Employer Health Insurance Stabilizes

One thing has gotten lost in the turbulence around the fate of the Affordable Care Act (ACA): the health insurance provided by U.S. employers is relatively stable.

One thing has gotten lost in the turbulence around the fate of the Affordable Care Act (ACA): the health insurance provided by U.S. employers is relatively stable.

Total premiums increased

3 percent for family plans (to $18,764 for the average, combined premium for employers and employees) and 4 percent for single employees’ coverage in 2017 (to $6,690), according to the Henry J. Kaiser Family Foundation’s annual report on the employer health insurance market. Employees enrolled in family plans pay under one-third of this total premium; single people, less than one-fifth.

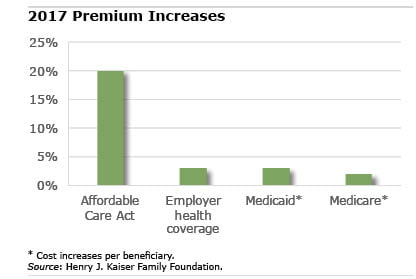

In contrast, there was a 20 percent spike in 2017 premiums paid by workers lacking employer health insurance who purchase their policies on the state ACA exchanges – and premiums are expected to increase sharply again in many cities in 2018. While the ACA’s system of mandates and subsidies has pushed the share of Americans covered to record highs, the new challenge clearly is to contain costs.

“It’s really striking how much more stable the group market is than the far smaller marketplaces in the non-group market,” Drew Altman, the Kaiser Foundation’s president, said during a recent webinar. He compared the 20 percent increases and “very high deductibles” typical of ACA plans to modest premium increases and “no real deductible growth this year” for employer health plans.

The rise last year in total employer plan premiums, although somewhat faster than inflation and wages, is an improvement over the 5 percent to 10 percent annual premium growth in the past decade.

No obvious explanation exists for this relative stability, Altman said, especially at a time prescription drug costs are surging and health care providers are consolidating their market power. “I think it’s healthcare’s greatest mystery right now,” he said about the employer market.

That’s not to say everyone can afford their employer medical plans.

Workers in small companies pay a larger share of the total cost burden – particularly for family coverage – than workers in large corporations. Further, workers increasingly are enrolling in high-deductible health plans – more than one in four today, compared with one in 20 a decade ago. These deductibles were, indeed, stable last year, but they average more than $1,505 for single workers in plans with a deductible, up from $616 a decade ago. Rising deductibles are one reason a large minority of Americans say they have difficulty paying for their medical care.

Coverage has also eroded: 89 percent of workers today have insurance through an employer, compared with around 93 percent in the early 2000s. Again, the coverage is spottier in small businesses with under 10 employees: only 40 percent are covered.

Employer health insurance for workers, Medicaid for the poor, Medicare for the elderly, and the ACA exchanges for the rest – from one U.S. household to the next, there is an unpredictable disparity in health care spending.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here.

Comments are closed.

It’s a shame all the confusion and stress the whole ACA fighting is causing. As the article points out, vast majority of folks are not really impacted by all the noise. While large groups had to comply with ACA benefit rules I doubt they will elect to reduce benefits, regardless of any “repeal and replace” action. The fighting is primarily over the small slice of the country (though totals millions) without access to group coverage. The ACA created winners and losers under the new rules.

Winners are those benefiting from expanded Medicaid or enjoying rate subsidies and/or cost-sharing reductions on their plans, along with people with “pre-existing conditions” now able to get coverage.

Losers are those with too much income for Medicaid or subsidies, but not enough to afford today’s sky-high premiums and deductibles. These folks lost plans and options that were otherwise affordable before the ACA. For them, the ACA was a disaster. These same folks who will pile into short term medical plans now that the 90-day coverage restriction is being lifted by executive order.