Financial Misinformation Shared Online

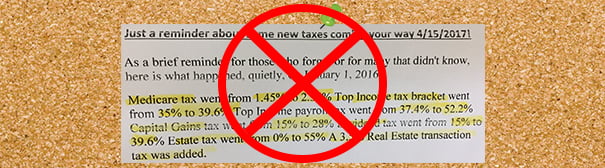

My mother sent an anxious email that included the above picture, which one of her elderly friends had emailed to her as a warning about coming tax increases.

“Have you seen this?” my mother asked in her email.

I’m glad she inquired, because it took 15 seconds to learn on factcheck.org that this misleading information has made the rounds on the Internet for three years in a row, updated to the new year – 2017 this time.

There are nuggets of truth in the misinformation above. The Medicare tax already increased as part of the Affordable Care Act. However, it applies only to employed couples earning more than $250,000 and employed individuals earning more than $200,000. The retirees living in my mother’s very modest senior community – and most working Americans – are not affected. Yet “shocking” information like this rears its head over and over again on Facebook, Twitter and other social media.

At a time that misinformation is deliberately being fabricated, and one such lie coursing through the Internet even spurred gun violence at a Washington, D.C., family pizza joint, it’s time to bring attention to false financial information that, unwittingly, people may be sharing online.

Some of the other taxes in the list above are either inaccurate – the top long-term capital gains tax rate is 20 percent, with a few exceptions – or out of context. Others are old news about prior tax rates that were restored under the “fiscal cliff” legislation that went in effect three years ago.

So why do folks fall for this?

Stanford University Professor Sam Wineburg has conducted research demonstrating that people tend to accept information delivered online at face value, without questioning its source.

Specifically, Wineburg showed that more than 80 percent of high school students who saw a “news” photograph – a daisy that was falsely claimed to have been deformed in the Fukushima nuclear power plant disaster in Japan – did not question its legitimacy. When it comes to the elderly, cognitive decline can make them even more vulnerable than teenagers to fake news, as well as Internet and email fraud.

“We simply have not caught up to the way these sources of information are influencing the kinds of conceptions that we develop on a day-to-day basis,” Wineburg told NPR.

As a newspaper reporter for 30 years, I was trained to ask two questions about any information that came my way: Where did it come from? Is this a credible source?

If you can’t answer those two questions, please don’t pass it on!

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our Squared Away blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here.

Comments are closed.

Financial misinformation is nothing new. It used to happen a lot in the past and I don’t think anything has changed today. For people who do not know which sources to believe in, it may cause distress. Nowadays information, even if it is a lie, spreads like the Ebola virus, which can turn into a disaster. I hope that people will be more careful when sharing information without confirming the sources.

As a resource:

http://gouldguides.carleton.edu/c.php?g=445829&p=3041358

This site has the fact checking recommendations of the Carleton College Library. I would trust librarians to know the best sites.

I also take everything I hear or see on CNBC or Fox Business with some skepticism. Many are there not to inform but to sell, and what they have to sell may be wrong for you.

Thanks for pointing out that tax information on the Internet can be misleading. Any discussion of tax increases can prompt people to assume that they will be negatively affected. AND, if the tax is associated with Medicare, it can be a dog whistle to folks who want to demean Medicare and other entitlements, or do away with entitlements of all kinds.

Thank you for raising this issue for your readers.

Chuck Miller, I agree about taking what you hear on business shows with a grain of salt. I recall one incident where the host, who is generally fair, was quite adamant that investors should heed his advice, quite aggressively so. The tone was very definitely hard sell–something of which I’m always wary.

While the case you described is disturbing, it is not as serious as the deluge of direct mail seniors get, some legitimate, but others of dubious source trolling for personal information. They often have official looking print and easily inferred as coming from a federal agency like Medicare or the VA.

I have a number of senior clients who call me about these. One in particular is always afraid she will “miss something important” and is convinced she must respond. Recently, her husband (a veteran) got a circular referencing VA benefits, when it was a home equity loan solicitation. She thought he still needed to contact them about his VA benefits “just to be sure.”

At least she now calls me first before responding. I can only imagine how many other older Americans take the bait.

Even when the source appears reliable, the information could be false. The credited source may have had nothing to do with the story. I want to confirm everything that I see online.

People will continue to be biased by their existing beliefs, which are hard to overcome, even in the face of contradictory evidence.

Social media has only amplified our propensity to seek the news that fits our established viewpoints.

We have more information at our disposal than ever, while wisdom remains scarce.

The only difference with misinformation now than earlier is that it occurs immediately and makes the rounds faster.

I wish you would do an article on “robocalls” and explain why the State Attorneys General are not doing much about them if anything. Senior citizens are deluged especially by these calls continuously all day. But this article gives good information on what questions to ask yourself to find out the reliability of the source.

Having just finished a presidential election in which false “facts” played a big role in influencing voters, consumers need to be especially vigilant to investigate so called “facts” before taking action. Be skeptical! Due diligence is always in fashion.

Social media has only amplified our propensity to seek the news that fits our established viewpoints.

We have been brainwashed to take everything we see and read in the news as Gospel. Now the internet makes it too easy to spread false or embellished news.