Market Fluctuations Highlight Risks as Baby Boom Retires

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Fluctuations emphasize the importance of Social Security as base retirement income.

The recent gut-wrenching falls in the Dow Jones Industrial Average and other market indexes highlight the terrifying nature of our employer-based retirement system. Yes, stocks over the long run have performed well, and the Dow will inevitably recover. But with the aging of the baby boom, the United States now has about 2 million people turning 65 each year. Those lucky enough to have a source of retirement income will increasingly be dependent on their 401 (k) plans.

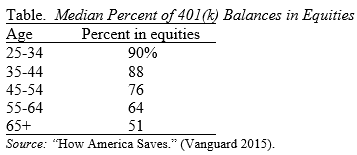

According to Vanguard, those aged 55-64 hold 64 percent of their 401(k) assets in equities and those 65 and older 51 percent (see table). These figures include the equity component of balanced strategies such as target date funds. These percentages must focus the minds of many approaching retirement on the Dow Jones headlines.

It is true that retirees do not need all their money in their first year of retirement and therefore have some time to wait for a recovery. And it is true that the worst thing people can do is to sell in a panic.

Although households shouldn’t panic, they should carefully consider their willingness and ability to bear risk. Stocks offer a higher expected return than other asset classes. But this higher expected return is not a free lunch – the price is greater risk. And if households do decide to dial down risk more than they currently do as they approach retirement, they will need to save even more to meet their retirement income goals.

But all that sensible talk doesn’t do away with the fact that it is really scary to see 5 or 10 percent of one’s retirement wealth disappear in a week and to be unsure about what’s going to happen in the next week. And it’s not like the typical household has money to spare. The Federal Reserve’s 2013 Survey of Consumer Finances showed that the typical family approaching retirement has only $111,000 in combined 401(k)/IRA assets. (IRA assets are included because most of the money in IRAs represents rollovers from 401(k)s.)

And the stumbling stock market is occurring during a time when the returns on fixed income instruments are very low. The yield on 10-year Treasuries is currently below 2 percent. And people are fleeing debt in emerging markets. In this environment many people do not see any other place to put their money than the U.S. stock market.

One thing that this market volatility highlights is the importance of Social Security as the base of retirement saving. The program is sensitive to demographic changes, and costs rise as the ratio of workers to retirees declines. But Social Security’s benefits are impervious to stock market fluctuations, and would be even if a small portion of the trust fund were invested in equities. Hopefully, knowing that their basic needs will be met through Social Security will allow those approaching retirement to sleep better.