What if Medicare Paid Your Dentist?

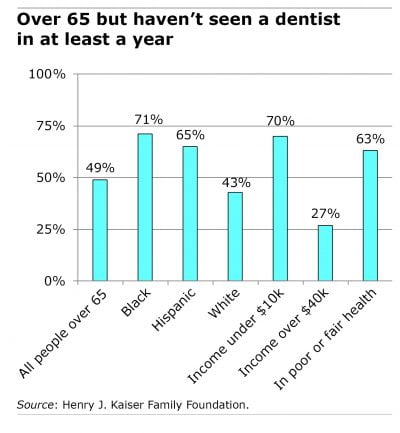

Two out of three U.S. retirees do not have dental insurance. Their basic choice is paying their dentist bills directly or, if they can’t afford it, forgoing care.

Two out of three U.S. retirees do not have dental insurance. Their basic choice is paying their dentist bills directly or, if they can’t afford it, forgoing care.

A new report analyzes the pros and cons of one potential solution to this pervasive problem: adding dental coverage to Medicare. Several bills that have circulated in Congress, including the Seniors Have Eyes, Ears, and Teeth Act of 2019, would do just that.

This approach recognizes that teeth and gums have everything to do with one’s health, said Meredith Freed, a policy analyst for the Kaiser Family Foundation’s Medicare policy program. Elderly people with loose or missing teeth have difficulty eating nutritious but hard-to-chew foods. Gum disease, left untreated, increases the risk of cardiovascular disease, and diabetes, which is increasingly prevalent, makes people far more prone to gum disease.

Oral health care “has a significant impact on people’s happiness and financial well-being,” Freed said. Dental coverage under Medicare would “improve their quality of life.”

But a proposal to do this would face an uphill climb in Congress. Medicare is already under-funded. Dental care would only add to the program’s rising costs. Retirees do have another option: about two-thirds of the Medicare Advantage plans sold by insurance companies offer dental benefits.

Freed’s new report laid out three basic options for reforming Medicare to cover trips to the dentist.

The first would add it to Medicare Part B covering outpatient medical care. The second option would be a separate, Part D-style dental insurance plan. The third option would be to expand the definition of medically necessary dental procedures, which are very limited under current law.

Each has its advantages and disadvantages, Freed said. Grafting dental coverage on to Medicare Part B would extend coverage to the largest numbers of retirees. The services Congress might agree to cover could range from only cleanings to comprehensive care that includes crowns, dentures and implants, and various options for paying out-of-pocket costs include copayments or even the donut-hole method used in Part D plans. The downside of this strategy is that Medicare premiums would increase for everyone who chooses to enroll in Part B. However, the federal government could regulate dentist’s fees to control costs, just as it currently does for physicians’ fees under Part B.

A second option would establish a separate, optional dental plan similar to the Part D drug plan. A big advantage is that retirees could choose the level of coverage they need – people with few dental problems could buy less insurance. But a Part D-style plan would be likely to cover a smaller population than adding dental care to Part B, which more retirees choose. Another problem is that if private insurers offer plans with myriad costs and coverage levels, it would add yet another layer of decision-making for Medicare beneficiaries already facing numerous choices.

The most expedient solution is to expand the number of dental procedures Medicare covers as medically necessary. Only extreme cases are allowed under the current law, such as procedures required prior to a heart valve repair. Under this reform, a limited number of retirees would gain coverage.

It’s clear that retirees need dental coverage. Providing affordable coverage is the challenge.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Comments are closed.

Coverage could be expanded if affluent retirees were asked to pay more reasonable part B premiums. Given the problems faced by so many households in obtaining adequate coverage, it’s shameful that our government subsidizes couples with $150K annual incomes to the extent of holding their part B monthly premiums to less than $150.

My wife and I have used a dental discount plan for years. At a cost of under $100 a year for both of us, we save over $300 during a typical year on cleanings and x-rays, over $600 if a crown is involved for one of us. Dental care is expensive but this approach saves us real money (and our teeth).

Personally, I’d prefer to continue with a discount plan than have Medicare-funded options.

I’m not familiar with dental discount plans. Would you explain how it works? Would you provide a website that you purchase this from?

A dental discount plan means your dentist agrees to accept less than the normal rate for a dental service or procedure. There are no claims to file or paperwork. You simply pay less than the regular charge.

For example, the price for an adult exam and cleaning may be $125. If you are a member of a discount plan the dentist agrees to charge you $55. Recently I needed a new crown. The regular price is $1,450. I paid $842.

I believe the plan I use is only available in Arizona, but similar plans exist everywhere. Ask your dentist which dental discount plans he or she accepts and follow up with those. Or, do a Google search.

Importantly, not all dentists accept all dental discount plans. Check before you buy one. Dentists use these plans to attract new patients or hold onto current ones. I assume they figure the increase in business makes up for the discounts on their services.

My wife and I have used the same discount program for 7 years and never have had a problem. We save hundreds of dollars each year on cleanings, x-rays, and filings or crown work.

Thank you so much, for explaining how the dental discount plans work. I had never heard of this at all. And obviously, the dentist isn’t going to offer it up front because it would cut into their profits.

If you’re an adult with periodontal disease who is afraid of the dentist or can’t afford dentistry, you won’t see a dentist and your standard health insurance policy wouldn’t cover you if you made that appointment.

This, despite the fact that untreated periodontal disease, is a precursor to heart disease.

If you allow your untreated periodontal disease to become heart disease, your insurance company will be thrilled to foot the bill- increasing your premiums and any other out-of-pocket costs accordingly.

Where is the logic in that? The cost of health care would vastly improve if less-costly preventive care (regular dental checkups) were covered, thus prevention would be incentivized to the point where untreated disease and its massive cost could be greatly reduced.