Retirement is Filled with Surprises – Good and Bad

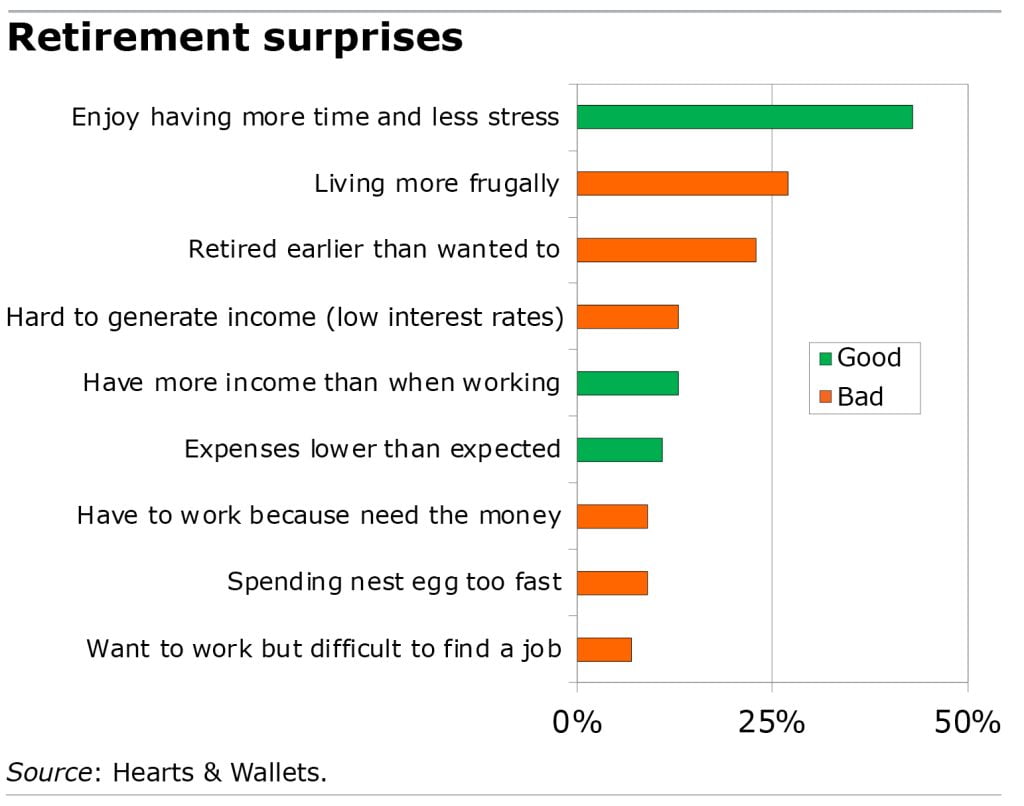

In a new survey asking retirees what surprised them about being retired, the big winner – for 43 percent – was how much they’re enjoying it.

The rest of the survey indicates that the freedom that comes with leaving the labor force often serves to leaven the considerable sacrifices some have to make for financial reasons.

One in four retired households, for example, agree they are “forced to live more frugally than we wanted,” and one in 10 said they’re “spending their nest egg too fast,” according to the survey, fielded in 2023 by Hearts & Wallets, which provides data to the financial industry.

I also suspect that one pleasant surprise – having more income than when they were working – mainly happens to people who didn’t worry much before they retired. Some retirees were glad to see their expenses are lower than they’d expected. One example they might have in mind: less income means paying less in taxes.

To minimize the surprises, Hearts & Wallets’ report suggested areas where financial advisers might find ways to help older workers and retirees. One area involves retirees who are split into two extremes: “chunk or nothing” spending of their retirement savings. One camp withdraws chunks of money out of necessity or for extraordinary expenses. The other camp withdraws little or nothing, sacrificing a more comfortable lifestyle to their fear of needing the money later. The firm’s research since 2010 consistently has shown that most retirees engage in one or the other.

Anthony Webb, an economist at The New School, estimates that withdrawing 3 percent of assets every year is a better bet than the well-known 4 Percent Rule if retirees want a thumbnail rule to reduce the odds of running out of money. Nearly half of retirees told Hearts & Wallets they withdraw 3 percent or less from savings, but most of them are withdrawing less than 1 percent, which is probably too cautious and lessens the enjoyment.

An often-neglected strategy is finding ways to trim household expenses – one car instead of two, fewer vacations – to align them with the drop in income after retiring. Homeowners who need more income also have the option of downsizing so they can spend some of their considerable equity raised from selling a home. However, about half of retirees say they don’t want to move to a smaller house.

Absent from Hearts & Wallet’s suggestions is the effectiveness of working as long as possible before signing up for Social Security. Delay adds substantially – 7 percent to 8 percent per year – to the monthly check that pays the bills. However, one in four retirees said they had to retire earlier than they’d planned, which indicates they did not want to work longer or couldn’t for physical or medical reasons.

It’s worth it for older workers planning for retirement to think ahead about the surprises that popped up in this survey.

Squared Away writer Kim Blanton invites you to follow us @SquaredAwayBC on X, formerly known as Twitter. To stay current on our blog, join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Comments are closed.

A win-win solution for young workers is to invest soon, often, and wisely. Savings made early in life bring a “free lunch” by taking advantage of compound interest and compounded stock reinvestments from dividends. I disagree with the common advice to hire a financial adviser or stock broker. Go for a simple total stock market fund with low management costs. There are multiple companies that offer this.

I retired December 2020, which was earlier than I anticipated. My husband, already retired, convinced me it would be great. I still work one day a week at the company I retired from; I look forward to it every week. The extra income helps fund my LTC insurance, plus I have a special project I’m working on there that gives me purpose. Additionally, I volunteer for a few organizations, which rewarding. In 2021, we took a nice vacation but haven’t had one since. So, not travelling around nor working much on household projects has made me less happy with retirement. Plus, my husband is in the “we’re just going to live on our Social Security for now” camp. We live in an expensive county, so the “let’s see how frugal we can be” game got old quick. This is not how I envisioned the first few years of retirement.