Does the U.S. Have a Retirement Crisis?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Call it what you will, Society of Actuaries’ survey shows a large percentage of retirees are worried.

At the end of a recent conference, the cosmic question arose – once again – as to whether the United States faces a retirement crisis or not. I’ve never been wedded to the word “crisis,” but the Center’s National Retirement Risk Index (NRRI) suggests that about half of today’s working-age households are at risk of not being able to maintain their standard of living in retirement. While the NRRI depends on a number of specific assumptions, anything close to 50 percent at risk does seem like a serious problem to me.

The conference participant bolstering the no-crisis view cited a survey prepared by the Society of Actuaries. That’s a good and respectable group, so never having given their survey the careful look it deserves, I took some time to read through the 143-page document. My starting position was if the SOA documented “no problem,” I would concede and start planning a lovely post-pandemic six months in Paris.

The 2019 online survey of about 1,061 pre-retirees and 1,255 retirees born between 1938 and 1973 was conducted by Greenwald & Associates in June 2019. This study was the tenth in a series documenting the retirement concerns and preparedness of older Americans. The authors acknowledge that the sample is not random, but rather consists of people willing to a take a 20-minute internet survey. They do reweight the results to match the age, sex, education, and household targets in the March 2019 Current Population Survey.

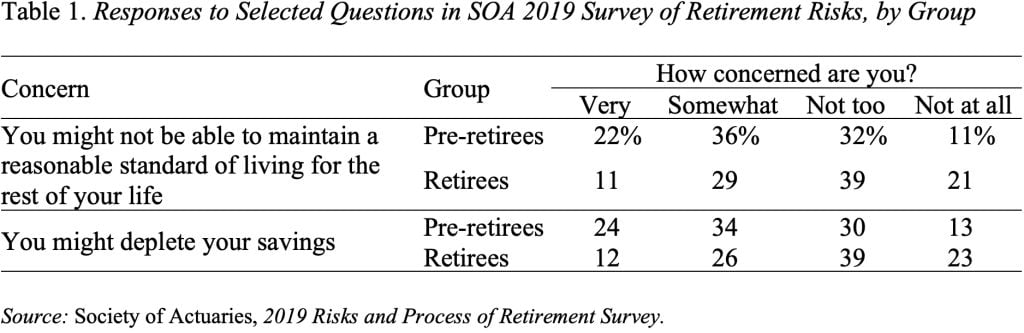

The results for 2019 had improved substantially over the previous survey in 2017 for both retirees and pre-retirees. In fact, the majority of the retirees surveyed are financially as well off or better than they expected before retirement. The authors note that this finding is hard to square with the fact that the retirees retired much earlier than the pre-retirees expected to retire, and substantially more people expect to work in retirement than actually do. So here are the results for the 2019 survey when respondents were asked about maintaining their standard of living or depleting their savings (see Table 1). Yes, it’s true that retirees were not as concerned as pre-retirees (a result consistent with previous surveys), but about 40 percent of retirees were either very concerned or somewhat concerned that they would not be able to maintain their standard of living or might run out of money.

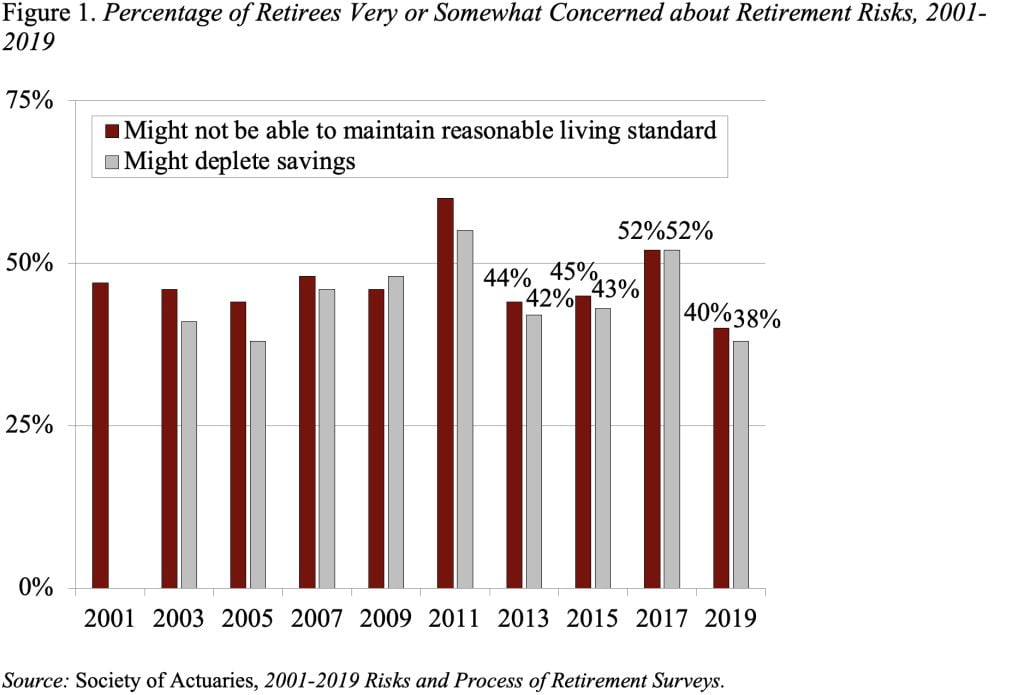

And 2019 was a great year in terms of responses – a decade after the last recession, the stock market was booming, and no one knew about COVID! Although the authors do urge caution when comparing online 2019 results with telephone surveys from 2011 or earlier, the 2019 results are still the lowest from any of the recent surveys (see Figure 1).

Can those who see a problem and those who do not really be arguing over whether 40 percent, 45 percent or 50 percent are at risk of not being able to maintain their lifestyle or running out of money? In any of those situations, an enormous swath of Americans feel vulnerable in retirement. That’s not an acceptable outcome.