More Carrying Debt into Retirement

No matter how you measure it, older Americans are falling deeper in debt.

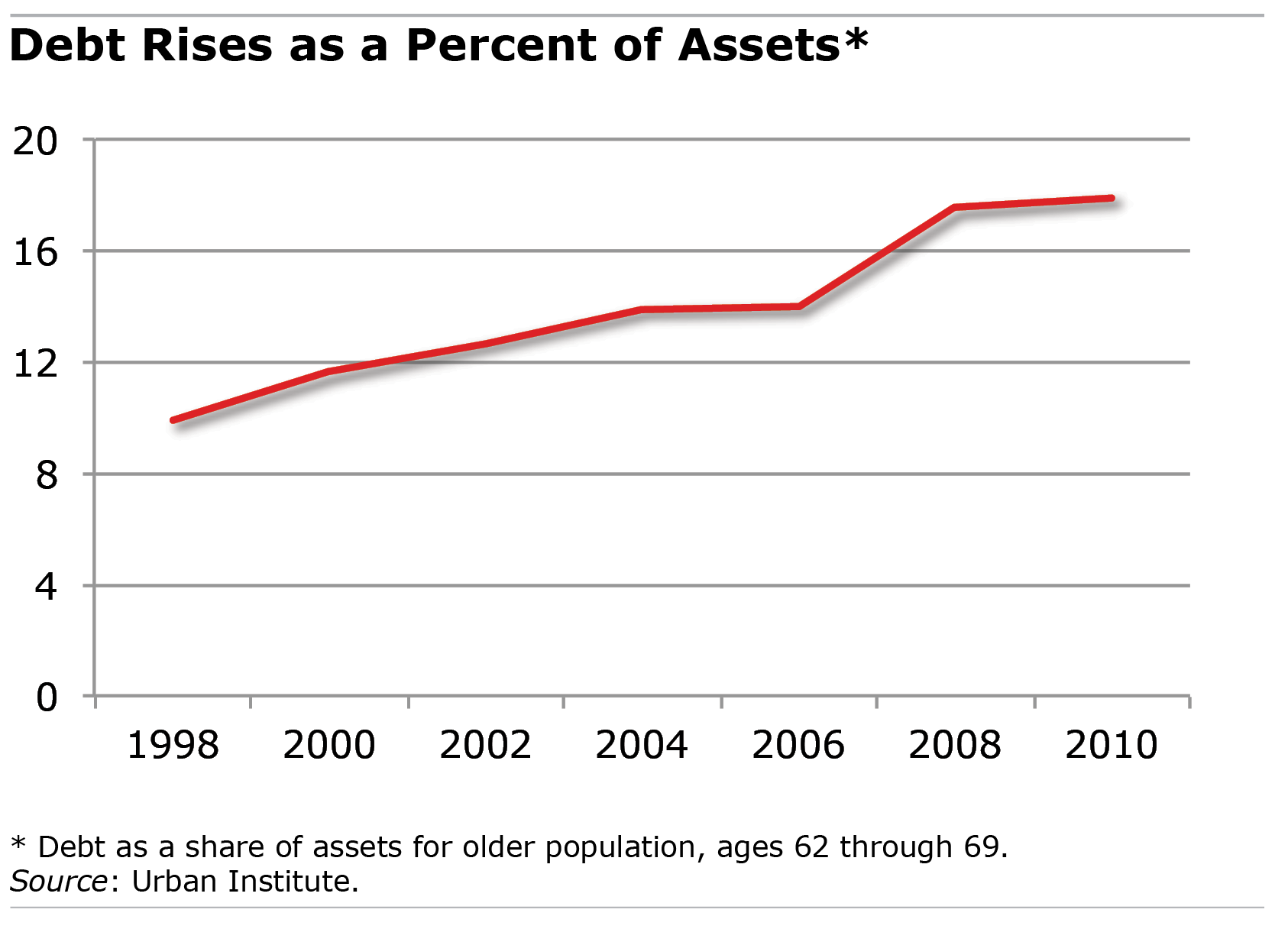

The number of people in their 60s who have debt has grown from just under half of that age group in 1998 to nearly two out of three in 2010. And their debt, as a share of their assets, has surged during that time from 10 percent to 18 percent.

Debt is becoming increasingly common among older people, regardless of their level of income, according to Urban Institute researchers, who presented their findings at the August meeting of the Retirement Research Consortium. (The Center for Retirement Research at Boston College, which sponsors this blog, is a Consortium member.)

Debt is becoming increasingly common among older people, regardless of their level of income, according to Urban Institute researchers, who presented their findings at the August meeting of the Retirement Research Consortium. (The Center for Retirement Research at Boston College, which sponsors this blog, is a Consortium member.)

Among individuals with incomes that place them in the top third of incomes, the share of older people in debt increased from 57 percent to 70 percent between 1998 and 2010 – a 13 percentage point rise. But that share rose by 17 percentage points for middle-income and by 14 percentage points for low-income people. In all three income groups, the amounts owed also rose.

One major reason more older Americans have debt is mortgages: more of them have one, in part because they’re paying them off more slowly than they once did. Mortgage balances have also increased. One possible explanation for these trends is that many homeowners traded up during the housing boom and took on larger mortgages. An unrelated study estimates that 17 percent of mortgage borrowers who are close to retirement age owe more than their house is worth.

Other factors – not necessarily negative – are also swirling beneath the surface that may explain what’s driving the growing prevalence of debt. More boomers with thriving careers want to work longer. So, the great incidence of debt among households in their 60s doesn’t always mean a higher incidence of retiree debt.

Taken alone, the debt trend among older Americans is striking enough. But it may be having an impact on baby boomers’ decisions about when they will retire.

People in their 60s who owe money, particularly if they have a mortgage, are increasingly likely to retire or start collecting their Social Security benefits later, according to the Urban Institute’s research, which is believed to be the first to confirm a link between debt and these major life decisions.

Much of the talk in retirement circles seems to center around whether aging baby boomers have enough money in their 401(k) retirement accounts.

But debt is a big part of the story.

Full disclosure: The research cited in this post was funded by a grant from the U.S. Social Security Administration (SSA) through the Retirement Research Consortium, which also funds this blog. The opinions and conclusions expressed are solely those of the blog’s author and do not represent the opinions or policy of SSA or any agency of the federal government.

Comments are closed.

This is an interesting article. I think one of the points this article leaves out is how much assets were lost during the recession. Your debt to assets ratio is going to increase significantly if you lost some value in assets.

It’s worth drawing the distinction between investment debt and consumption debt. Mortgage debt – traditionally referred to as ‘good debt’ incurred with wealth creation in-mind – and consumption debt or bad debt – spending on consumable goods and services that offers no ROI. The Lusardi/Mitchell paper is enlightening. Debt and debt management may be regarded as two sides to the coin of financial literacy, i.e. how to avoid carrying debt into retirement through fiscal planning and personal financial control including budget management. And on the flip-side, how to best manage debt that exists as you enter or find yourself in retirement. The latter includes consolidation and repayment strategies for example, to reduce the cost burden where debt is carried. In terms of debt management financial literacy, a problem often unrecognized or noted is that the debt service industry perpetuates the use of service terminology in a way that causes confusion. Even well-educated prospective retirees can have difficulty understanding debt management strategies that may be appropriate for their situation.

Eye opening post for sure. I meet regularly with clients preparing for retirement in both situations, in debt and debt free. The ease of retirement planning and freedom that a debt free future retiree feels is extremely compelling. I realize that sometimes increased debt may be a result of something out of our immediate control. However, I believe that a majority of the debt being incurred prior to retirement may be a result of lack of self-control and discipline with regards to one’s finances. Definitely not the most fun of words (self-control and discipline), but they make a world of difference and provide more joy and freedom than the words evoke on their own! Thanks for the post.