How Bush Tax Cuts Reduce the Tax Advantage of 401(k) Plans

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

One of the major selling points for 401(k) plans has been their tax-preferred treatment under the federal personal income tax. But the value of the tax preference depends crucially on the tax treatment of investments outside of 401(k)s. And the taxation of capital gains and dividends has been reduced dramatically – particularly by the Bush tax cuts – making saving outside of 401(k) plans relatively more attractive and lowering the value of the tax preference.

The intuition is clearest when comparing stock investments in a Roth 401(k) to a taxable account, as the amount initially saved is the same. (Remember the tax advantages to a conventional 401(k) and Roth are equivalent, assuming no change in tax rates before and after retirement.) Assume the tax rate on capital gains and dividends is set at zero. In both cases, the investor pays taxes on his earnings and puts after-tax money into an account. In the Roth 401(k) plan, he pays no taxes on capital gains and dividends as they accrue over time and takes his money out tax free at retirement. In the taxable account, he pays no tax on the dividends and capital gains as they accrue and takes the money out tax free at retirement. In short, the total tax paid under the Roth and the taxable account arrangement is identical.

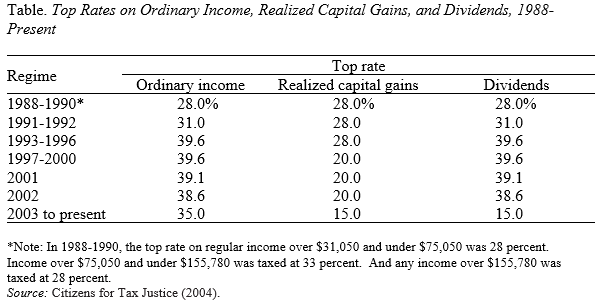

How close is the assumption of a “zero” tax rate to the real world? The Table summarizes the maximum tax rates applied to capital gains and dividends since 1988. The 1986 tax reform legislation set the tax rate on realized capital gains equal to that on ordinary income. The capital gains tax rate became preferential in 1991-1996, not because it changed but because the rates of taxation of ordinary income increased. Subsequently, Congress explicitly reduced the tax rate on capital gains to 20 percent effective in 1997 and to 15 percent effective in 2003. Dividends traditionally were taxed at the rate of ordinary income. That pattern was changed effective in 2003 when the rate on dividend taxation was reduced to 15 percent.

Interestingly, many of the same people favor both tax preferences for 401(k) plans and favorable treatment for capital gains and dividends. The two goals are clearly inconsistent. The lower the tax rate on capital gains and dividends, the lower the tax preference for 401(k)s.