Marching to Retirement Without a Plan

Only about half of all U.S. workers in the private sector participate in retirement savings plans at their current places of employment, according to a new report by the Center for Retirement Research.

Only about half of all U.S. workers in the private sector participate in retirement savings plans at their current places of employment, according to a new report by the Center for Retirement Research.

Pension coverage in this country “remains a serious problem,” concludes the Center, which also sponsors this blog.

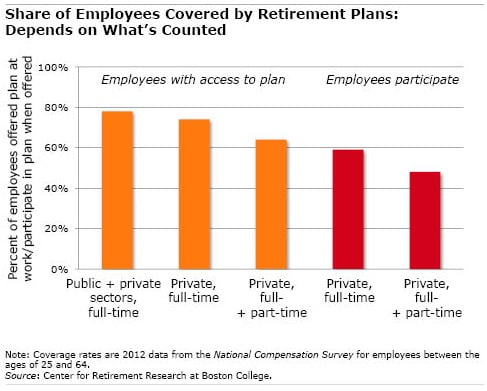

The goal of the Center’s report is to make sense of the myriad estimates of how many Americans are covered at work. One prominent source of data is the federal government’s survey of employers, the National Compensation Survey. The NCS shows that 78 percent of full-time workers, ages 25 through 64, have some type of defined benefit or defined contribution plan available to them at work.

But that’s the rosiest way to slice the data.

The share of employees who are covered slides to 48 percent when public-sector, often unionized, workers are stripped out of the NCS; when part-time, private-sector workers are added in; and when one counts only the share who actually participate in an employer plan when it’s offered to them.

This is somewhat higher than the 43 percent participation rate the Census Bureau says that private full- and part-time workers themselves report to federal census takers. Other data sources put the comparable share at between 40 percent and 55 percent of private-sector workers in recent decades. (The estimates are for both defined benefit and 401(k)-style plans, but the latter is more common in the private sector.)

These are plan participation rates at a given point in time. Two-thirds of U.S. households, by the time they reach their 60s, have a retirement plan somewhere in their work histories. But many workers have little to show for their efforts, if they moved in and out of jobs that may or may not have offered some type of plan.

The remaining one-third of older households have no pension coverage at all. Too many people are marching toward retirement without much of a plan.

Comments are closed.

I find this subject very confusing on several levels…1) are you including 401(k)s, 403(b), etc. as retirement plans? 2) besides government work or unionized labor (where the coverage is through the union and small in numbers), how many other private sector employers actually offer a “pension”? 3) I know it is a subject for another discussion, but relevant none the less, how about the solvency of these plans. They are all drastically underfunded and in the government cases, about to bring down the government entities (state, county & cities) that created them. It is a house of cards and if the government keeps making changes on the 401(k)s, etc. that program is not as enticing as before. It was once sold to the working man as a REPLACEMENT for pensions.

Joe,

Good questions!

The estimates of pension coverage include both defined benefit and defined-contribution plans such as 401(k)s or 403(b)s. But since the focus here is on the private sector, defined contribution plans are more relevant (defined benefit plans are mainly in the public sector).

Also, 3 out of 4 private employers offer some type of plan. You can see more details in Table 1 on Page 3 of the full report: https://crr.bc.edu/briefs/is-pension-coverage-a-problem-in-the-private-sector/

I hope this answers your questions.

Kim (blog writer)