Changing Social Security: Who’s Affected

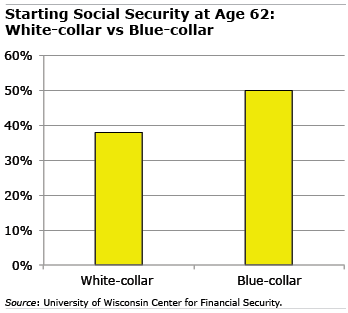

Due to the strength and agility required for physical labor, half of blue-collar workers sign up for Social Security as soon as they’re eligible – at age 62.

But a large majority of white-collar workers wait so they can lock in a larger monthly check for retirement.

In a new study, Lindsay Jacobs at the University of Wisconsin found that blue- and white-collar workers would also respond very differently to potential increases in the program’s two benchmark ages: the earliest eligibility age and the full retirement age.

In a new study, Lindsay Jacobs at the University of Wisconsin found that blue- and white-collar workers would also respond very differently to potential increases in the program’s two benchmark ages: the earliest eligibility age and the full retirement age.

Raising the earliest eligibility age to 64 would not change retirees’ lifetime benefits. But a two-year hike in the full retirement age would amount to a significant benefit cut – and with the depletion of Social Security’s trust fund projected for 2035, some version of this change might one day be considered.

The first change – raising Social Security’s earliest claiming age – would require a much bigger adjustment by blue-collar workers. Jacobs predicted that this group would respond by working an extra year, on average, compared with a few more months for white-collar workers.

Requiring workers to wait longer for their benefits does have a financial advantage: a larger Social Security check every month. The problem for some blue-collar workers is that they couldn’t make it to 64. One result, then, is that increasing the early retirement age would push up applications to Social Security’s disability program, according to the study funded by the Retirement and Disability Research Consortium.

Jacobs gauged the impact of raising the early retirement age based on how quickly workers’ declining health would affect their ability to work as they age. To understand how they would react to raising the full retirement age, she examined how workers’ decisions about retiring, saving, and signing up for Social Security would change under various policies. She classified the workers as blue- or white-collar using data that describes job tasks to show that the physical demands at work influence these decisions.

The second possible change would increase the full retirement age by two years, which amounts to an across-the-board cut in benefits regardless of when workers claim them. In response, white-collar workers, who are already more inclined to hold out until the full retirement age, would be more likely to work even longer to reach the new, higher benchmark age.

But blue-collar workers would bear the brunt of the benefit cuts, because their physically demanding jobs would often prevent them from working longer to offset the cuts.

When weighing various changes to Social Security, it’s important to remember that blue-collar workers have less leeway to adjust to a change in the rules.

To read this study, authored by Lindsay Jacobs, see “Occupations and Work at Older Ages: Varied Responses to Policy.”

The research reported herein was derived in whole or in part from research activities performed pursuant to a grant from the U.S. Social Security Administration (SSA) funded as part of the Retirement and Disability Research Consortium. The opinions and conclusions expressed are solely those of the author and do not represent the opinions or policy of SSA, any agency of the federal government, or Boston College. Neither the United States Government nor any agency thereof, nor any of their employees, make any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.

Comments are closed.

It is one thing to leave your job voluntarily, and quite another to lose your job due to age.

When that happens it is hard enough to be less than full retirement age. What would anyone older do for money if unable to find a job or claim benefits? The study is flawed if one does not consider all aspects of why one may retire earlier than FRA and being forced to is often beyond the control of the employee. Congress does nothing to enforce laws to protect aging workers.

THANK YOU!!!!! I’m dealing with this now! Thanks to COVID & my age….

The difference here is white collar workers usually have 401ks or IRAs plus savings to delay application. While blue collars are less physically able to remain on their jobs. Raising the SS & Medicare payroll tax by 1 percentage point each would solve many of these problems.

Here’s what needs to happen. Change the FRA back to 65. Keep the age 62 for those who can’t make it to 65. Look at all the jobs that will open up for the kids that are getting out of college. 70 is a RIDICULOUS punishment for those of us that have busted our butts over all these many years. And now add COVID 19. Now let’s add ageism to the factor since being laid off. I’m losing my home & having to move in with family. It’s degrading. And hardly nothing on my SS. I’ve been working since 16 & I’m 64 and laid off for 6 months. Congress needs to step up to the plate.

Being a construction worker leaves us in poverty. Our bodies have been worn to a frazzle. While, most times being scarcely paid with no chance of having retirement savings, stuck on social security.

Whoever you are, don’t quit your jobs too soon and apply for SSI.

Just to clarify, SSI is a separate welfare program which just happens to be administered by Social Security offices, it has no relation to retirement benefits. It’s a confusing similarity of program names.

Disability benefits are called SSDI, and then there are SS retirement benefits. You’re right about not taking your retirement benefit too early if you can help it, because your benefit is significantly lower the earlier you take it. Unfortunately, the blue-collar workers I know have mostly HAD to take their retirement benefit early because their jobs are too physically taxing to continue to work until 66 or their employers have let workers of all types go when they reach older ages.

Another problem is the worker who sadly passes away and doesn’t even make it to 62 (I’ve known several). That worker’s many years of paying in to the system yields nothing, except perhaps a widow benefit.

Social security should not be used as a one size fits all program. Different jobs take more out of you than others do. Retirement age should be determined by the amount of physical stress the job requires.

Social Security and Medicare are already skewed so significantly that the benefits and coverage individuals receive often bear little relationship to the contributions workers make or the taxes they pay.

Consider:

(1) The progressive benefit formula for Social Security that significantly benefits individuals with consistently lower wages,

(2) Social Security spousal benefits of 50% of the worker’s benefit for those who never worked for wages or paid FICA taxes,

(3) Medicare’s non-contributory Part A Hospital Coverage – for those who start coverage 1/1/21, they could have paid only $723.84 in FICA-Med taxes over the past ten years (plus the same amount from the employer). Keep in mind that the estimated monthly premium for Part A coverage in 2021 is $471, so, the cost of coverage could exceed the contributions in as little as 2 months (actually one month where there is a spouse the same age who did not work for wages),

(4) Medicare Part B and Part D premiums are funded by general revenues (primarily income taxes). American taxpayers whose income reported on tax returns place them in the lower half of incomes (70+MM returns) only paid 3% of all federal income taxes in recent years (and, if you adjust for the earned income tax credit, they paid less than $0 in income taxes as a group).

So, there are a ton of equity issues regarding these entitlement programs.