High-deductible Health Plans on the Rise

Health insurance is really starting to hurt.

Health insurance is really starting to hurt.

Premium increases and deductible creep, documented in the Kaiser Family Foundation’s comprehensive annual survey of employer health benefits, are eye-popping figures. Although there has been a slowdown in medical inflation and health care spending overall, the growing prominence of high-deductible plans is evidence that more of these costs are shifting to employees.

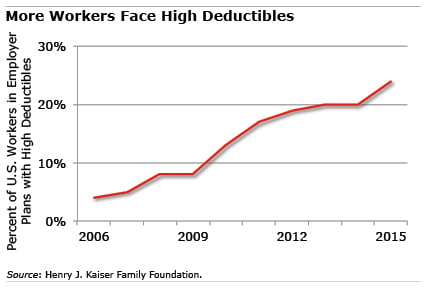

- One in four workers today is enrolled in a health insurance plan with a high deductible – up from 4 percent a decade ago – exposing them to larger out-of-pocket expenses than traditional health plans if they become ill. [Kaiser’s definition of high-deductible plans is that they are accompanied by a tax-preferred savings plan to help workers pay their medical bills.]

- These deductibles average around $2,000 for single coverage, but they exceed $3,000 for about 20 percent of single workers. Deductibles average $4,350 for a family plan, but nearly 20 percent face deductibles exceeding $6,000.

- Average annual premiums for single workers in these plans range from $773 to $1,021, while family plan premiums are $3,660 to $4,407.

- Everyone’s deductibles are rising much faster than premiums. For example, the share of the annual premium paid by all single workers with health coverage has increased 19 percent since 2010, to $1,071. But their deductibles have risen 67 percent, to $1,077.

- Retiree health care trends, in contrast, might be stabilizing. Since 2009, the share of larger companies offering the coverage to retirees has bounced around between 23 percent and 28 percent.

Employers are also paying more for annual premiums, according to Kaiser – about $1,000 more per single worker than they paid in 2010 and about $2,800 more for a family plan.

But it’s clear from the data that this shared burden falls heavily on employees.

To stay current on our Squared Away blog, we invite you to join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here.