Massachusetts Public Pension Benefits Are Stingy

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Despite cheap benefits, the state fails to fund.

Whenever people write about excessively generous public pension benefits, I think of Massachusetts. Massachusetts stands out among state-administered plans as being one of the cheapest.

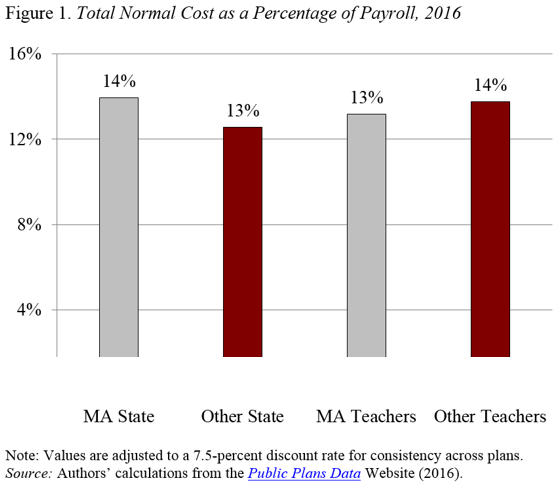

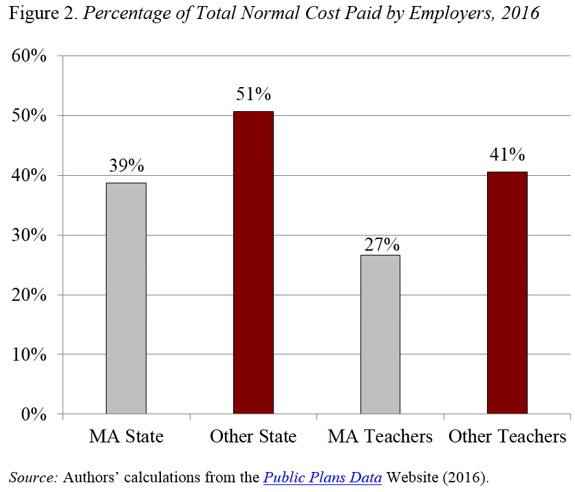

Two factors explain why it is so cheap. First, public employees in Massachusetts are not covered by Social Security, which means the state does not pay the 6.2-percent payroll tax that other employers pay for Old Age, Survivors, and Disability Insurance. Second, despite having no Social Security protection, the normal costs – the cost of accruing benefits – of the Massachusetts plans are comparable to the national average for state-administered plans (see Figure 1). But Massachusetts public employers pay a much lower percentage of normal costs than most other public employers – about 40 percent for the State Employee Retirement System, and 30 percent for the Teachers (see Figure 2).

Taking into consideration that Massachusetts makes no Social Security contributions and pays only a fraction of the normal cost, the state contributes only about a third as much towards retirement plans for its employees as other states.

The flip side of the low contributions, of course, is that the Massachusetts plans do not serve public employees well. They shortchange participants on a number of dimensions. Young and short-term workers are hurt by 10-year vesting. All employees pay very high contribution rates. And older or long-term workers are at risk because retirement benefits are only partially inflation-protected. It’s hard to hire qualified workers if low retirement benefits aren’t offset by higher wages.

While a cheap plan is not good for public employees, it should be easy to fund. But Massachusetts’ plans have low funded ratios. The plan for state employees has a ratio of assets to liabilities of 64 percent; the comparable number for the teachers’ plan is 53 percent. In Massachusetts’ defense, the state only started funding in the 1980s, so the state has been promising benefits for eight decades and funding for three. Not surprisingly, it entered the century with a substantial unfunded liability; and then it was hit by two financial crises.

To prevent the unfunded liability from growing – never mind paying it down – the state must contribute enough to cover the normal cost and the interest on the unfunded liability. The state has failed to make this minimal contribution to either plan since 2003.

Underfunding a cheap plan helps current taxpayers, but hurts 1) future taxpayers who will have to pick up the bill and 2) current and future employees who are unlikely to see the benefit improvements they need.