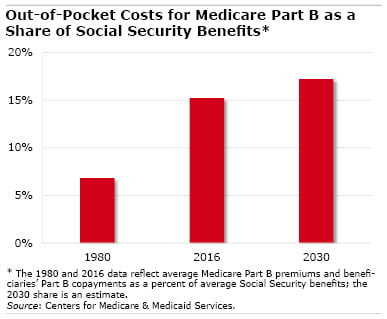

A Bigger Bite Out of Social Security

Most retirees didn’t notice the $5 cost-of-living increase in the average Social Security check. That’s because the Part B Medicare premium deducted from their checks went up nearly as much (from $104.90 in 2016 to an average $109 this year).

Most retirees didn’t notice the $5 cost-of-living increase in the average Social Security check. That’s because the Part B Medicare premium deducted from their checks went up nearly as much (from $104.90 in 2016 to an average $109 this year).

Beyond premium hikes, the bigger issue for retirees are the additional out-of-pocket costs they must pay as part of their Part B coverage for doctor visits and outpatient care. When rapidly rising copayments are added to the basic premium, they together consumed more than 15 percent of the average Social Security benefit last year. That is more than double the percentage in 1980, and it’s expected to exceed 17 percent by 2030, according to the Centers for Medicare and Medicaid (CMS).

The CMS estimates were made prior to the announcements of 2017’s final COLA and Part B increases. But the trend of eroding benefits was confirmed by Juliette Cubanski, associate director of Medicare policy for the Henry J. Kaiser Family Foundation.

“This should raise some red flags among people who may not be realizing about the need to save more. Social Security, while it’s a vital source of support, might not stretch as far as it used to,” she said.

Cubanski also noted that CMS’ estimates do not include the financial pressures on seniors from another rising medical cost: prescription drugs. Strictly for comparison’s sake, consider that Kaiser estimates the Medicare program’s per capita expenditures for the Part D prescription drug benefit will increase 5.8 percent annually over the next decade, exceeding the 4.6 percent annual increase in per capita Part B expenditures.

In truth, the impact on individual retirees from COLAs and medical costs vary widely. For example, there is some protection from increases in Part D drug premiums, because seniors can search for less expensive drug plans during open enrollment each year. The federal “hold harmless” provision that caps Part B premium increases at the dollar increase in Social Security benefits check didn’t apply to higher-income retirees.

But for the majority of the baby boomers making their financial plans for retirement, be aware of the incredibly shrinking Social Security check.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our Squared Away blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here.