A Use for Online Information You’re Sharing: Fraud

There is no end to the websites and phone apps requiring your phone number, email and other personal information as the cost of passage into the products and services they provide. Even some financial companies sell your data to third parties for a profit.

But it is virtually impossible to see what happens after the fresh information you’ve handed over is attached to your existing profile in the netherworld of the cloud.

New research confirms what many have suspected: some of your data is being used to rip you off.

By comparing the fraud complaints filed by Android and iPhone users after Apple added a tough new security feature, the researchers, all business professors, found that the iPhone’s anti-tracking technology resulted in individuals filing fewer fraud complaints with the federal government.

The complaints they analyzed focused on the types of fraud, such as identity theft, that specifically can occur as a result of tracking. Apple’s anti-tracking technology “had a substantial effect in reducing fraud,” they concluded.

Apple, which has nearly half of the U.S. cell phone market, introduced its App Tracking Transparency technology, known simply as ATT, in the spring of 2021. That year, U.S. adults lost nearly $6 billion to fraud.

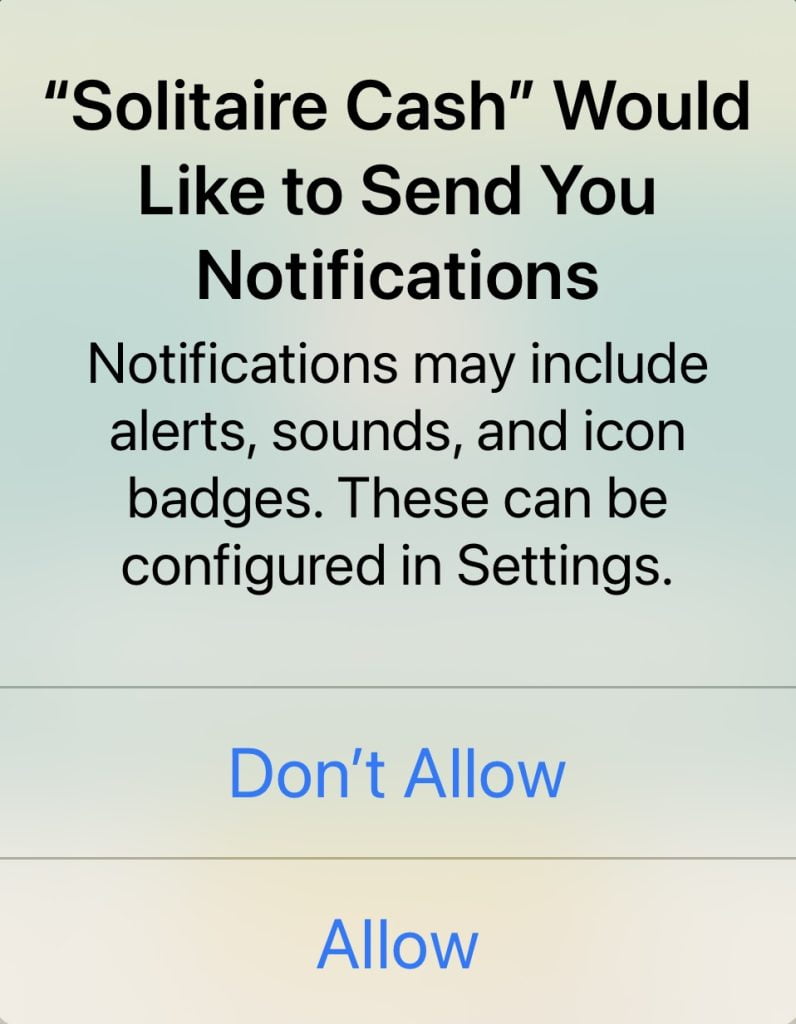

ATT’s default is that app providers can’t track you online unless they get your permission first, and most people stick with the default. Apple’s customers have probably noticed the pop-ups asking them to “allow” an app to track their activity. (Tracking can also be controlled under the “privacy & security” heading in your iPhone’s settings.)

After ATT was put in place, fraud declined about 3 percent for every 10 percent increase in the share of iPhone users in an average zip code, because it’s so much easier – almost effortless – for them to bar apps from tracking them. Prior to ATT, fraud complaints were unrelated to whether a county’s residents mostly used iPhones or Android phones.

Regulation in the United States to protect online privacy is highly ineffective because it is a patchwork of industry-targeted federal laws (healthcare or finance) and individual state laws. In contrast, the European Union in 2018 approved some fairly robust privacy legislation. But federal legislation here to regulate tracking stalled in Congress a couple of years ago and has made little progress.

Comprehensive legislation that makes a concerted effort to protect Americans’ privacy online is long overdue.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Comments are closed.

Is there any comparable information for Android users? If Android doesn’t offer similar control over apps tracking people’s activity, are Android users at greater risk for fraud?