How Much Will Your Retirement Taxes Be?

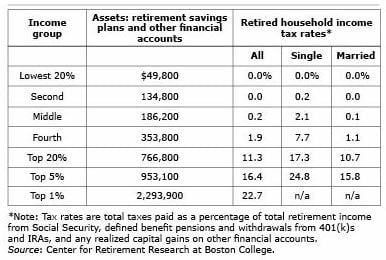

Four out of five retired households will pay little or no income taxes. But the tax rates at the highest income levels are meaningful, averaging 11 percent of household income and as much as 23 percent at the very top.

These estimates come from a new analysis by the Center for Retirement Research that sheds light on a potentially important consideration that is often overlooked by people approaching retirement age.

The highest tax rates are paid by the highest-income households because they often withdraw money from 401(k)s and IRAs to supplement their Social Security benefits. They must also pay capital gains taxes when they sell stocks and bonds for a profit from their regular financial accounts.

Households with income in the top 20 percent have nearly $770,000, on average, in retirement savings and other financial assets – their taxes equal 11 percent of their total retirement income. However, limiting the households to the top 5 percent of the income distribution, the tax rate increases to 16 percent – and the top 1 percent pays 23 percent.

Households with income in the top 20 percent have nearly $770,000, on average, in retirement savings and other financial assets – their taxes equal 11 percent of their total retirement income. However, limiting the households to the top 5 percent of the income distribution, the tax rate increases to 16 percent – and the top 1 percent pays 23 percent.

These estimates assume retirees start pulling money out of their taxable 401(k) and IRA accounts when the IRS’ required minimum distributions (RMDs) kick in at age 70 1/2 – this age will increase to 72 next year. The tax rates were very similar under alternate scenarios that assume retirees either start withdrawing savings prior to the RMD or buy an immediate annuity with a survivor’s benefit.

The tax estimates are based on data for older U.S. households with at least one recent retiree. The researchers first calculated their expected future lifetime income from Social Security, 401(k)s and other sources in each year. The future yearly tax payments were then estimated using a program that applies IRS rules and each state’s tax rules to the various types of retirement income.

The tax rates are their total tax bills as a percentage of their total income.

Tax rates are negligible for the majority of retirees, because Social Security is the dominant source of income. Under federal tax law, retired couples pay no taxes on these benefits if their total income, with some adjustments, is less than $32,000 a year – or $25,000 for single retirees. Everyone else pays taxes on up to either 50 percent or 85 percent of their benefits, depending on their income.

The ins and outs of tax law will be important to baby boomers when they retire – but mainly for the ones with the most financial resources.

To read this study, authored by Anqi Chen and Alicia H. Munnell, see “How Much Taxes Will Retirees Owe on Their Retirement Income?”

The research reported herein was derived in whole or in part from research activities performed pursuant to a grant from the U.S. Social Security Administration (SSA) funded as part of the Retirement and Disability Research Consortium. The opinions and conclusions expressed are solely those of the authors and do not represent the opinions or policy of SSA, any agency of the federal government, or Boston College. Neither the United States Government nor any agency thereof, nor any of their employees, make any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.

Comments are closed.

Thanks for sharing this information. Not many people know that tax rates for retirees can be negotiated. There’s also the fear of underpayment penalties. So, it’s important to know where you can save without ending up owing Uncle Sam.