Evaluating a Pension Buyout Offer

Like many baby boomers, I’ve received an offer from a former employer that’s meant to entice: “The Company is offering you a limited-time opportunity to receive this benefit now, rather than waiting until you otherwise become eligible to receive payments from the Plan.”

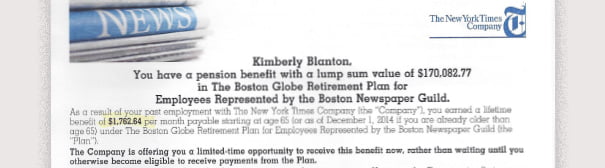

My 17-year employment as a Boston Globe reporter entitles me to a $1,762 monthly pension for life, starting at age 65. I’m 57 now. But a few weeks ago, the company put two alternatives on the table: take a smaller pension that starts now or trade my pension for a lump sum of $170,000 in cash. The deadline for accepting the new offer: the day after Christmas.

The New York Times Co., which used to own the Globe, has no doubt made this offer to employees for the same reason most companies do: to reduce burdensome pension liabilities and create financial certainty. But what’s in it for me? And how should other boomers think about similar offers coming over the transom?

My first thought was this: I’m working now and don’t want or need a pension right away. This money is for my retirement. I view my decision as choosing between the remaining two options: my original pension at 65 or the new lump sum offer.

A senior economist here at the Center for Retirement Research, Anthony Webb, helped me compare these two options.

Webb calculates that I could use the $170,000 to buy an annuity that would start paying $1,256 when I turn 65 – versus my original $1,762 pension from the Times at 65. By this standard, the lump sum isn’t very generous.

Another strategy would be to accept the lump sum and invest the money in the booming stock market. This could solve one problem with my pension. The pension, in contrast to Social Security, will be fixed at $1,762, and inflation will erode its value over what I hope will be many years of retirement. If the stock market rises – as it tends to do over the long haul – the lump sum would add substantially to my 401(k). But the market’s a crapshoot.

So how much would my lump sum have to grow so I could buy an annuity, using today’s market rates, that starts paying $1,762 every month at age 65? According to Webb, $323,790. That requires 9.6 percent in annual returns by investing the lump sum over the next 7.5 years. That rate of return looks high to me and even more unlikely with a U.S. stock market flirting with record high levels. And why should I take all that risk?

If the pot of money did grow to $323,790, however, I could forgo the annuity and just withdraw about 4 percent of it every year once I turn 65 – or $1,079 a month, an amount that would grow with inflation.

This is just one way to look at a buyout offer. I’ll need a steady and predictable flow of income when I retire, and the original Times pension of $1,762 a month still looks pretty good to me.

Comments are closed.

Since you are over 55, try to negotiate a monthly settlement that starts right now for the rest of your life. Many older defined benefit plans have an age 55 option. It will be lower than the $1,762 and you could sock it away until you retire. A major insurance company has been sending me a pension check every month since I turned 55 in 1999.

Also, what is the guarantee the NYTimes will be around in 8 years? There is the PBGC, but who knows what will happen to it. One more thought: did your friend calculate the present value of that $1,762 from 65th birthday to life expectancy? That number would help in decision making.

Good Luck!

My thought is to take the money. There is no guarantee that the pension will exist in 10, 15 or 20 years. So many pensions fund have gone belly up in the last 15 years leaving the pension holders with little or nothing. Just ask anyone who worked for the city of Detroit or any of the major airlines.

The present value of this $1,762 monthly payout for 25 years, beginning at age 65, for a person now 55 years old using a 6% discount rate is $157,706.

Pensions are in big trouble. The PBGC estimates multi-employer plan funds will be gone in 8 years and single employer (the big guys) could be gone in 10. Frankly, a bird in the hand is worth two in the bush. I’d take the lump sum and invest part (say $150,000) in a deferred fixed rate annuity (age 65 or older) with a top rated mutual insurance and use the rest for the stock market with a non-market weighted S&P 500 index or total market index (exclude bonds). That way you get some secure income and some growth potential. But be careful, use Weiss Ratings for choosing your annuity insurance, they are the most stringent and accurate according to gov’t studies. And avoid variable rate plans and all the other fancy iterations, high fees with market risk.

The decision is more complicated than taking the lump sum or the regular payout. You’d have to look at your debt level and your other retirement plan asset allocations to make a good decision.

Debt matters because carrying large balances can consume much of the monthly income you’ll receive if you choose regular payments. You might be better off paying off the debt with the lump sum and investing the rest.

And if you’re fairly debt free (and I’m betting you are), the other consideration is your asset allocations in other retirement plans.

Many financial planners consider Social Security and regular pension payments as fixed income, so if you already have much of your retirement money in fixed income (as in a traditional glide path strategy), you may be over-weighting in fixed income by choosing the regular payout, being too safe and raising your longevity risk.

Any asset can’t be viewed independently, but as part of a whole financial picture.

Making the decision is really tough, but here is my thought: take the money and run, because corporate America doesn’t want to be in the pension business any longer. There is no guarantee that the $1,762/month will be there in 7.5 years – the NYTimes may unilaterally lower the pension amount and you won’t have any say in that. I read an article on Yahoo! Finance that said just that not long ago. As for the PBGC, they’re in trouble, too, due to the number of plans being terminated. The market is a crap shoot, sure enough, but life is a crap shoot, too – you might die at age 70. I retired from AT&T and was going to take the pension but at the last minute decided to go with a lump sum. The deciding factor for me was when I got a statement from AT&T informing me that they had granted a lump sum payout to 6,000 managers that hit the pension fund in the amount of a bit over $4 billion (yes, billion!). That, to me, was the figurative writing on the wall. I took the money and ran. Was it the right decision? Who knows? The inflation factor was another big issue – if I live another 20 years, my fixed pension could be worth half what it is now. At least in the market, inflation is compensated for. It’s a tough decision to make. Good luck!!

I think you and your advisor looked at this correctly. It’s important to keep apples with apples, avoid fruit salad. You only have one viable choice, take the regular pension payments, or self-manage a lump sum. Not only is the Globes payment a much better deal, but letting them manage your fund relieves you of the burden and expense of trying to match their pension payout with your own performance.

You could also factor in the tax complexity with lump sum conversions, then the IRA withdrawal rate details. Then if you did invest some of it in the market, there are capitol gains and losses to manage. Sure, there are a million guys out there very anxious to do this for you, but again each service adds more fees that quickly eat lump sums.

For me, there would also be the, “now I can buy my boat issue.” Having a large balance appear monthly from the broker always makes me want to buy something I don’t need…a boat in my case.

Another factor: recent financial articles have revealed that pensions plans are grossly overcharged in fees by their third party management companies with mediocre and often under-performing results. And you have no say in who those managers are or what they charge. Pension funds are the bread and butter (and bonuses) from the management firms. At least if you take the lump sum, the funds will be in YOUR control and you can make informed decisions about where it goes, who manages it for you, and what fees/costs you are incurring for the return.

https://www.bogleheads.org/wiki/Lump_sum_vs_pension

Your last sentence makes it sound like you think the option of the $1,762 pension is still viable – it is not.

Take the money. Invest it or buy the annuity, pump your IRA (and if available, your 401(k) and your spouse’s), and learn to live on your current salary. At your age, a regular IRA might give you a little more to put in (higher salary now reduced by taxes vs. Roth with after tax money) Work as long as you can, past age 66 (FRA), and hope for the best = a rising market for 10+ years. Good luck!

Your employer cannot just unilaterally lower the pension amount that you’ve already accrued. It’s against the law.

What they can do is freeze accruals.

So if the $1,762 is assuming that you’ll continue to work until retirement, then that’s at risk. But if that’s based on your pay and your service right now, then that’s guaranteed by law.

Can you say City of Detroit pensioners? Laws can be changed. What about bankruptcy?

Dear readers – Appreciate all the advice!

I’m still going to bet on the Times and, if not that, the federal government still being around.

What I didn’t say in the blog is that my husband has a pension (he’s a public high school teacher), I have Social Security, and we’re paying off the house. So it’s not as difficult a decision as it might be for some. We hope we’ll be fine either way – and I can’t assume the worst will happen. Hope I’m right!