Lost Wealth Today vs the Great Recession

For older workers starting to think about retiring, the economic maelstrom the coronavirus set in motion is a reminder of that sinking feeling they experienced just over a decade ago.

In 2008, the stock market plunged nearly 40 percent, accelerating the steep decline that was underway in U.S. house prices. The unfolding 2020 recession is playing out differently. But both downturns have one thing in common: Social Security as a stabilizing influence on older workers’ retirement finances.

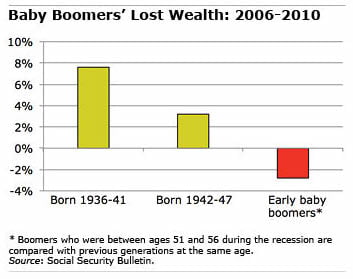

A 2011 study of the change in baby boomers’ finances during the Great Recession found that total wealth dipped by 2.8 percent, on average, between 2006 and 2010 for households between ages 51 and 56.

A 2011 study of the change in baby boomers’ finances during the Great Recession found that total wealth dipped by 2.8 percent, on average, between 2006 and 2010 for households between ages 51 and 56.

The 2.8 percent decline in wealth at the time was a significant setback for baby boomers. In more normal times, earlier generations had increased their wealth by 3 percent to 8 percent at comparable ages.

Nevertheless, things could have been so much worse for baby boomers were it not for the substantial wealth they had built up over several decades in their future Social Security benefits – an amount that is unaffected by the collapse of financial and housing markets. The average value of these future Social Security benefits was 30 percent of boomers’ wealth.

Wealth in the study also included home equity and retirement plan accounts.

This time around, it’s too early to determine the severity of the downturn’s effects on older workers. Unlike the previous recession, though, this one has had little impact on house prices so far, and the stock market, after sinking in March, has regained about half of its losses thanks to aggressive action by the Federal Reserve.

The major worry is unemployment. The jobless rate approached 15 percent in March – well above the 2009 peak of 10 percent – and economists expect it to keep rising.

But, in any recession, Social Security is a stabilizing force. Today, it represents a large share of older workers’ wealth just as it did a decade ago. And lower- and middle-income workers’ benefits are a much larger share of wealth, because they are far less likely to have substantial assets in 401(k)s.

Social Security’s progressive benefit formula also helps them more in retirement by replacing a higher percentage of their current earnings, though the redistribution among individuals is larger than it is for households.

Social Security, the researchers concluded, “played a major role in cushioning the effects of the recession.”

What was true then is still true today.

To read this study, authored by Alan Gustman, Thomas Steinmeier, and Nahid Tabatabai, see “How Did the Recession of 2007-2009 Affect the Wealth and Retirement of the near Retirement Age Population?”

Read more blog posts in our ongoing coverage of COVID-19.

The research reported herein was derived in whole or in part from research activities performed pursuant to a grant from the U.S. Social Security Administration (SSA) funded as part of the Retirement Research Consortium. The opinions and conclusions expressed are solely those of the authors and do not represent the opinions or policy of SSA, any agency of the federal government, or Boston College. Neither the United States Government nor any agency thereof, nor any of their employees, make any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.

Comments are closed.

Social Security and Medicare are the major reason today’s seniors have much less worry than earlier generations. Crucial to keep these programs on a solid footing – yes, even if we have to pay more taxes.