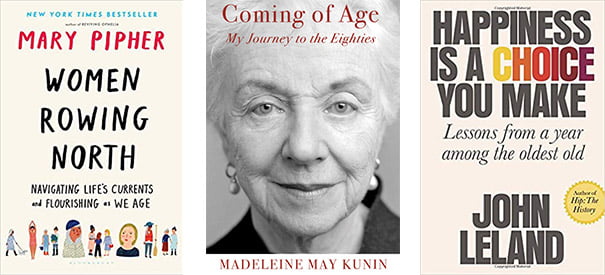

Books: Where the Elderly Find Happiness

Aging is not, as the cliché goes, for the faint of heart. If a woman makes it to 65, she can expect to live at least 20 more years. Three new books written by or about the elderly provide a wonderful roadmap to aging with grace, introspection, gratitude, and humor.

“Coming of Age: My Journey to the Eighties” by Madeleine May Kunin

The former Vermont governor and ambassador to Switzerland has authored books about politics, feminism, and women as leaders. In her new memoir, she has blossomed into an essayist and poet. Kunin, who is 85, muses about defying “death’s black raven” on her shoulder. The color red is one way to achieve this. She bought a Barcelona Red Prius (easier to find in the parking lot), and then she and her late husband, John, purchased two oversized red armchairs. “I wanted to bring life inside – not leave it outdoors. And the red chairs did exactly that,” she says.

In her poem, “I Loved You When You Did the Dishes,” she writes tenderly of John – first as a robust partner, then as a dependent, and always as “the man of my dreams.” Old age has given her permission to let down her guard, which she did not do as a public figure. Now she discloses private matters like thinning skin and her pain when, as a young legislator in the 1970s, male colleagues didn’t take her seriously. But she invariably looks back on her life with humor. Kunin tells one anecdote about ducking into a men’s bathroom to avoid the long line for the women’s room. A man who recognized her immediately said, “I never thought I’d meet the governor here.”

“Women Rowing North: Navigating Life’s Currents and Flourishing as We Age” by Mary Pipher

Early in her book, Pipher borrows a novelist’s words: “Old age transfigures or fossilizes.” Pipher, who is a psychologist, urges women to aim for transformation or “willing ourselves into a good new place.” The most important thing, she says, is to keep moving along, upriver – memory loss, muscle loss, and stereotypes be damned! Each chapter is a roadmap to that good place: Understanding Ourselves. Making Intentional Choices. Building a Good Day. Creating Community. Anchoring in Gratitude. In the chapter Crafting Resplendent Narratives, she advises readers dealing with difficult situations to “honor our pain and move toward something joyful.”

Pipher admires a woman named Willow, caregiver to her husband with Parkinson’s. Willow wakes up every morning looking for ways to make him laugh. But I often found myself skipping past these anecdotes about other women in the book to get to the next batch of 71-year-old Pipher’s insights. “I argue that neither our genetics nor our external circumstances determine our happiness,” she writes. “Rather, happiness depends on how we deal with what we are given.” Every January, the writer refreshes her own narrative about her life when she and her daughter-in-law escape to a retreat. Her book ends with the comforting thought that we are accompanied on our journey into old age by spouses, family, friends, and grandchildren.

“Happiness is a Choice” by John Leland

Okay, elderly men find happiness too. To research his book, Leland, a New York Times reporter, whiled away hours and hours in the company of six men and women in their 80s and 90s. Fred Jones, an 87-year-old World War II veteran, has had more than his share of hardships, but age has given him a kind of happiness that the young, with their eyes on the future, can’t grasp: Happiness, he says, “is not the dance you’re going to tonight. If you’re not happy at the present time, then you’re not happy.” Leland explains how seniors use selective memory to overcome the inordinate losses they experience – the deaths of spouses, siblings, and friends. John Sorensen, also profiled in the book, had a 60-year relationship with his former partner but can remember only a single argument in all their time together.

The only couple in the book are Helen Moses and Howie Zeimer, who fell in love in the nursing home. Leland struggles to understand why Helen’s love grows as Zeimer becomes increasingly disabled and dependent on her. “The less capable Howie was, the more she could do for him … the more she got in return,” Leland writes. The biggest lesson for readers from his time with the elderly is about “what it means to be human. Old age is the last thing we’ll ever do, and it might teach us about how to live now.”

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Comments are closed.

Please don’t use the word “elderly” – it has connotations of feebleness. It’s the one word in surveys that seniors definitely don’t want to be called…

Ted – I was not aware of that, but it makes sense. I have made a new policy here at the blog: no more use of “elderly”!

Kim

I had breakfast this morning with the ROMEO’s: Retired Old Men Eating Out. We meet weekly for breakfast, sometimes lunch. There were eight us around the tables today. Men float in and out of the group: somebody moved; the new wife of an 80 year old did not like his old friends; I would rather do lunch than breakfast and today was an exception for me.

Bob is our oldest at 84. Within the last few years he has had cardiac stents, back surgery, and broken bones from a fall. He is going strong and just moved with his wife, 80, into a smaller house. They are always going somewhere and busy, busy, busy.

I could fill a book, maybe I should, with the adventures and busyness of the seniors in my life. Thanks for bringing these books to my attention. I’ll pass them on to my friends.

What should we use in the place of “elderly”?