Making 401(k) Automatic Provisions Automatic

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Reports provide mixed picture on plans already automated.

Given the large gap between retirement needs and retirement resources, our retirement programs need to work as well as possible. In the private sector, 401(k) plans, the main vehicle for retirement saving, are not working as well as they could. This problem could be remedied with more extensive use of automatic provisions – automatic enrollment and automatic escalation in the default contribution rates. The Pension Protection Act of 2006 encouraged both these provisions through a safe harbor, but progress has been slow.

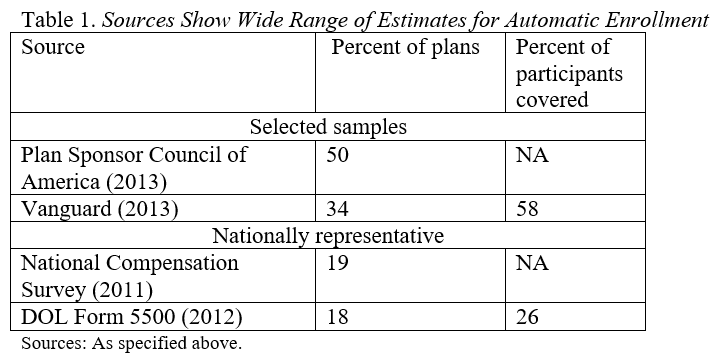

The question is how slow. Different data sources provide very different pictures about the extent to which automatic provisions have taken hold. The most optimistic assessment comes from sources covering particular plans. The Plan Sponsor Council of America (PSCA), an industry group that conducts an annual survey with about 600 responses, reports that about half of plans have auto-enrollment. Since auto-enrollment is much more prevalent among large plans, the percent of participants covered by such a provision is certainly greater than 50 percent. Vanguard, which tends to have a disproportionate number of large plans, reports a significantly lower percent of plans with auto enrollment – 34 percent. However, these plans cover 58 percent of participants. Shifting from selected plans to a nationally representative sample or census of plans sharply reduces the percent with automatic enrollment. The National Compensation Survey estimates 19 percent of plans and the Department of Labor’s Form 5500 shows only 18 percent of plans have auto enrollment.

In addition to the wide range of estimates, many of the plans with auto-enrollment do not have auto-escalation in the default contribution rate. The same inertia that makes auto-enrollment effective for participation can lock people into low levels of contributions. That is, the typical default contribution rate is 3 percent, and, left on their own, people tend to stay at this level. This phenomenon explains why Vanguard shows an average contribution rate of 7.5 percent for plans without auto-enrollment compared to 5.6 percent for plans with it.

Only the PSCA and Vanguard provide information on auto-escalation. The PSCA survey shows that about 65 percent of plans with auto-enrollment also have automatic escalation in the default contribution rate. The Vanguard number is 70 percent. But the PSCA breaks down the total between mandatory escalation and voluntary escalation, and only about a third of plans have mandatory auto-escalation. Vanguard does not provide similar data. The national surveys do not provide accessible data on the percent of plans with auto-enrollment that also offer auto-escalation.

What difference does it make if the estimates for auto-enrollment and auto-escalation are all over the lot? Plenty, if one believes – as I do – that the auto-provisions should be mandatory. It’s a much tougher fix if only 18 percent as opposed to 50 percent of plans currently have such a provision.