Few 401(k) Participants Changed Portfolio Allocation When Market Tanked

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

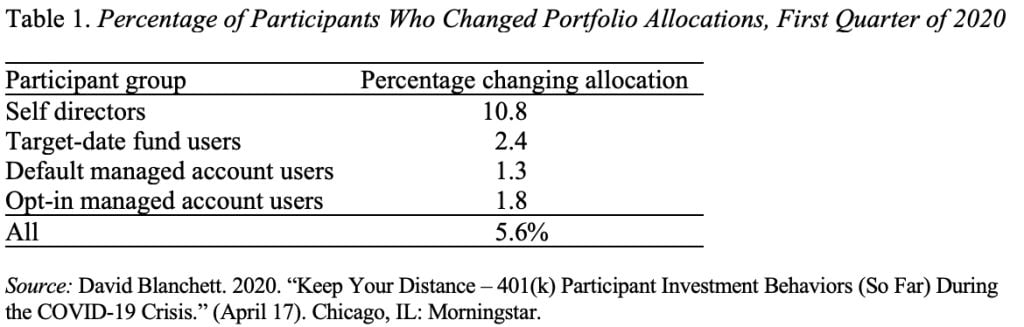

Morningstar shows those with self-directed investments were more likely to change than those in TDFs or managed accounts.

The rumor has been that 401(k) participants took little action when the stock market declined by more than 30 percent in February and March 2020. A Morningstar study provides some numbers to back up the lore.

The data come from a major recordkeeper for defined contribution plans. The starting point was snapshots for two dates: December 31, 2019 and March 31, 2020. To be included in the analysis, the participant had to show up in both samples. That is, they had to be enrolled on or before December 31, 2019 and still in the plan March 31, 2020. This construct ensures that observed changes reflect active decisions by participants as opposed to the sponsor replacing one fund with another. The final sample consisted of 635,116 participants across 509 plans.

The important finding is that only 5.6 percent of participants enrolled as of December 31, 2019 changed their portfolio allocation during the first quarter of 2020. Participants who adjusted their portfolios changed their equity allocations. Most of these changes were relatively small, with an average equity reduction of about 10 percentage points. However, older participants who changed their accounts made larger changes than younger participants, particularly if they were invested more aggressively.

Much of the report goes on to look closely at the 5.6 percent who did move their money. For this exercise, the report identifies four types of participants – self-directing their accounts, using a target-date fund, defaulted into a managed account, and opted into a managed account. The pattern across participants shows that those with professionally managed solutions – target-date funds or managed accounts – were much less likely to change their allocation.

On balance, this report seems like good news. Buying high and selling low doesn’t end well!