Use of Medicare Subsidy Low in Some States

A major government program helps poor and low-income retirees and adults with disabilities defray what can be substantial healthcare expenses that aren’t covered by Medicare. But enrollment is unusually low in some states because of more stringent eligibility standards.

The Medicare Savings Programs, which are administered by the states and funded by the federal government, subsidize Medicare’s Part A and Part B premiums and cost-sharing obligations for more than 10 million Medicare beneficiaries.

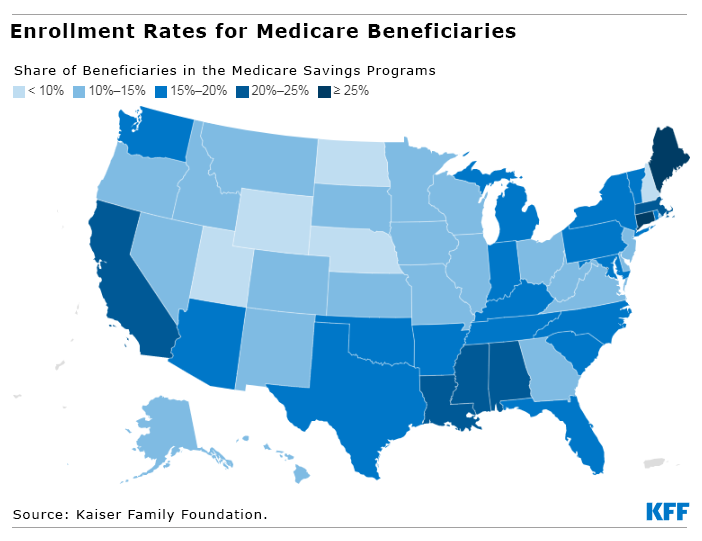

But participation varies widely from state to state, according to a new report by the Kaiser Family Foundation, due to a combination of differences in need and varying eligibility standards.

No more than 10 percent of the retirees in Nebraska, New Hampshire, North Dakota, Utah, and Wyoming are enrolled in their state programs. The enrollment rates are double or even triple that – from 20 percent to 26 percent – in Alabama, California, Connecticut, the District of Columbia, Louisiana, Maine, Massachusetts, and Mississippi.

A major reason for the disparities in enrollment is the difference in the dollar value of assets retirees in each state are permitted to have and still qualify. The federal government set the dollar values on the stocks, bonds, and other assets of Medicare beneficiaries at $8,400 for single and widowed retirees and $12,600 for couples in 2022. The house and one car do not count.

But several states have chosen to make it easier to qualify by setting asset limits that exceed these federal minimums. In fact, eight of the nine states and the District of Columbia that have the highest shares of retirees in their programs either set asset limits above the federal standard or don’t have an asset test at all.

These states still restrict participation to disadvantaged people by placing income caps on eligibility, which range from about $13,000 to $26,000 per year in all but one state. But in several states that only match the low federal minimums for assets, disadvantaged retirees aren’t getting the financial assistance they need to access medical care.

Meredith Freed, a senior Medicare policy analyst for Kaiser, said that between a third to half of retirees with incomes below 135 percent of the federal poverty limit nationwide are not enrolled.

Medicare beneficiaries spend an average $6,000 per year out of their own pockets for medical care. “Having help with premium and cost-sharing is incredibly important,” Freed said.

There are a few reasons for the variation in state enrollments. One is awareness of the programs, which hinges partly on state efforts to promote them. The state poverty rate also plays a role. For example, Alabama, Louisiana, and Mississippi – three of the poorest states – are among the states with more than 20 percent of their retired and disabled residents enrolled.

But the asset standards set by each state are crucial. North Dakota has the lowest coverage of any state, with 7 percent of its retirees in its Medicare Savings Program. North Dakota’s asset and income tests for eligibility are the federal minimums.

At the other extreme, Connecticut has the highest enrollment rate – 26 percent – partly because the state doesn’t limit the dollar amount of assets for program eligibility. Its income requirements – $2,265 per month for single retirees and widows and $3,063 for couples – are also the highest of any state.

The choices each state makes in how it administers the program matters, Freed said. “We did find that states that have raised the income and asset thresholds tend to have a higher share of people enrolled in those programs,” she said.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.