More Retirees Today Have a Mortgage

In one significant way, retirement is materially different than it used to be: far more retirees are still trying to pay off their houses.

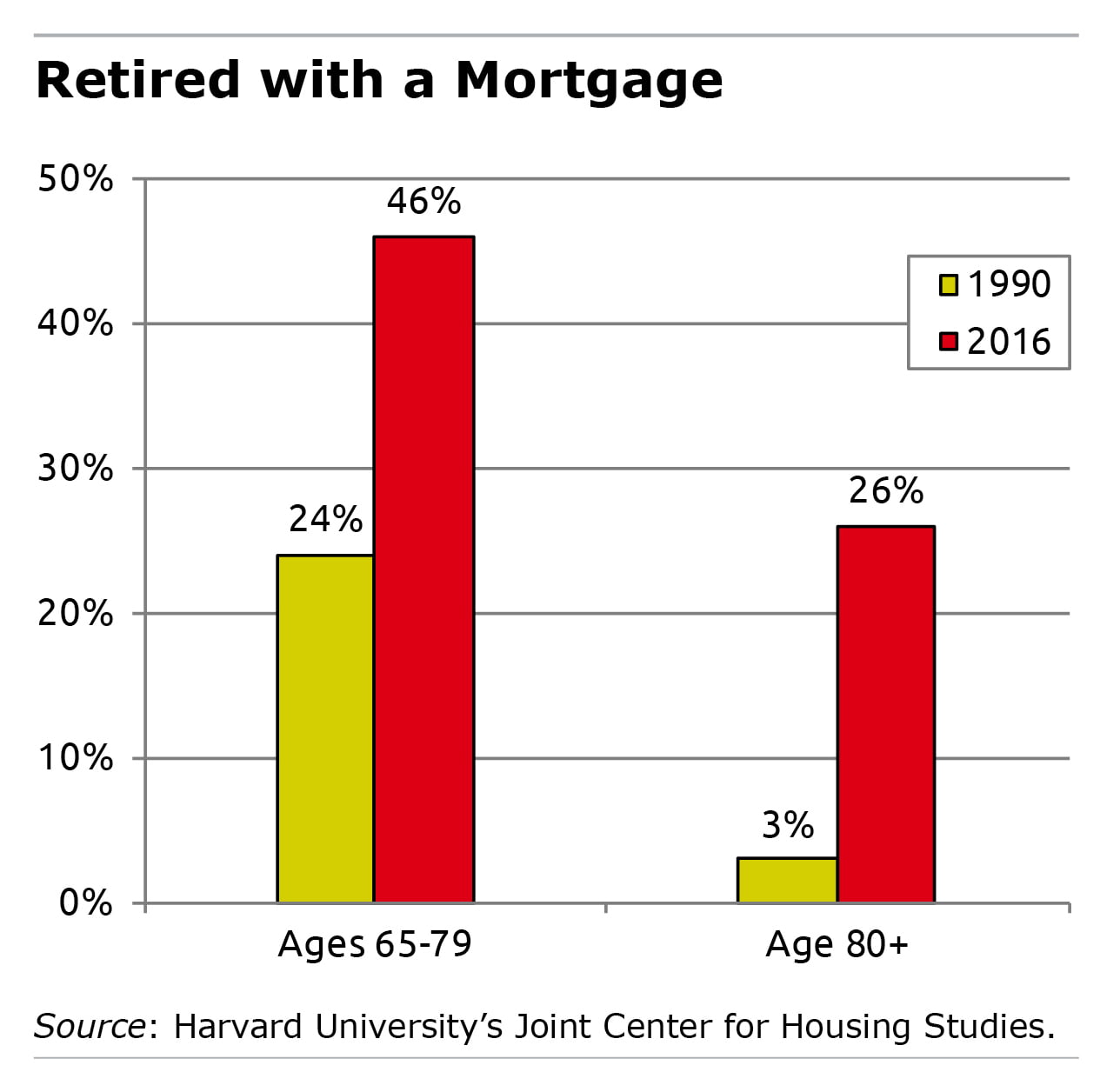

Thirty years ago, just one of every four homeowners in their late 60s to late 70s still had a mortgage – today, nearly half do. Once people hit 80, mortgages used to be extremely rare – only 3 percent had them. Today, it’s one in four, Harvard’s Joint Center for Housing Studies recently reported.

Thirty years ago, just one of every four homeowners in their late 60s to late 70s still had a mortgage – today, nearly half do. Once people hit 80, mortgages used to be extremely rare – only 3 percent had them. Today, it’s one in four, Harvard’s Joint Center for Housing Studies recently reported.

Retiree’s financial condition depends on much more than how much they spend on housing – in particular the size of their retirement savings accounts and Social Security checks. But rent or a mortgage payment is typically the largest item in the monthly budget. Being free of both can be a significant boost to one’s standard of living in retirement.

Jennifer Molinsky, a senior research associate at Harvard’s housing center, described several developments over the past three decades that may explain the dramatic increase in the share of retirees with mortgages.

First, she said, Americans today “seem to have less aversion to debt” than the generation that grew up after the Great Depression and was instilled with frugality. Although consumer debt levels always ebb and flow with the economy’s cycles, total debt as a percentage of disposable income is significantly higher today than it was in the 1990s. The 1986 tax reform act also made mortgages a more attractive form of debt to hold. The reform eliminated the income tax deductions for interest on credit cards and other types of consumer debt, with one exception: mortgage interest.

Having a mortgage isn’t necessarily a bad thing. Mortgage rates have fallen dramatically in recent decades. Many retirees who are still making monthly mortgage payments were able to reduce the payments by refinancing old, partially paid off mortgages into new 30-year loans with lower interest rates.

But another factor that may have pushed up the share of retirees with mortgages has been the long-term run-up in house prices, relative to earnings, which makes it increasingly difficult to pay off a house before retiring. In the late 1980s and early 1990s, house prices were about three times the typical household’s earnings, according to the housing center. Today, prices are more than four times earnings.

Further, many baby boomers responded to the nationwide housing market boom in the mid-2000s by extracting equity from their homes, which increased the size of the mortgages they have carried into retirement. The higher debt levels resulting from this extraordinary period of rising prices may be temporary, however, and today’s workers may have less mortgage debt in the future when they retire. Only time will tell.

Whatever the explanation for the greater prevalence of retirees with mortgages, Molinsky said one trend is clearly negative: the share of households over age 65 that are paying more than 30 percent of their income for housing – whether in the form of rent or a mortgage payment – is at an all-time high.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Comments are closed.

It doesn’t make sense to look at just one part of the household’s balance sheet. You need know whether an increase in liabilities has been matched by an increase in assets. In financial parlance, people with both mortgages and financial assets may be doing no more than locating on a preferred point on the efficient market frontier.

Would you say the same about using a reverse mortgage? In other words, why treat home equity as sacrosanct while subjecting other assets to a process of de-cumulation?

We still have several years to go on our retirement home mortgage. Payment is less than $1,000/month including taxes and insurance.

We have many, many friends who have no mortgage payment but their HOA dues plus having to eat X amount of dollars in the country club lodge, plus property taxes, plus insurance on their home. They are required to pay much more in “fees” than we are.

We live in a non-gated retirement community, have all the expected amenities (sans golf) and I wonder really who is better off?

Jack, you are doing WAY better than your HOA constrained friends. Congrats and enjoy!

Our bank finally stopped begging us to take out a bigger mortgage. We refinanced several years ago into a custom loan: 12 years at 2.65%. I kinda wished we’d borrowed more to pay cash on a townhome “investment” in a nearby community. We’ve made extra payments and have about 6 years left. We resisted the urge to use our equity as a piggy-bank or buy a McMansion. Since we never “up-sized” no need now to downsize.

I just refinanced — small $155,000 — which reduced the interest rate to 4% for 30-years. No desire to stuff my walls with cash — willing to bet I can do better in the “markets” over next 10-15 years.

Take into account new mortgage products that provide monthly incomes to seniors are now available to be used to pay living & medical expenses. The mortgages are paid when seniors die, by the descendants.

And there are those of us who have to pay rent! Not much difference than a mortgage. Except I don’t own my place. And the rent goes up every year.

With a monthly payment of only about $670, and an interest rate of about 3.3%, I choose not to pay off my mortgage because my money is returning more than that in the stock market. I’m 72 and may never pay it off, but so what?

If the market crashes maybe then I’ll decide to go mortgage free.

Age 65 isn’t what it used to be. Data show an ever larger portion of the population age 65+ is still working – sometimes out of financial necessity, sometimes for access to health care coverage (if not for the worker, than for a younger spouse), many times for other reasons.

Similarly, data show many more older Americans own condo’s than ever before, and that many more financed those purchases with reverse mortgages than ever before.

Which means, they cashed out their home equity. So, yes, must look at the overall balance sheet to see whether older Americans are better off or worse off.

Finally, while poverty has traditionally been only an income measure in America, take a close look at the poverty level. It has declined from 30+% in the 1960’s to less than 10% today. If you think so what, take a look at the relative poverty rates of children in America.

Your mortgage should be paid out or as close to, when you retire – so you dont have a monthly expense for your house.