Housing Wealth Battered But Still Significant

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Retirees should consider tapping their home to help meet consumption needs.

Given my enthusiasm for tapping home equity in retirement either through buying a cheaper house or taking out a reverse mortgage, I thought it might be wise to take a renewed look at housing equity among those of retirement age. I wasn’t sure exactly what I would find given the lingering effects of the bursting of the housing bubble, the apparent increase in households with mortgage debt, and the reported decline in homeownership rates. The quick answer is that older households do not have as much home equity as during the bubble in house prices, but it remains an important component of wealth.

The data come from the 2013 Federal Reserve’s Survey of Consumer Finances. I focus on households with heads age 60-65, because most people retire in this age range, and reverse mortgages become available at 62. Before looking at the numbers, it’s important to note that the national housing price index has increased by nearly 10 percent since the survey was completed.

In 2013, 77 percent of households in their early 60s owned a house. The median house price was $185,000. But 63 percent of households in their early 60s continued to have a mortgage. Subtracting outstanding mortgage balances from the gross house price yields median home equity of $110,000, which accounts for more than 40 percent of the homeowners’ total wealth as conventionally measured. The fraction is lower if Social Security wealth and that from defined benefit plans are included in the wealth measure.

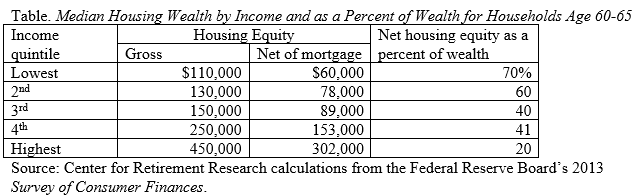

Of course, the amount of home equity varies by income level. As shown in the table, the median amount of net home equity rises from $60,000 in the lowest income group to $302,000 in the highest. In contrast, the importance of home equity relative to total wealth declines as income increases.

The importance of home equity over most of the income distribution shows that it could provide an important source of income in retirement. This income can be accessed by moving to a smaller house, which both substantially reduces property taxes and other expenses and provides a pile of assets that can generate returns.

The alternative for those who want to remain in their home is to take out a reverse mortgage.

A reverse mortgage is a mortgage: a loan with the borrower’s home as collateral. But unlike a conventional mortgage, it is designed as a way for homeowners age 62 and over, with substantial home equity, to tap that equity as a source of funds to pay bills or health care expenses or to provide additional retirement income. Unlike conventional mortgages, borrowers are not required to make monthly payments. The loan must be repaid only when the borrower moves or dies. This is the key advantage for retirees who need more income: so long as they live in their house, a reverse mortgage does not add a claim on the income they already have.

People with mortgages are eligible for a reverse mortgage, but must use those funds first to pay off their mortgage. Eliminating mortgage payments substantially reduces the demands on their monthly income. But the increase in households 60-65 with a mortgage on their home – from 53 percent in 1989 to 64 percent today – is a concerning trend.

Full disclosure: I am an investor in Longbridge Financial, a company that provides reverse mortgages in a socially responsible fashion.