Quiz: Financial Well-being or Unease?

What does it mean to have a sense of financial well-being? Or what does it mean to have its opposite, financial uneasiness?

Based on in-depth interviews with dozens of people in focus groups, the federal Consumer Financial Protection Bureau has developed a financial well-being quiz. The quiz is the agency’s attempt to quantify a very subjective concept so that researchers can measure it and integrate this measure into their research, said Genevieve Melford, a senior research analyst for the CFPB.

“It’s about creating a tool that allows meaningful research and effective interventions that might help people,” she said.

We think regular people can also gain personal insight by taking a short version of the CFPB’s quiz on this blog. After taking the quiz, write down your score, and return to the blog to learn what it means.

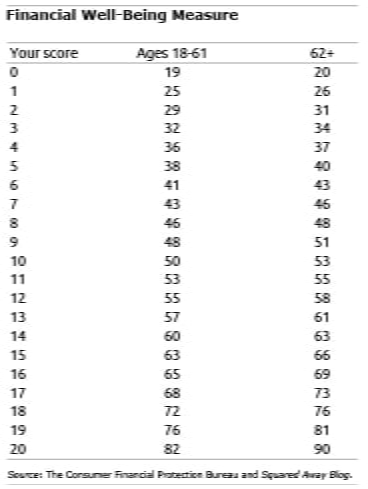

To see where you stand among the 14,000 people who’ve already taken the quiz, find your score in the left column of the table here and then move to the right – under the column for 18-61 year olds or for 62 and older.

As a caveat, the CFPB said that those who’ve already taken the quiz do not constitute a random statistical sample. But 14,000 is still a large and diverse enough group to tell you something.

The average well-being measure is 50 on a 1-100 scale.

If you scored high, don’t let a sense of well-being fool you, however. A recent study by the Center for Retirement Research, which supports this blog, finds that our subjective assessments of financial well-being generally reflect only our day-to-day concerns – and not long-term issues like saving for retirement.

The upshot: a sense of financial well-being can still get in the way of achieving financial peace of mind.

To stay current on our Squared Away blog, we invite you to join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here.

Comments are closed.

“If you scored high, don’t let a sense of well-being fool you, however.”

Oh, nooo, we would never do THAT. We’re followers of the Center for Retirement Research. 😉