LGBTQ+ Community’s Homeownership Rate is Low

Black Americans’ homeownership is dramatically lower than it is for Whites, and one reason is discrimination. This also seems to be the case for the LGBTQ+ community, a new study indicates.

About half of LGBTQ+ adults said in a survey that they are homeowners. Nearly three out of four who are not LGBTQ+ are homeowners.

Why does this matter? As workers build wealth to prepare for their eventual retirement, the equity in their homes is usually their largest store of wealth – and worth more than their retirement accounts. Lower homeownership puts the LGBTQ+ community at a distinct disadvantage.

The study, by the Federal Reserve Bank of St. Louis, found that the homeownership gap was significant even when the researchers accounted for major factors that can affect it, such as income and race and whether the person is married. In this apples-to-apples comparison, they said, the persistence of a gap “suggests the possibility of discrimination playing a role in these groups’ lower homeownership rates.”

The data analysis lines up with what individuals have told the Federal Reserve in surveys about their experiences in the housing market generally. Transgender and non-binary adults and people who identify their sex as “other” were five times more likely to say they experienced discrimination when trying to rent or buy a house.

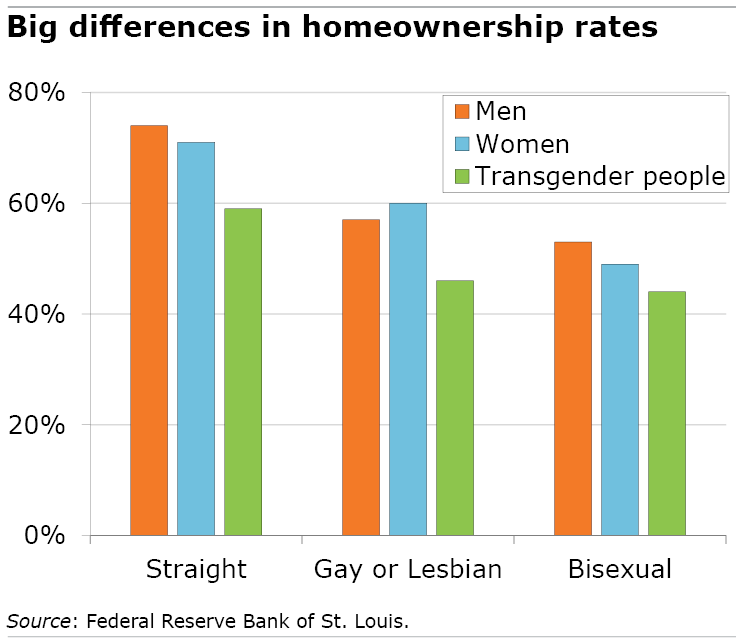

The study broke down the homeownership rates by both gender identity and sexual orientation. The gaps between LGBTQ+ and non-LGBTQ+ Americans is striking. Straight men and women have the highest homeownership rates, exceeding 70 percent. The rates for gay men and lesbian women are closer to 60 percent, though lesbians are slightly more likely to be homeowners.

Transgender individuals in any case – straight, gay or lesbian – have lower homeownership rates. Bisexuals’ homeownership is even lower.

When people are discriminated against, ”they are not participating in this wealth-building channel to the same extent,” the study concluded.

Squared Away writer Kim Blanton invites you to follow us @SquaredAwayBC on X, formerly known as Twitter. To stay current on our blog, join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Comments are closed.

Thank you for sharing this important information. I’m wondering if geographic location and/or urban vs. suburban vs. rural residence might play a role given the concentrations of people who are sexual and gender minorities in large cities (like New York) where the costs of home ownership are prohibitive and renting is commonplace.

Not sure the point of the findings. I had an unmarried partner for 29 years before she passed. Explaining to loan officers and bank officials was a pain in the arse, but we kept pushing thru. We got the loan, paid it off, took a heloc while waiting to retire and use the proceeds for raw land.

“suggests the possibility” is incredibly weak as a jumping off point.