Minorities, Particularly Hispanics, Are Increasingly Unprepared for Retirement

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Hispanics hurt badly by owning homes in the wrong states when the housing bubble burst.

Despite an extended period of recovery since the global financial crisis and Great Recession, working-age households are less prepared for retirement than they were in 2007. The situation is worse for minorities, particularly Hispanics, according to a recent study from the Center for Retirement Research.

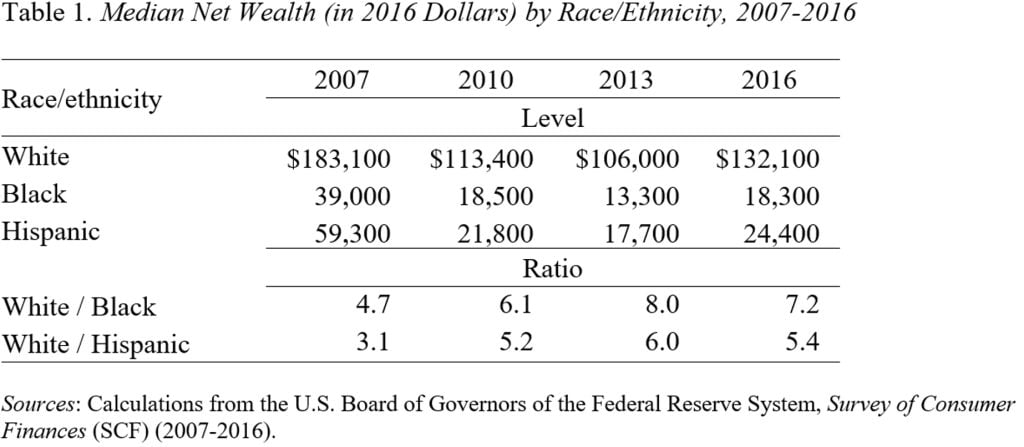

A shocking gap exists between the wealth holdings and income of white households on the one hand and black and Hispanic households on the other. Table 1 shows that while wealth levels for all groups have not recovered from the Great Recession, the disparity between whites and minorities has increased.

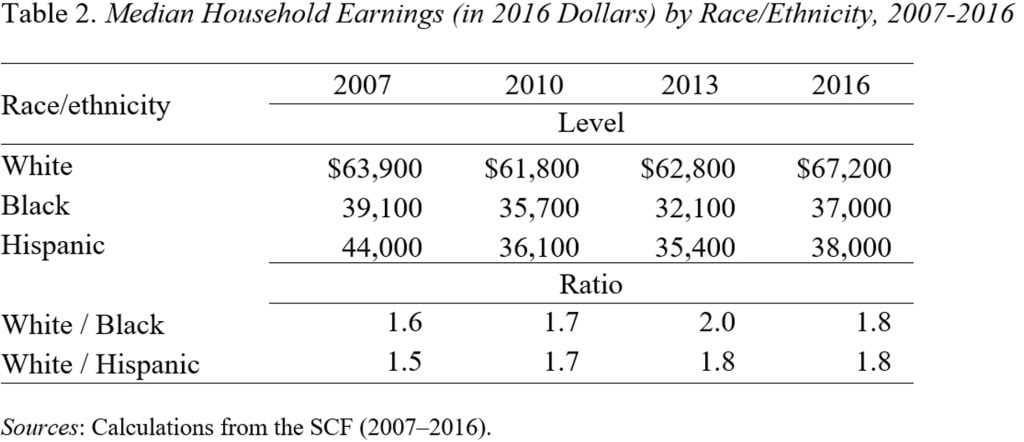

The story for earnings is somewhat different (see Table 2). By 2016, median household earnings for white households had recovered from the global financial crisis, but earnings for black and Hispanic households were still below their 2007 levels.

Documenting that gap, however, says little about the retirement preparedness of the groups.

On the one hand, lower-paid workers are more financially strapped and less likely to have a retirement plan at work. Moreover, low wealth means minority households are less likely to own a home, which could support their consumption in retirement. On the other hand, lower earnings means a lower target income to replace in retirement and a higher replacement rate from Social Security’s progressive benefit formula.

We used the National Retirement Risk Index (NRRI), which is based on data from the Federal Reserve’s Survey of Consumer Finances, to estimate retirement preparedness by race. The NRRI compares households’ projected replacement rates – retirement income as a percentage of pre-retirement income – with target replacement rates that would allow them to maintain their standard of living.

The results are shown in Table 3. As expected, whites have the lowest percentage at risk – with 48 percent not on track to maintain their standard of living in retirement. Blacks have a somewhat higher share at risk with 54 percent, while Hispanics show 61 percent at risk.

The results suggest that maintaining a low level of income with little wealth may not be that much more difficult than maintaining a high level of income with lots of wealth. A key reason is that Social Security, with its progressive benefit formula, boosts the replacement rates for low earners, which helps explain why the gap in the NRRI between blacks and whites has narrowed since the financial crisis and Great Recession. However, this cushioning effect from Social Security was not enough to keep Hispanics’ retirement prospects from deteriorating sharply. A key reason is that Hispanics suffered much steeper losses in housing values than whites or blacks because Hispanics are more concentrated in the states hardest hit by the bursting of the housing bubble. As a result, Hispanic households face a much greater chance of being unable to maintain even their lower levels of pre-retirement income in retirement.