More Bad News on Our Health Insurance Costs

Nearly 40 percent of Americans have delayed or skipped necessary medical care in the past year because they couldn’t afford it.

How do we stack up to other developed countries? Dead last. Even the lowest-wage workers in places like Australia, New Zealand, and the United Kingdom are better able to afford their care than the average U.S. worker.

The cost barriers to U.S. healthcare, laid out in a new report by The Commonwealth Fund, are hardly earth-shattering news. Large deductibles, a sharp rise in 2023 premiums, the high cost of prescriptions, spotty insurance options, and providers’ poor billing practices – the multitude of problems continue.

Many Americans, regardless of how much they earn or the quality of their insurance, “have inadequate coverage that’s led to delayed or foregone care, significant medical debt and worsening health,” the healthcare research organization said.

And there’s more bad news: premiums for family plans under employer insurance went up sharply this year – 7 percent, according to KFF – after being stable in 2022. This year, employees with family plans are getting an average of $6,575 deducted from their paychecks to contribute to their premiums. But that number masks a significantly larger burden – $12,000 in premiums – for employees at small firms that can’t afford the top-drawer coverage Fortune 500 companies provide.

Congress did give one group a break last year. The financial assistance package passed during COVID had increased the subsidies for workers buying individual plans under the Affordable Care Act (ACA). The Inflation Reduction Act of 2022 extended those generous subsidies through 2025. Still, these health plans often have high deductibles that provide a second barrier to affordable care.

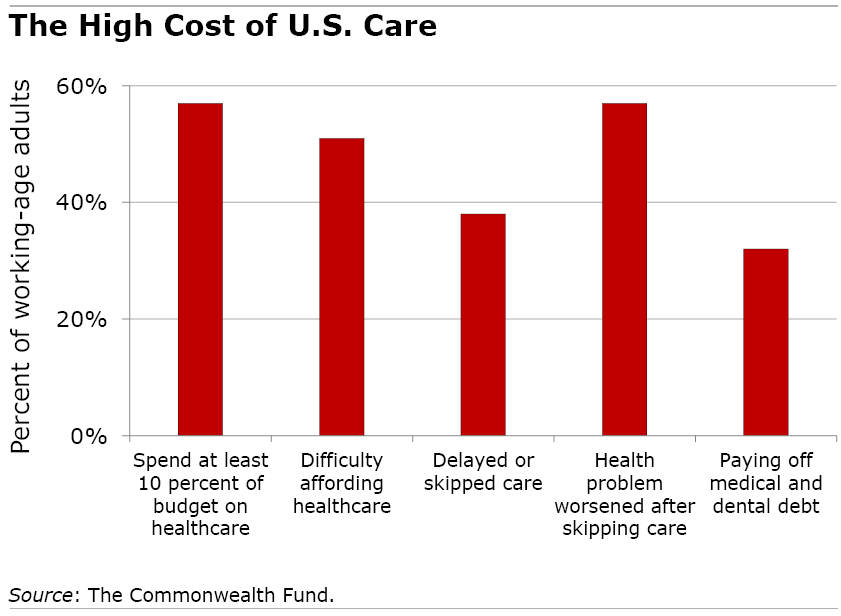

The bottom line, laid out in Commonwealth’s survey, is that there are health and financial costs to expensive medical care. More than half of working-age Americans said a medical problem got worse after they decided to skip care. A third were paying off medical or dental debt when the survey was conducted early this year. More than half of workers devote more than 10 percent of their monthly household budgets to premiums, deductibles, coinsurance and other payments for care.

Commonwealth provided a laundry list of steps that Congress, state lawmakers and regulators could take to provide relief, from enacting tougher regulations on medical debt to further reducing the ACA’s out-of-pocket costs and ending state waivers that override Medicaid’s requirement that care is covered during the three months prior to applying if the person is approved for coverage.

KFF’s chief executive, Drew Altman, doesn’t have much hope for relief, though he does point out that the nation has expanded coverage significantly in recent years through Medicaid and the increased ACA premium subsidies.

But when it comes to cost, Altman said, “the nation has no strategy.”

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Comments are closed.

The US healthcare system is a mess and getting worse. I have no idea why we aren’t demanding that Congress address the root causes of why the system is so expensive, so fragmented and so harmful to all Americans. Perhaps this is one part of the problem — the money made in 2022 (over and above the costs of care and its delivery) by the five most profitable healthcare companies in the US (according to Google’s AI BARD):

UnitedHealth Group: $20.6 billion

Cigna: $6.7 billion

Elevance Health: $6 billion

CVS Health: $4.2 billion

Humana: $2.8 billion

Total profit for the top five healthcare companies in 2022 was $40.3 billion

No one ever addresses the reasons for the problems. Some have mentioned them, but no one addresses them – no need to list them here, they’re easy to find. And no, shifting expensive costs to taxpayers will not cut the cost of care. Just reposition it. And having lived through one “Obamacare reform” where my premiums literally doubled from 2011 to 2014 (~700 to 1400/mo for the family), I highly doubt anything will really be done.

Government programs (ie. “Obamacare”) will not, and cannot improve our healthcare system. Full agreement with the previous statement about premiums doubling ~ mine did also. I wasn’t paying just for mine, but for the add’l families premiums that now get healthcare and pay zero for it. Shifting their costs to me is not a sustainable plan. Anyone who thinks it is is fooling themselves.