Rising House Prices in COVID Still Cause Sticker Shock

If you want to find a place where houses remain affordable, try Syracuse, New York. It’s a college town, so it’s probably a nice place to live.

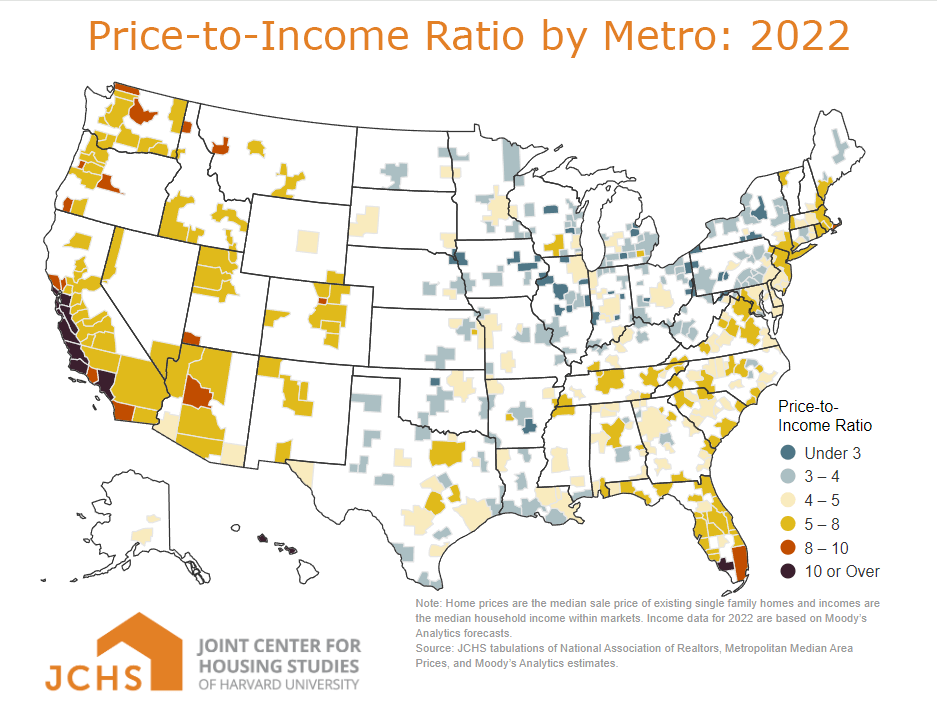

Syracuse is the only large U.S. city where the cost of a typical home is less than three times the household income of residents in that area, according to a new report by Harvard’s Joint Center for Housing Studies. U.S. News & World Report named it one of the top places to live, and a big reason was affordability.

“Price-to-income ratios that low were the norm across much of the country in prior decades,” the center explained. But no longer. The ratios are at their highest levels since the 1970s.

In 2022, 48 of the 100 largest housing markets had prices that exceeded five times household income. In 2019, before COVID, only 15 markets were that high. In a few places, prices are at insane levels, including Honolulu and San Francisco, where they are 11 to 12 times local incomes.

Home equity is often workers’ and retirees’ largest form of wealth. But the pandemic has dealt several successive blows that have made homebuying – and building that crucial form of wealth – increasingly unaffordable.

Blame the high prices on the surge in demand in a hot housing market early in the pandemic. The fire was fueled by unusually low interest rates. Remember all that buying activity? Families traded up to a bigger house so mom and dad had an office apart from where the kids were zooming school. City residents packed up and moved to the suburbs or rural areas to escape COVID, bringing their big-city price expectations and bank accounts with them. Investors interested in profiting also jumped in, putting more pressure on prices.

Miami is a prime example. Northerners moved to a part of the country where safer outdoor activities are possible year-round. House prices there are nearly nine times local incomes.

Pandemic demand was first. But then inflation hit. The Federal Reserve responded by hiking up interest rates, and the rate on 30-year mortgages more than doubled to nearly 8 percent. This eroded housing affordability by greatly increasing monthly mortgage payments. A house or condo that might’ve been viable prior to the pandemic was suddenly out of reach.

High interest rates also had another effect, depressing the inventory of homes for sale and pushing up prices. Homeowners are still reluctant to sell a house backed by a low-rate mortgage and buy a new place at a much steeper rate.

More recently, mortgage rates have started dropping, but they are still much higher than pre-COVID levels. The experts are not optimistic that the housing market will return to the days prior to the pandemic. Buying a house will continue to be a struggle in 2024.

Squared Away writer Kim Blanton invites you to follow us @SquaredAwayBC on X, formerly known as Twitter. To stay current on our blog, join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Comments are closed.

The house price to income really doesn’t tell the whole story. A better statistic is changes in the share of people in each MSA who can buy the median house at prevailing interest rates. That would capture the combined impact of increasing house prices and increasing mortgage interest rates. And don’t bank on house prices coming down any time soon. Homeowners are simply selling and giving up their low interest rate mortgages, so inventory remains tight.