Changes in Marriage Increase Class Divide

In the 1960s, half of all wives were housewives, and their husbands often earned enough money to support a family. Today, these traditional families are a rarity and two incomes have become essential to surviving economically.

In the 1960s, half of all wives were housewives, and their husbands often earned enough money to support a family. Today, these traditional families are a rarity and two incomes have become essential to surviving economically.

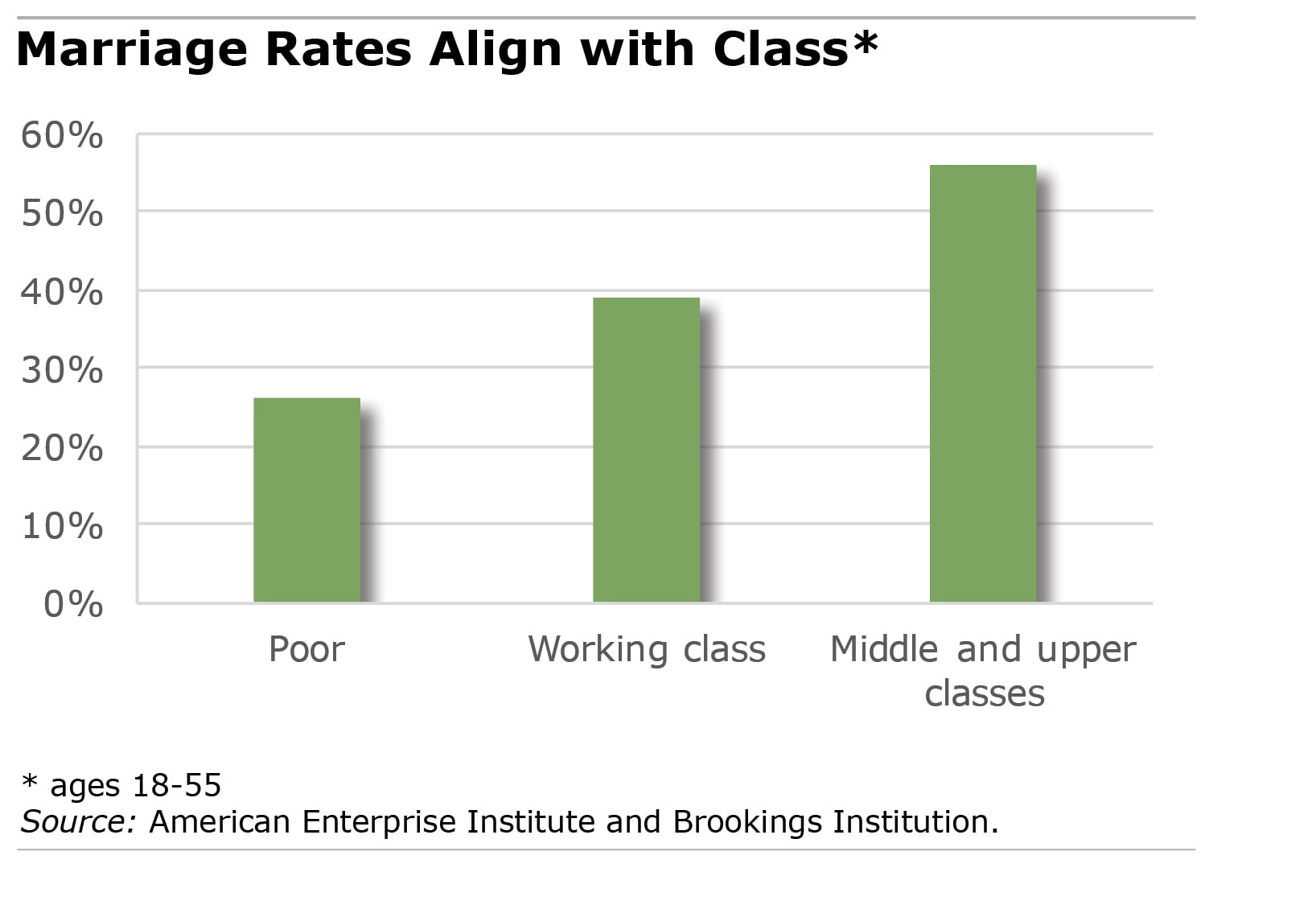

A new joint report by the American Enterprise Institute and the Brookings Institution argues that poor and working-class families’ increasingly fragile family structure – despite the rise of dual-income spouses – often leaves them “doubly disadvantaged.” And lower marriage rates among poor and low-income couples help to explain why “America is increasingly divided by class,” write the authors, W. Bradford Wilcox, a professor and director of the National Marriage Project at the University of Virginia, and Wendy Wang, research director for the Institute for Family Studies.

They explain that higher rates of divorce and of couples cohabiting affected the poor’s marriage rate first and most harshly in the 1960s; working-class couples were next, though to a lesser extent in the 1980s. Marriage is far more common among the middle and upper classes.

The authors cite several economic and social forces behind these trends. The losses that less-educated, lower-income men “have experienced since the 1970s in job stability and real income have rendered them less ‘marriageable.’ ” Stagnant or declining wages for middle- and working class couples impede their ability to afford a home, which is the most valuable financial asset most households own. Couples lacking property may “have fewer reasons to avoid divorce.”

The authors also contend that cultural shifts had weakened the family before the economic problems surfaced, though not everyone would agree with this view. Specifically, they said that the 1960s and 1970s counterculture, an expression of individualism, hasn’t mix well with marriage in particular for people with less education.

Americans’ waning involvement in civic and religious organizations also eliminated important social supports for people with fewer material resources. The financial and other stresses of poor and working-class young adults also “make it more difficult for them to navigate today’s choices related to sex, contraception, childbearing and marriage,” the authors write.

The solution, say the conservative AEI and more liberal Brookings Institution, is “to pursue a range of educational and work-related policies to shore up the economic foundations of working-class and poor families.” There is disagreement about whether or how to do this.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here.

Comments are closed.

I’ve always wondered the chicken-egg aspect of this —> Did the rise in prices over time (to what it is today) make two incomes essential to surviving economically? Or did the onset of two household incomes many decades ago result in the market pricing this in, driving prices up to where they are today?

Times change. Economics change. Job & career opportunities change. Those that are able to adapt to this world will do well. Those who can’t adapt won’t do well. (That’s the way it is with life everywhere, isn’t it?)

Locally, we have 75% of our high school graduates going to universities, 15% going to 2-year colleges/certifications, 7% to the military, 3% directly to the workforce. We need to “help” the next generation be more educated (in marketable professions), more experienced (with internships/apprenticeships), to have more stable jobs with higher incomes, and all the benefits and access that comes with that. A discussion about the need for stronger religious and civic involvement would add many more paragraphs…

Your question is an interesting one. A realtor told me that it is their belief that the onset of the two-income couple (along with the federal law requiring mortgage lenders to consider the second income in granting mortgages) was significantly responsible for the run-up in home prices. They saw it happen, and, in their opinion, the prices just could not have gone so high and so fast without many, if not most, couples having as much as doubled their household income with the inclusion of the second income.

When a single co-worker tried to buy a house, the agent chided him that he needed to get married to afford a home of his own.

Now, prices are such that even two-income couples are priced out of many markets. This can’t go on if our economy is going to prosper.

Growing up in the 60’s and 70’s, what I saw in my own family was very little economic security in family finances due to my parents’ lack of career options: a blue collar working father (high school education only) and a stay-at-home mom (drop-out). We only had one broken down second-hand vehicle (usually cast off by a relative) and moved several times due to cash flow issues. In my teens, my mother decided that the kids didn’t require constant care and got her GED, took some accounting courses, and got a job. Suddenly we had disposable income, which did give the family more financial options and security, but also caused other issues as the money went into new cars, new furniture, clothes, fancier meals and even eating out(!). Credit cards became the order of the day and the debt grew. Nothing went into savings for higher education for the kids, retirement, medical, or emergency funds. So in short, the second income simply offered a more expensive, albeit nice, lifestyle and more options to accrue debt. The kids paid for college by working and taking lots of lower-level classes at the local community college (no loans back then) and living like poor, starving students, which we were. The only thing that saved my parents at retirement is that my dad’s company added a 401(k) late in his career which helped them save a little bit. He died at age 64, leaving my mom to survive mostly off the largess of the kids (free room and board) and a bit of Social Security.

The second income revolution absolutely inflated consumer spending, debt, and prices as essentially the consumer economy skyrocketed. Unfortunately, to this day, what I see in my friends and family is that the expansion of income options greatly increased the demand for significant lifestyle improvements, well beyond the actual monetary value. This happens through the aggregation of both revolving and long-term debt by all levels of socioeconomic capacity, except the 1%ers. How else can you explain college-educated, two-income families pulling in well into 6 figures, but depending on student loans to primarily fund college for their own children?

If the bulk of the secondary income had gone into savings for higher education, medical care, long-term care and retirement, the picture for the government debt and its various welfare/Social Security programs would be radically different. In effect, we learned we could spend now to support our lifestyles and the consumer economy to be rewarded by the government with promises of student loans, cheap mortgages, healthcare, and future retirement support that simply will not be there. For boomers, the illusion of security has never been irrevocably broken. As we look around, it seems our parents and elders managed to get by with the current system. The warnings of collapse or severe impacts fall on deaf ears because so far it’s worked, and most won’t believe it until they experience the coming disruption first hand. Of course, by then, it will be too late.