Moving? Check the State Taxes First

New Jersey’s retirement income exclusion for couples leaped from $20,000 to $100,000 in 2016. Minnesota and South Carolina now have income tax deductions for retired military. And Rhode Island started exempting the first $15,000 of retirees’ income from the state’s income tax.

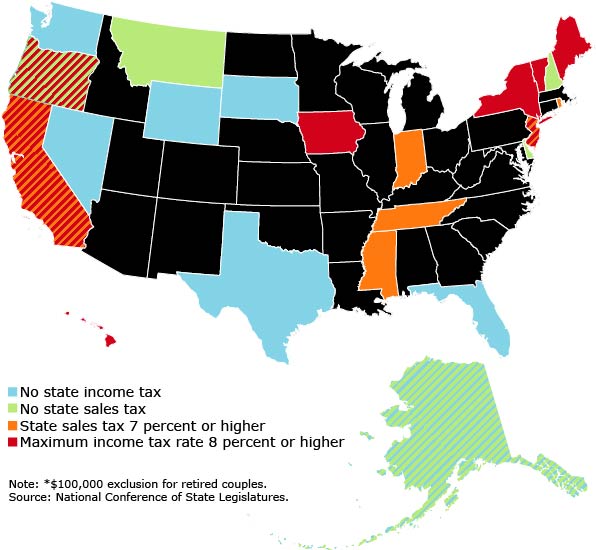

State taxes are one piece of the financial puzzle to consider when retirees – or Millennials – are thinking about moving to reduce their living costs, find a job or friendlier climate, or be close to the grandchildren.

The Retirement Living Information Center recently compiled a nice summary of tax rates for all 50 states on its website. The information comes from sources like the Federation of Tax Administrators, The Tax Foundation and the National Conference of State Legislatures.

The Retirement Living Information Center recently compiled a nice summary of tax rates for all 50 states on its website. The information comes from sources like the Federation of Tax Administrators, The Tax Foundation and the National Conference of State Legislatures.

State taxes vary dramatically. Alaska, Florida, and Texas are among the states boasting no personal income taxes, though some offset this with relatively high property or sales taxes. A few states – yes, Alaska again – have no sales taxes. Tax deductions and exemptions for retirement income are the norm, but they vary widely from one state to the next.

Full disclosure: the Retirement Living Center is a company that makes money by referring retirees to senior communities listed on its website or by arranging residents’ reviews of these communities. But the state tax website is free and publicly available.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here.

Comments are closed.

Just a heads up – we may not have a state income tax here in WA, but our sales taxes are quite high (varies by location but generally just below 10%). Be sure to check out the whole picture before making your decision. Don’t let the tax tail wag the dog!

Good to know Nancy. The NCSL says Washington state’s sales tax rate is 6 percent. Do you also have local sales taxes on top of that?

Here’s the NCSL website: http://www.ncsl.org/research/fiscal-policy/state-sales-and-use-taxes-2013.aspx

Thank you for reading & commenting!

Kim (blogger)

follow-up: The Olympia, Washington, general sales tax rate is 6.5%. Depending on the zipcode, the sales tax rate of Olympia may vary from 8.7% to 8.9%

Every 2017 combined rates mentioned above are the results of Washington state rate (6.5%), the Olympia tax rate (0% to 2.4%), and in some case, special rate (0% to 2.2%). There is no county sale tax for Olympia, Washington.

The Olympia’s tax rate may change depending of the type of purchase.

So CRR is encouraging retirees to live in places that don’t spend as much on debts and public employee pensions?

That has a lot to do with the tax burdens on that map.

In 2009 we moved from California to North Carolina and in 2014 we moved back to California. Before each move we checked tax rates, however, it was not the first thing we checked. My advice is to first check that the lifestyle is consistent with your preferences because that is the highest priority.

When you check tax rates, you should do a detailed analysis of your specific situation. In our case, we pay far less state income tax in CA than NC. NC has a flat, 5.75%, tax structure. CA has a very progressive tax structure resulting in our paying a marginal rate far lower than 5.75%.

Finding the right balance for your situation is key to keeping your tax burden down. How income is generated matters, of course (income taxes), but so do your choices on whether to own a home or rent one (property taxes), what kind of consumer you are (sales taxes), and more. In some cases, states may have low sales or income taxes, but raise revenue in other ways, via “intangible” taxes: vehicle registrations, gasoline taxes, and so-called “user fee” public items such as toll roads or entrance fees for state parks.

It can be difficult, but you need to see where your lifestyle fits into all these intersections to determine what your actual effective tax bill will be.