More Households Entering Retirement with Debt

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

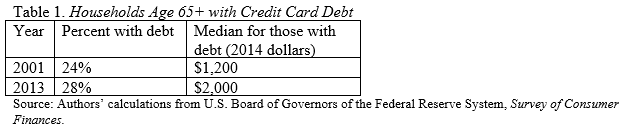

In 2013, about a third of those 65+ had a mortgage and 28 percent had credit card debt.

Two recent events have forced me to take a look at debt. The first was a call from a bankruptcy judge saying that the pool of people applying for bankruptcy was noticeably “grayer” than in the past. Of course, the simple aging of the population would lead to more older people applying, but the judge’s sense was that more was going on than the aging of the Baby Boom. The second item was the publication of a recent article in the Washington Post entitled “Mortgage Debt – the New Retirement Time Bomb.”

The most recent source of data on debt by age of household is the Federal Reserve’s 2013 Survey of Consumer Finances. The three major categories of debt are: 1) credit card debt; 2) installment loans; and 3) housing debt. To get a sense of how recent the change in debt loads has been, I compare 2013 with 2001 (although the unemployment rate was significantly higher in 2013 than 2001 – 7.3 percent versus 4.6 percent, seasonally adjusted). Credit card balances consist of balances on bank-type cards, store cards, or other charge accounts. In the case of credit card debt for households age 65+, both the percentage of households holding such debt and the dollar amount increased (see Table 1). Those increases may not look that dramatic, but they occurred over a period when the incidence and amounts for every other age group were declining.

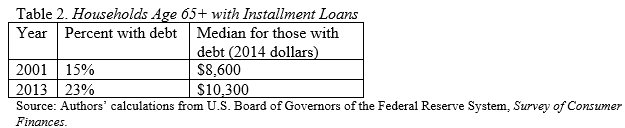

Installment debt includes non-real-estate loans that have fixed payments and a fixed term, such as education loans; automobile loans; and loans for furniture, appliances, and other durable goods. Here again, the percent of households age 65+ with such debt has increased as has the median amount for those with debt. In this case, debt for the non-elderly has also been increasing due in large part to rising student loans.

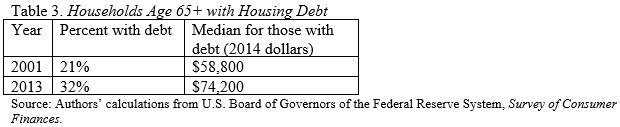

Housing debt includes both mortgages and balances on home equity lines of credit (HELOCs) on the primary residence. As Table 3 shows, in 2013 about a third of older households held housing-related debt compared to only 21 percent in 2001, and the outstanding balance for those with debt was substantial at $74,200.

Holding substantial debt going into retirement places a large demand on the household’s retirement income. Most financial planners urge households to pay off their mortgages before they retire. Large required monthly payments seem particularly inconsistent with retirement income streams that will increasingly be derived from 401(k) balances, which will likely be much less predictable than the annuity income paid from traditional defined benefit plans.

In short, the new trend towards more debt in retirement does seem like a development to worry about.