College Calculator Bridges Class Divide

A degree from a premier college can vault a teenager from a low-income family to the height of economic success as an adult.

But disadvantaged students face a multitude of barriers to attending the nation’s top colleges, from getting the grades required to withstand stiff competition for acceptance to the absence of a degreed family member who can steer a child, niece or grandson through the process.

Phillip Levine is breaking down one barrier: the well-founded fear among low-income and even middle-class families that an elite liberal arts college is out of the question.

Levine designed a calculator to estimate how much an individual applicant will actually pay, after plugging in his or her family’s unique financial data, such as income, house value, mortgage amount, etc. – and the calculator is way easier than filling out a FAFSA form. Argh.

What’s new about Levine’s cost estimates is that they come from crunching family financial stats into a program that contains an individual college’s unique information about its financial aid and work-study programs, as well as how much current students pay based on their parents’ financial information [these data are supplied anonymously to Levine].

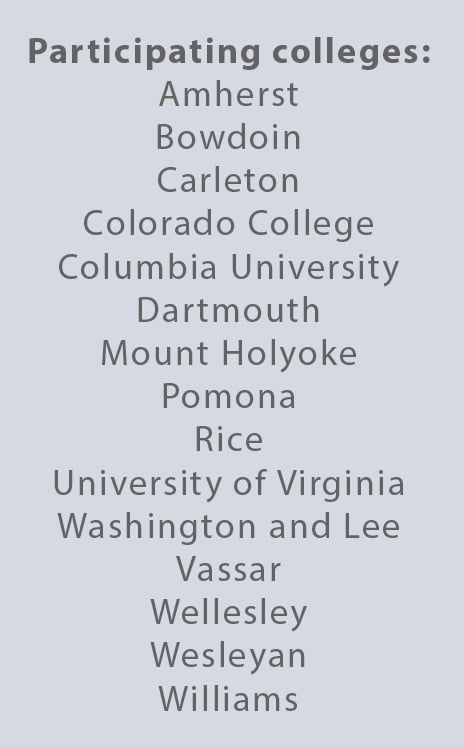

To date, 15 colleges have signed on to work with Levine, who initially created the calculator for applicants to Wellesley College, where he is an economics professor.

To date, 15 colleges have signed on to work with Levine, who initially created the calculator for applicants to Wellesley College, where he is an economics professor.

A fear of unaffordability is very real for many parents and teens, since “sticker prices” at elite colleges run into the tens of thousands of dollars per year. Many reasonably conclude after seeing the sticker price that a local community college or state school is the only viable option. The calculator estimates how much of the sticker price for tuition, room and board must actually be paid out-of-pocket by the family. Separate estimates show how much of the sticker price can be paid with grants from the college, loans, and money the student can earn in work-study programs.

Top colleges have also been criticized for not enrolling enough low-income students, but aid programs do exist to help them attend. A recent story on WGBH public radio in Boston told the story of Kisha James, who is attending Wellesley College after learning her family’s contribution would be “zero.” Just as Levine’s calculator had predicted.

“This is all about what it is you can do to take people at the bottom of the [earnings] distribution and find ways to lift them up,” Levine said.

Here’s another calculator to estimate the average cost of college and debt payments.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here.

Comments are closed.

That’s really great! Everybody has the right to education and a calculator such as this can help families and students plan at an early stage for a better future.

We really appreciate such efforts!