Burdensome Rents are “the New Normal”

During Boston’s mayoral election in November, Mayor Marty Walsh boasted that his administration has overseen $100 million in housing investment. Walsh’s challenger, City Councilor Tito Jackson, responded that this new investment has been dominated by the luxury apartments and condominiums sprouting downtown and around GE’s new headquarters in the booming Seaport neighborhood.

During Boston’s mayoral election in November, Mayor Marty Walsh boasted that his administration has overseen $100 million in housing investment. Walsh’s challenger, City Councilor Tito Jackson, responded that this new investment has been dominated by the luxury apartments and condominiums sprouting downtown and around GE’s new headquarters in the booming Seaport neighborhood.

Walsh retained his seat, but Boston’s housing debate is playing out from Orlando to Austin to San Francisco.

“The lack of affordable rental housing is a consequence of not only [increases in the number of] lower-income households but also steeply rising development costs,” Harvard University’s Joint Center for Housing Studies concluded in its annual report on the nation’s housing stock.

An unprecedented 1 million new renters have come into the market annually since 2010, the center said, fueled by well-heeled older couples and young professional couples with children pouring into luxury apartments and the single-family homes that are on the rental market.

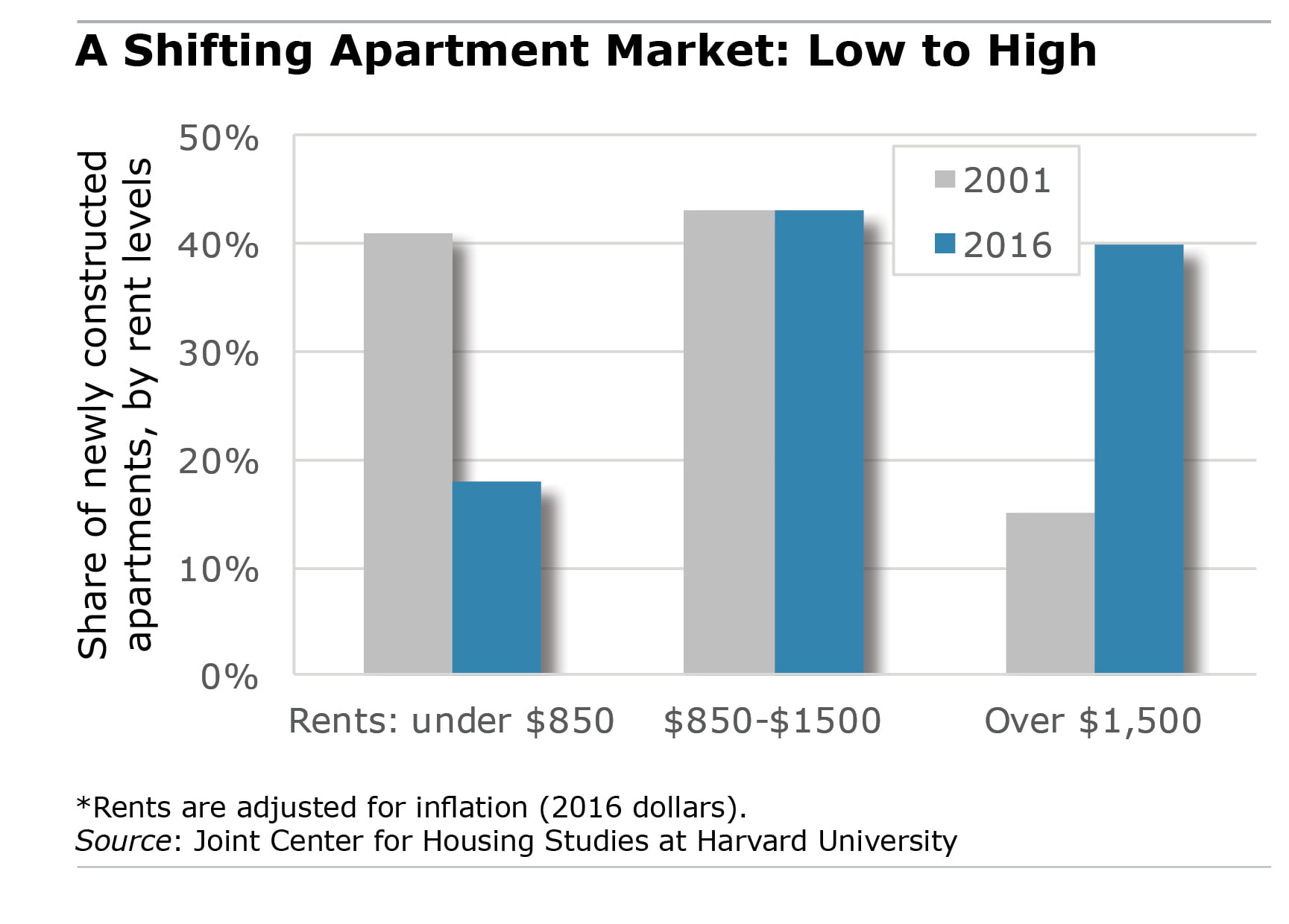

Building has slowed more recently, but not before strong demand had driven up the typical U.S. apartment rent by 27 percent, to $1,480, between 2011 and 2016. And $1,100-plus apartments leaped from one-third of the rental market to two-thirds; all rents were adjusted for inflation.

A decline in available apartments renting for under $850 are depriving working-class families of options. “[O]nce-affordable units have become out of reach for lower-income households,” the report said.

Rents have been rising since surging demand following the foreclosures in the mid-2000s forced homeowners into apartments. At the same time, higher-earning couples began to view renting as a less risky option.

The decline in affordable options is pronounced in what are known as “naturally occurring” affordable units. As apartments in older multifamily buildings become dated, their rents naturally stall or fall. But with so many people in need of housing, including the swell of working Millennials, rents in many of these units have moved out of reach for lower-income people.

Cost-burdened renters, the report found, are now “part of the new normal.”

To follow Squared Away in 2018, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here.

Comments are closed.

Like the rental market, the situation in the Boston metro housing purchase market is just as difficult in terms of affordable housing. According to the National Association of Realtors, prices of less-costly existing single-family homes in the region have risen by almost 7.5% in the last year alone, far outstripping income gains. Thin inventories of available homes to buy leave marginal borrowers at a disadvantage, as they lack the means to compete against stronger bidders and cash buyers. With older housing stock being renovated and whole neighborhoods being gentrified, the squeeze may worsen before it gets better.