Good News on Retirement Trends

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

The percentage of 62 year olds claiming at 62 has declined sharply.

With lower Social Security replacement rates, vanishing traditional pensions, and longer lifespans, people need to work longer to ensure a secure retirement. Working longer directly increases current income; it avoids the actuarial reduction in Social Security benefits; it allows people to contribute more to their 401(k) plans; and it shortens the period of retirement.

The good news is that people have begun to respond. In a recent study, using unpublished data from the Social Security Administration (SSA), we found that of eligible workers turning age 62, the share claiming benefits at that age fell from 56.0 percent in 1996 to 35.6 percent in 2013 for men; the comparable decline for women was 62.8 percent to 39.5 percent.

Much of this decline was obscured in the annual data reported by SSA. These annual data show of all workers claiming benefits in a given year, the percentage that are age 62, 63, 64, etc. The problem is that when the size of the group turning age 62 is increasing, as it has over the last two decades, the data will show that 62-year-old claimants make up a larger portion of total new claimants in a given year even if a smaller percentage of 62-year-old workers claim immediately.

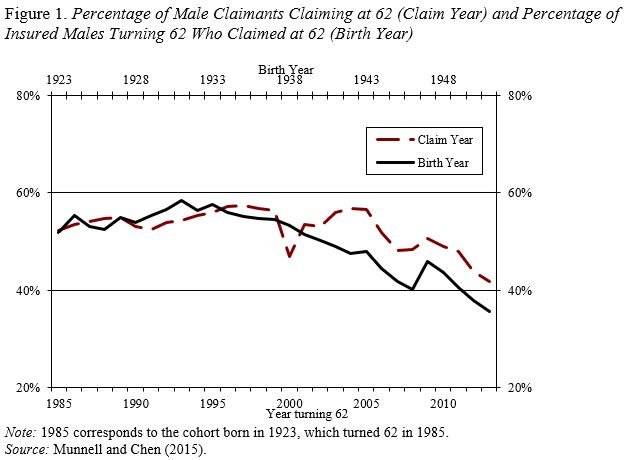

The number of eligible participants turning 62 began to increase around 1997, rising from 829,000 in 1997 to around 1.4 million in 2013. For readers who are surprised, like we were, that the increase in numbers began before the retirement of the baby boomers, we note that births declined sharply from the 1920s through the trough of the Great Depression, and then started to increase in 1935. This reversal shows up 62 years later with the number of people eligible for benefits beginning to rise in 1997. This increase in the number of participants turning 62 – or “cohort effect” – distorts the trend in claiming patterns. To accurately follow claiming behavior over time, one must look at cohort data. Such data show, of the potential claimants turning 62 in a given year, the percentage that claim benefits as soon as possible. As evident in Figure 1, which compares the percentage of men claiming at 62 on a claim-year and cohort (or birth-year) basis, the two approaches provide very similar results until 1997; afterward the two series start to diverge. Since 1997, the decline has been much more dramatic on a birth-year basis.

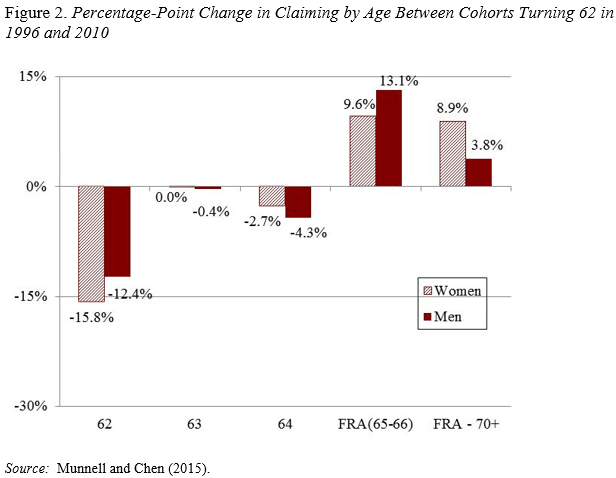

One final chart (Figure 2) shows the overall shifts in claiming between the cohort that turned 62 in 1996 and the cohort that turned 62 in 2010. For both women and men, claiming before the FRA has dropped, while claiming at or above the FRA has increased.

So the news is good. Let’s celebrate.