest of their lives: https://amp.timeinc.net/time/money/5375073/seniors-missing-property-tax-deferral

Hi,

Situation is same in India as well. People nowadays are least interested in debt and don’t want to leave any inheritance.

Hope more and more people realize the importance of this income stream.

I think using your home equity could be a real problem. I think it’s better to pay off your mortgage early so you don’t have any house payments when you retire or shortly after you retire.

Paying off your mortgage early may not be the best tax strategy. However, you have to weigh the tax savings in mortgage interest with the possible loss of property tax savings above $10,000 a year. This tax balancing act is why you employ CPAs.

My father is 90 and still going strong, and one of his dreams now is to leave as much as possible to his children and grandchildren, not to saddle them with having to deal with the paperwork of paying off HELOCs and Reverse Mortgages when he goes.

If the article were suggesting you can beat housing market returns + interest by putting the equity in other investments, I’d be on board. If the suggestion is for people who absolutely need the additional income to consider these options, I’m on board.

But the reality seems to fall in line with the typical Baby Boomer attitude of “you can’t take it with you.” So spend it all instead of leaving a legacy for your offspring and theirs. Sad.

I am retired and my financial situation is more than adequate with Social Security, a pension and IRA. I am debt free and see no need for HELOC.

Several of my retired friends have considered HELOC and took no action because they either did not understand it or were afraid of the future consequences, or already in debt up to their eyeballs.

The horror stories of HELOC’s were another deterrent.

It is a good idea for Boomers to develop a careful strategy for using the equity in their homes. They need to weigh the positives and negatives of each strategy: aging in place, downsizing and using the equity to increase their income, or turning to reverse mortgages.

One reason the takeup of reverse mortgages is so low is that the only one with financial incentive are the reverse mortgage companies. CPAs, financial planners, etc. make nothing from them. I have had one for a little over a year. My available line of credit balance (principal limit, less loan balance) has grown a little over 5% in the last year. The closing costs were about 4% of my home’s value. If I use it I do not owe anything until I have to leave the house for a period over 12 months. My responsibilities are to maintain the property and pay the property taxes. Things I have to do anyway if I stay in the house. If I do the 2 things I just talked about I cannot lose the line of credit from the reverse mortgage, unlike a HELOC, which would if there is another 2008-like housing crisis. Paying down the loan balance with emergency funds can allow those emergency funds to earn above market returns for those short-term funds. The emergency funds can then be taken back out to use as needed. Reverse mortgages can also be a useful vehicle to provide funds for living expenses in downmarkets, so that a retirement portfolio won’t be depleted while the market is in freefall, which will enhance returns from that retirement portfolio in the long run.